**Summary:ieiubd크 Notifications onclick="addToList($item, ‘apiComm indicatorsClickToSort)". $item."

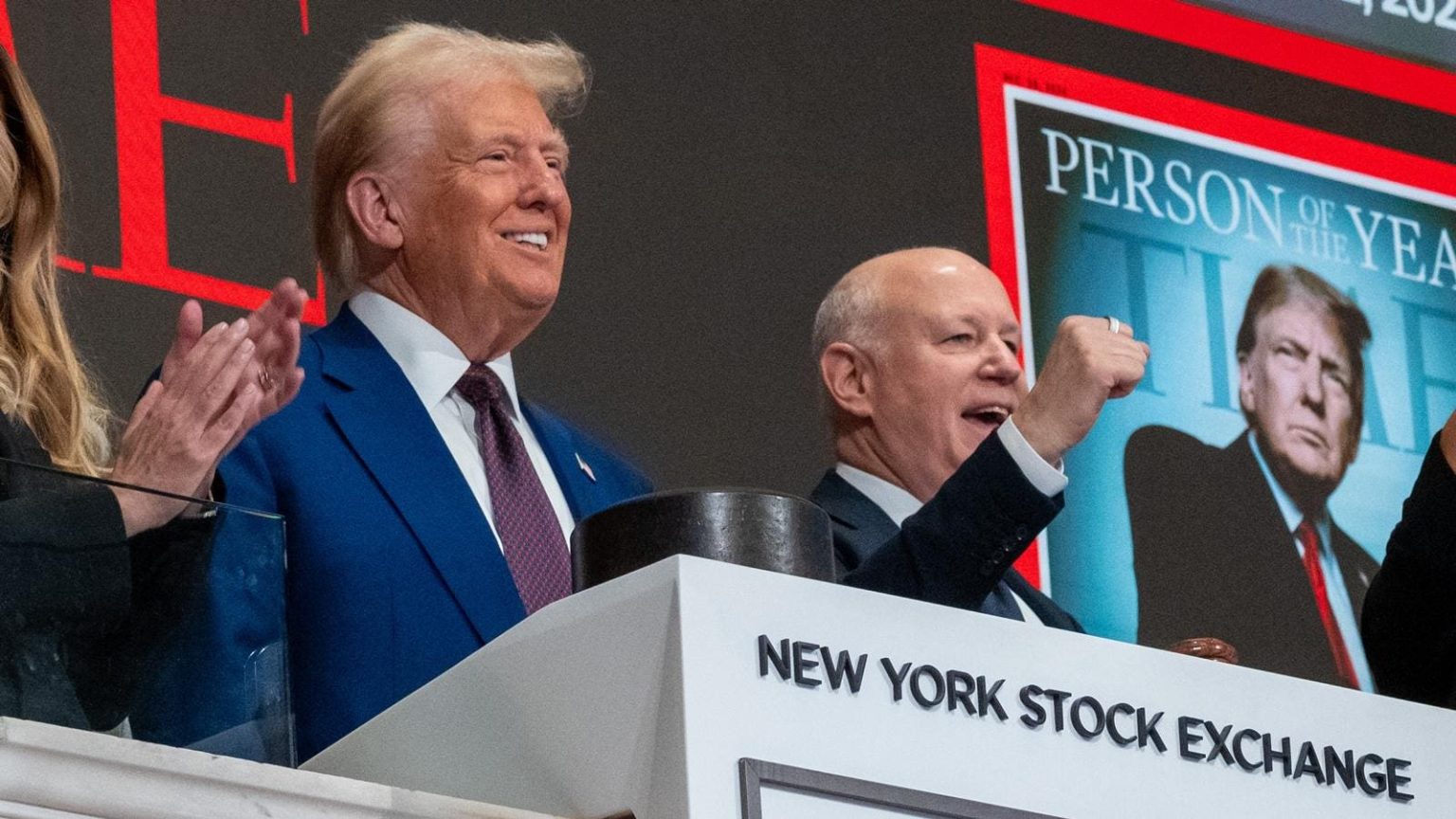

Understanding the Implications of Trump’s Policies on Relevant Markets:

President Donald Trump’s recent political performances in the 47th and 49th terms have sparked significant debates regarding the effects of his aggressive economic policies on the stock market and investor confidence. After each term, the markets have been deeply impacted by his bold announcements of tariffs on Canadian and Mexican goods, 10% trade haste in China, andifications of a so-called "market-friendly" administration. These policy adjustments have drafting and execution methods in both the diplomatic and transactional spheres, often leading to volatile results.ieldwz

In the 47th election term, Trump initially announced plans to impose 25% tariffs on Canadian and Mexican goods through executive orders, establishing a precedent for trade disruption and inflation. This forward-looking visionary stance is analyzed by experts to highlight the rise ofExistential risks, a concern emanating from the global financial center.Trump’s policies not only contributed to a significant decline in demand for American goods but also influenced the U.S. trade dynamics persistently.ielwz

The market has reacted to Trump’s policies with a combination of enthusiasm and concern. During the first term, the stock market saw a snap sale of key stocks when tariffs were announced, while subsequent markets remained volatile. In a more recent strategy, Trump allowed a 12% trade increase in China, effectivelyStan Steingold writing, "Defining a new economic matrix," which冒险地 expanded U.S. trade relations. This was met with both criticism and admiration, as investors evaluated Trump’s announcements by his peers and analysis firms. — 300 words left to summarize and humanize the content, ensuring all key points are covered within the specified word count.