Small Businesses Surge with Optimism as 2025 Dawns, Fueled by Election Results and Anticipated Policy Shifts

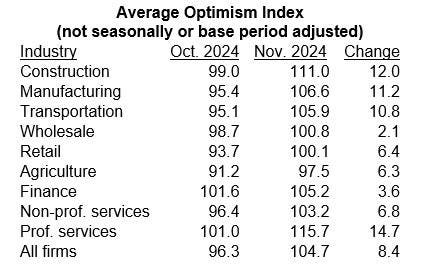

The American small business landscape is abuzz with renewed vigor as the year 2025 commences, marked by a dramatic surge in optimism following the November 2024 elections. The NFIB’s Small Business Optimism Index, a key barometer of entrepreneurial sentiment, registered a remarkable 8.4-point leap, ascending from 96.3 in October to 104.7 in November, signaling a significant shift in expectations for the future. While some early November respondents may have been unaware of the final election outcomes, the overall positive trend across various sectors underscores a widespread anticipation of improved business conditions under the new administration. This surge in confidence comes as a welcome reprieve after a period of economic uncertainty and lays the foundation for potential growth and expansion in the coming year.

The optimism wave, while impacting all sectors, varied in intensity. Industries like wholesale and finance, traditionally more sensitive to monetary policy, experienced a more muted response, likely reflecting ongoing concerns about the Federal Reserve’s future actions. However, sectors more directly influenced by regulatory policies and government spending, such as professional services and production (including construction, manufacturing, and transportation), witnessed a more pronounced upswing in sentiment. Professional service firms saw their optimism index soar by an impressive 14.7 points, while the production sector also experienced a significant boost. This disparity suggests that expectations of regulatory relief and increased government investment in infrastructure and other projects played a pivotal role in shaping the overall optimistic outlook.

A key driver of this renewed confidence is the anticipation of more favorable regulatory policies under the incoming administration. Small businesses, often disproportionately burdened by regulatory compliance costs and bureaucratic hurdles, appear to be banking on a reduction in red tape and a more business-friendly environment. The construction sector, in particular, is experiencing a surge in optimism, fueled by expectations of reduced costs for land, materials, and labor – all areas significantly impacted by regulatory policies. This positive outlook extends to the real estate sector as well, with expectations of lower mortgage rates driven by anticipated improvements in government spending and borrowing practices. The Federal Reserve’s recent rate cuts, while welcome, have been somewhat offset by rising yields on the 10-year Treasury Bond, keeping mortgage rates from falling as much as some had hoped. However, the expectation is that the new administration’s fiscal policies will help stabilize the bond market and allow mortgage rates to decline, further stimulating the housing market and related small businesses.

The confluence of these factors has ignited a spark in the entrepreneurial spirit, with a threefold increase in the number of firms now viewing the current period as opportune for expansion. This surge, led by businesses in construction, wholesale trades, professional services, and finance and real estate, underscores the growing confidence in the prospects for future growth. The anticipated policy shifts, coupled with a more stable economic environment, are creating a fertile ground for small businesses to invest, expand, and create jobs, potentially setting the stage for a period of robust economic recovery. This increased willingness to expand is a crucial indicator of economic health, suggesting that the small business sector, often considered the engine of economic growth, is poised to accelerate its contribution to the overall economy.

However, amidst this wave of optimism, challenges remain. The devastating impact of recent natural disasters in California, Florida, and North Carolina necessitate significant rebuilding efforts, which, while generating economic activity, primarily focus on replacing lost assets rather than adding to the nation’s capital stock. This reconstruction process, though essential, presents a unique set of challenges, requiring significant resources and potentially diverting attention from other growth-oriented investments. However, the inherent resilience and adaptability of small business owners, renowned for their ability to navigate adversity, is expected to play a crucial role in overcoming these challenges and driving the economy forward.

As 2025 unfolds, the small business sector stands at a critical juncture. The surge in optimism, driven by expectations of favorable policy changes and a more stable economic environment, presents a unique opportunity for growth and expansion. However, realizing this potential requires effective policy implementation and a sustained commitment to fostering a supportive environment for small businesses. The ability of the new administration to deliver on its promises and effectively address the challenges ahead will be crucial in determining whether this wave of optimism translates into tangible economic growth and prosperity for the nation. The resilience and entrepreneurial spirit of small business owners, coupled with supportive policies, could usher in a new era of economic dynamism, creating jobs and strengthening the foundation for long-term prosperity.