DeepSeek Disrupts US Stock Market, Billionaire Fortunes Plunge

The US stock market experienced a significant shakeup on Monday as DeepSeek, a Chinese generative artificial intelligence startup, made a grand entrance, sending ripples throughout the tech industry. DeepSeek’s unveiling of a powerful large-language model, developed at a fraction of the cost of its American competitors, sparked concerns about the future of AI spending, hitting Nvidia, the American AI leader, particularly hard. The resulting market turmoil led to substantial losses for several prominent billionaires, reshaping the landscape of global wealth.

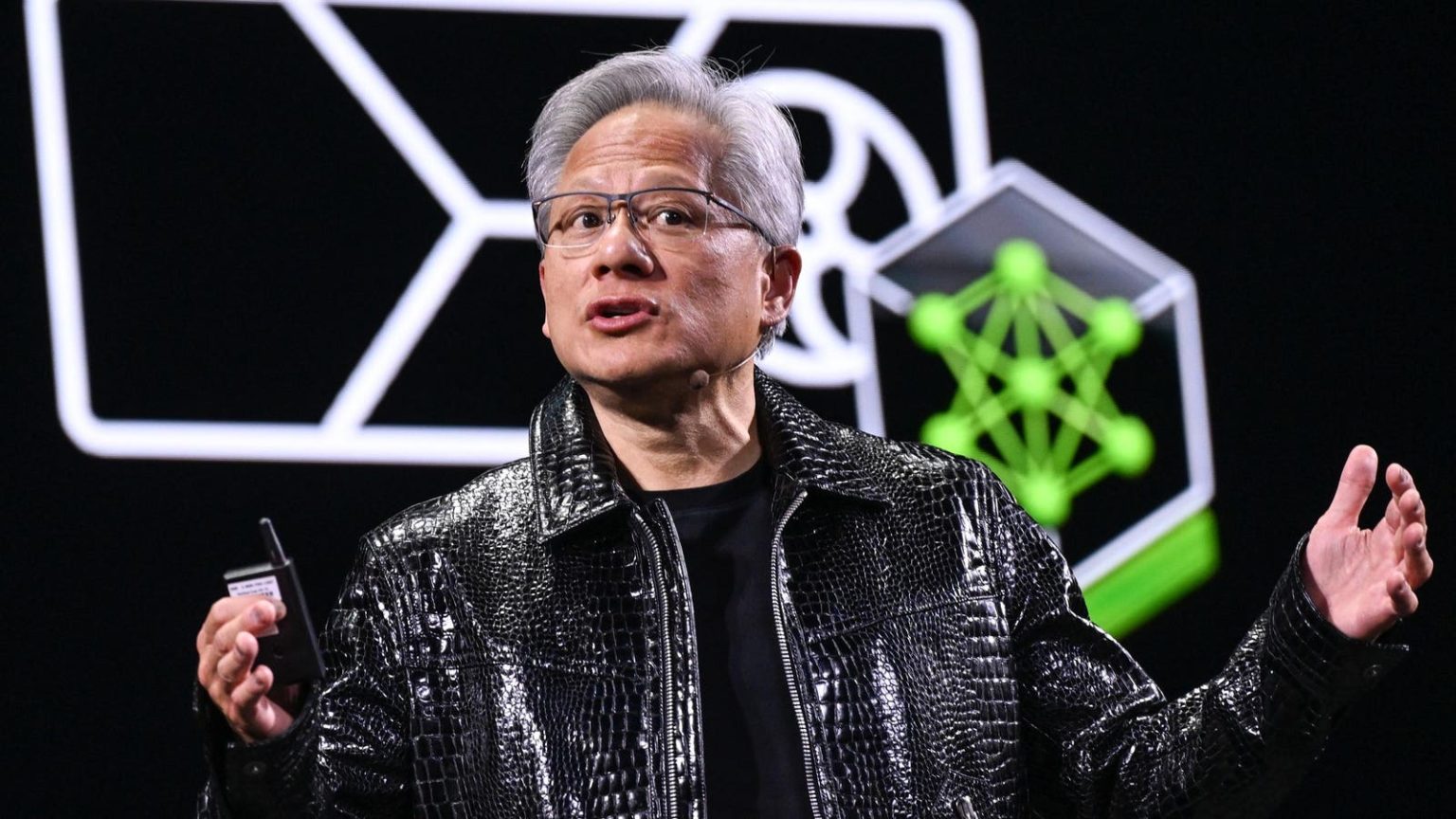

Nvidia’s shares plummeted by 17%, erasing a staggering $589 billion from its market capitalization, a record single-day loss. This dramatic decline directly impacted CEO Jensen Huang, the company’s largest individual shareholder, whose net worth plunged by $20.8 billion. Huang’s fortune, shrinking from $124.4 billion to $103.7 billion, resulted in a significant drop in his ranking on the Forbes real-time billionaires list, falling from 10th to 17th place. He now trails figures such as Spanish fashion magnate Armancio Ortega, Walmart heirs, Microsoft co-founder Bill Gates, Dell CEO Michael Dell, and former New York City Mayor Michael Bloomberg.

Oracle chairman Larry Ellison also suffered a substantial blow, losing $27.6 billion as Oracle stock tumbled 14%. This significant loss caused Ellison to fall from the third-richest person globally to fifth, overtaken by Meta CEO Mark Zuckerberg and LVMH luxury goods tycoon Bernard Arnault. The market downturn wasn’t limited to Nvidia and Oracle. Several other Big Tech companies experienced significant losses as DeepSeek’s competitive offering cast doubt on the sustainability of lavish spending on generative AI technology.

DeepSeek’s revelation that its large-language model was trained on just $5.6 million worth of Nvidia’s graphics processing units (GPUs) further fueled the market’s anxieties. While some analysts, like Bernstein’s Stacy Rasgon, questioned the accuracy of this figure, it nonetheless raised the possibility of developing advanced AI models using significantly less of the expensive technology sold by Nvidia. This development has potentially far-reaching implications for the demand for Nvidia’s GPUs and the company’s future profitability.

The list of billionaire losers on Monday extended beyond Huang and Ellison. Dell CEO Michael Dell saw his fortune decrease by $12.4 billion, while Google co-founders Larry Page and Sergey Brin experienced losses of $6.3 billion and $5.9 billion, respectively. Early Google investor Andreas von Bechtolsheim lost $5.4 billion, Tesla CEO Elon Musk saw his wealth decline by $5.3 billion, and Interactive Brokers chairman Thomas Peterffy’s fortune dropped by $4.1 billion. Broadcom chairman Henry Samueli and co-founder Henry Nicholas III also experienced substantial losses, with their net worths declining by $3.7 billion and $2.8 billion, respectively.

While the tech sector largely struggled, Apple stood out as a notable exception. Its shares rose more than 3%, likely due to its comparatively less aggressive investments in AI compared to its Big Tech peers. This positive performance benefited Warren Buffett, whose Berkshire Hathaway conglomerate holds a significant stake in Apple. Buffett emerged as the biggest American billionaire winner on Monday, with a $2.3 billion gain. Apple CEO Tim Cook saw his net worth increase by $23 million, and Laurene Powell Jobs, the widow of Apple co-founder Steve Jobs, gained $289 million. This contrasting performance underscores the varying impact of the DeepSeek disruption across the tech landscape.

The broader American stock market also felt the tremors. The S&P 500 fell by 1.5%, and the tech-heavy Nasdaq Composite Index slipped by 3.1%, with Nvidia and other Big Tech companies contributing significantly to these declines. The DeepSeek development not only raises questions about the future demand for GPUs but also challenges the high valuations of American tech companies, which have largely benefited from the US-centric generative AI revolution. With a major Chinese competitor now in the arena, the competitive landscape has shifted, potentially impacting future growth projections and investment strategies.

The emergence of DeepSeek and its cost-effective AI model introduces a new dynamic to the global AI race. The reduced reliance on expensive hardware could democratize access to advanced AI technologies, potentially fostering innovation and competition. However, it also presents challenges for established players like Nvidia, who may need to adapt their strategies to maintain their market share in this evolving environment. The long-term consequences of this disruption remain to be seen, but it’s clear that DeepSeek’s arrival has significantly altered the trajectory of the AI industry and the fortunes of those invested in it. The events of Monday highlight the volatility of the tech market and the significant impact that disruptive innovations can have on established players and the broader economic landscape.