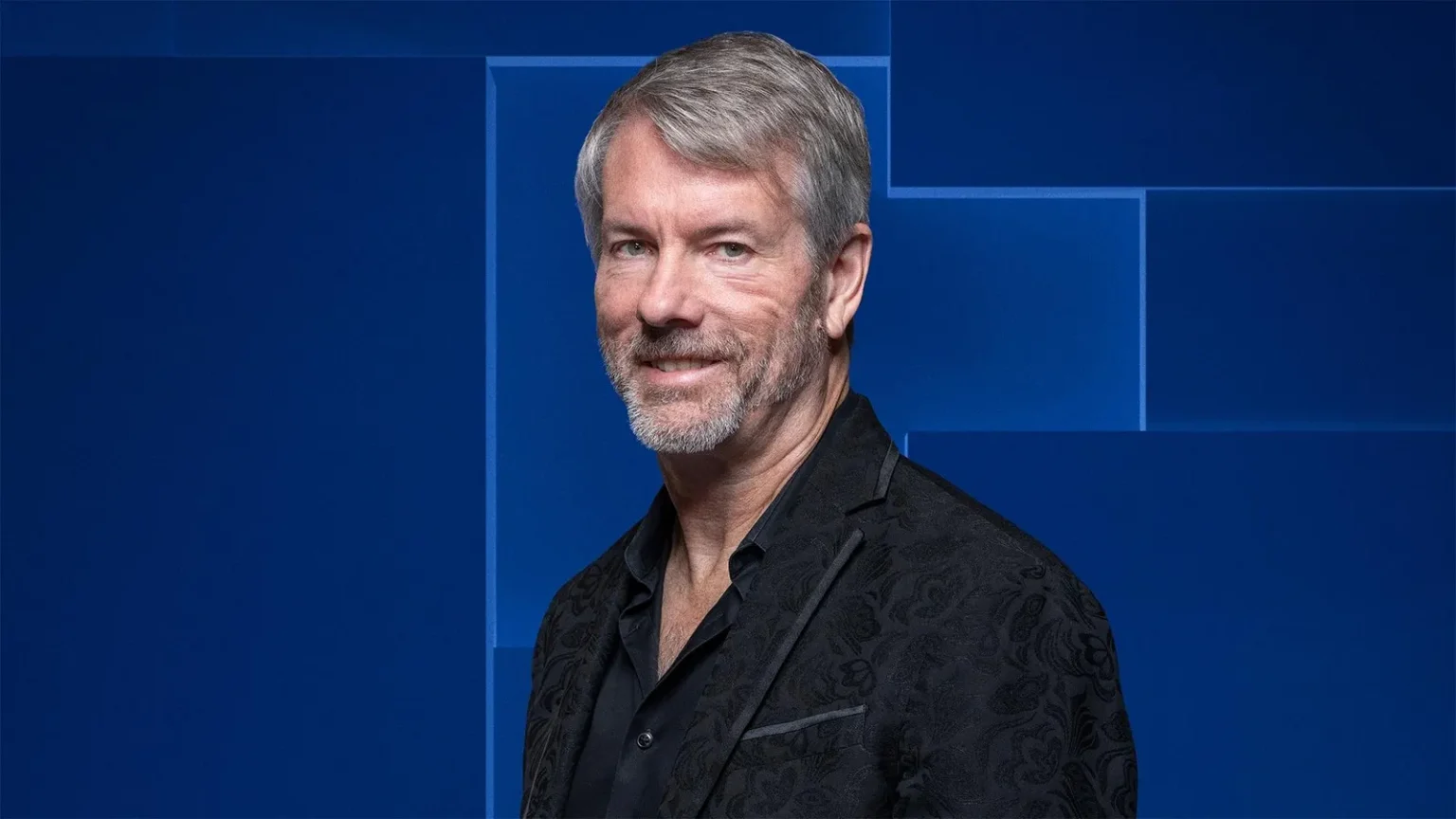

The Rise and Challenges of Michael Saylor’s Bitcoin Strategy

In the high-stakes world of cryptocurrency investment, few stories are as compelling as Michael Saylor’s transformation of his data mining software company into the stock market’s largest corporate holder of bitcoin. When bitcoin recently plummeted 35% from its October peak of $126,080 to $82,000, it put a spotlight on Strategy, whose fortunes have become inextricably linked to the cryptocurrency’s performance. For most Nasdaq-listed companies, such market movements might be background noise, but for Strategy, it raised existential questions about its business model and future direction.

For nearly two years, Strategy enjoyed a remarkable premium in its trading value, sometimes 190% higher than its actual bitcoin holdings, making it an attractive amplified bet on bitcoin for institutional investors. This approach helped Saylor’s personal net worth climb from $1.6 billion in 2022 to $5.4 billion, while inspiring hundreds of copycat companies known as digital asset treasuries. However, the recent market downturn has eliminated Strategy’s premium entirely, with its shares falling 60% over a year, bringing its market capitalization to $49 billion—now lower than the $56 billion worth of bitcoin it holds. This unexpected reversal has been accompanied by S&P Global Ratings assigning Strategy a B- credit rating, deep in junk territory, citing “high bitcoin concentration, narrow business focus, weak risk-adjusted capitalization, and low U.S. dollar liquidity” as significant concerns. More troublingly, JPMorgan analysts have warned that Strategy risks removal from major benchmarks like MSCI USA and the Nasdaq 100, which could trigger an exodus of up to $2.8 billion from passive funds, with potentially more at risk if other index providers follow suit.

Undeterred by these challenges, Saylor has pivoted his messaging and strategy. His new mantra—”the credit is the product and the equity is the afterthought”—signals his belief that Strategy’s future lies not in being a bitcoin-tracking stock but in creating bitcoin-powered income instruments for yield-seeking investors. To execute this vision, Strategy has introduced a series of perpetual preferred securities with colorful names like Strike, Strife, Stride, Stretch, and Stream. Each offers high fixed dividends backed by the company’s bitcoin holdings. For instance, Strike pays an 8% annual dividend quarterly, while Strife and Stride pay 10%. Stretch adjusts its 9% dividend monthly to keep its price near $100 par value. A key selling point is that these dividends are treated as “return of capital” for tax purposes, allowing investors to reduce their cost basis rather than paying taxes on distributions annually—a significant advantage for taxable investors compared to similar corporate preferred stocks.

However, the recent bitcoin downturn has negatively impacted these preferred securities as well. Stretch now trades below its $100 par value with a yield of approximately 11%, while the euro-denominated Stream fell below its €100 issue price in less than two weeks after announcement, with its yield jumping from 10% to 12.5%. These developments reflect growing investor concern about Strategy’s ability to maintain its dividend payments during a prolonged bitcoin bear market. The company now faces roughly $700 million annually in preferred dividends and convertible interest payments. Additionally, Strategy has approximately $8 billion in convertible debt outstanding, $7.4 billion of which is “out of the money,” meaning holders are unlikely to convert to equity at maturity because the stock trades below conversion prices. With its premium gone, issuing more equity—Strategy’s previous funding method for bitcoin purchases—is no longer financially advantageous.

Despite these pressures, Saylor isn’t considering outright bitcoin sales as a first resort. Although Strategy’s average acquisition price per bitcoin is around $74,400, even a market decline below this level wouldn’t trigger forced liquidations. The company’s earliest significant financial pressure point doesn’t arrive until September 2028, when holders of $1 billion in convertible notes can demand repayment. In the meantime, Saylor continues his innovative approach to corporate finance, even claiming to use artificial intelligence to help design new securities. At a recent conference, he outlined plans to eliminate leverage while increasing “amplification” through non-debt instruments like perpetual preferreds and equity-linked securities. His goal is to achieve 30% “amplification” annually, which would allow Strategy to grow its bitcoin holdings while gradually reducing leverage from the current 11% to zero by 2029 through the equitization of its convertible bonds.

Some supporters believe Saylor has found “the killer app for bitcoin,” comparing Strategy’s evolution to the early development of gold-backed credit markets. The company’s journey can be viewed in three chapters: first as the primary vehicle for equity investors to gain bitcoin exposure before dedicated ETFs existed; then as a preferred hedging venue for institutions before bitcoin ETF options became available; and now as a pioneer in transforming bitcoin into an income-generating asset for investors who cannot directly hold cryptocurrency. Former ParaFi Capital analyst Kevin Li notes that fixed-income managers restricted by mandates can purchase Strategy’s preferred stock even if they cannot buy bitcoin or many ETFs directly. Despite current challenges, Strategy’s shares have still delivered a remarkable 1,160% return since Saylor began purchasing bitcoin in August 2020. As he ventures into credit markets, the question remains whether yield-focused investors—typically more cautious than volatility-embracing stock traders—will embrace his vision for bitcoin-backed income securities in sufficient numbers to sustain the company’s ambitious strategy.