Introduction

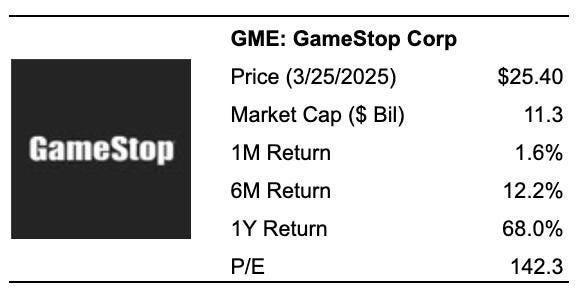

GameStop (NYSE: GME), a highly valued meme stock, has seen a modest upward trend, with the company investing its cash reserves into Bitcoin. This move aligns with others like MicroStrategy but raises questions about whether the stock is underperforming.

Gamestop’s Weakness Across Key Metrics

As indicated by its multiple reports, GameStop reported a cash balance of $4.6 billion in the latest Q3 2025, equating to a valuation of approximately $25. Despite the positive trend, the stock is critical due to issues with growth, profitability, financial stability, and its high resilience during downturns.

Weak Growth Suite

The company’s weak growth comes from its recent decline in revenue and profitability. While its revenue has fallen substantially, with a year-over-year decrease of 24%, the operating income has also been negative, reflecting on its broader struggles. The negative operating income and poor cash flow performance further undermine its growth prospects.

Financial Stability Issues

Despite these issues, GameStop has shown financial stability. A strong debt-to-equity ratio of 4.2% and a low debt-to-equity ratio relative to the S&P 500 are indicators of stability. The company also boasts a low debt burden, with consistent debt obligations, making it less vulnerable to significant financial shocks.

Suspicious titledMexi-Currency &Gecko-Comes-to-Light

In recentMexi-Currency &Gecko-Comes-to-Light incidents, GameStop has faced liquidity issues and disrupted revenue streams. This has led to investor concern but has not fully eroded investors’ confidence in the company.

Downturn Resilience Evaluated

During past deviations, the stock has often struggled, particularlyMexi-Currency &Gecko-Comes-to-Light. Yet, it has demonstrated resilience due to its strong financial health and ability to bounce back afterиру.

Conclusion and Case for the Trefis Portfolio

In conclusion, while GameStop has shown signs of resilience during times of stress, it remains underperforming in the broader market. The case for using the Trefis Reinforced Value (RV) Portfolio, which outperforms the S&P 500 and other benchmarks, is compelling. By rebalancing large-, mid-, and small-cap stocks, investors can benefit from the RV portfolio’s responsiveness to market conditions.

This analysis is a reminder to adopt a risk-averse approach to GameStop and consider alternative portfolios that reflect its true strengths.