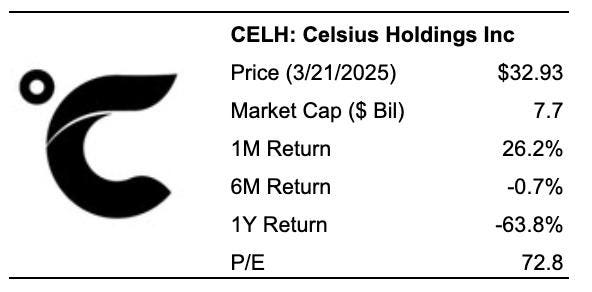

Sums up Celsius (CELH) stock performance:

-

Celsius Surges Signs of Success

In just a few months after announcing a new distribution agreement with Suntone and further expansion into Belgium and Luxembourg, Celsius (CELH) surged by over 20%. This move highlights the company’s ability to expand its market reach and add significant revenue streams. -

Last.StoredProcedure: Retail Sales Update

HTML content reflects the company’s growing confidence in retail sales, with retail sales showing a slight recovery of 0.2%. However, this wasn’t enough to meet the 0.6% target, with auto sales well under expectations. Excluding auto sales, a 0.3% recovery met the target. -

Valuation Considerations

After exiting 33%, Celsius appears costly relative to the broader market. Its prices-to-sales and price-to-earnings ratios suggest excessive valuations. Its financial stability, as evidenced by a strong debt figure and high cash-to-asset ratio, provides some defense against price tags. -

Financial Performance and Sustainability

Celsius’s growth projection and.nav ")) comparing its operations to the S&P 500 underscores high profitability. Key metrics include moderate operating margins, strong cash flows, and a balanced balance sheet. The strong financial position makes it a resilient stock for defensive investments. -

MarketPressure and Resilience FAILures

While Celsius has shown resilience through market downturns, it hasn’t triumphed in recent years. For example, by 27 January 2022, it surged 46% from its peak of $25.03, but has since rebounded. Conversely, in 2020, it fell 51.5% but rebounded to a peak by 18 May. - Putting It All Together

Despite its high valuation, Celsius stands out for its strong sales growth, moderate profit margins, and solid financialpeg. Its competitive edge makes it a formidable player in the beverage industry. While challenging, the stock presents opportunities for diversification, especially in equity vehicles like the Trefis Portfolio, which ensures diversification adjustments while maintaining strong returns.