Visa Stock Concerns and Portfolio Advice

Visa Stock Concerns and Portfolio Advice

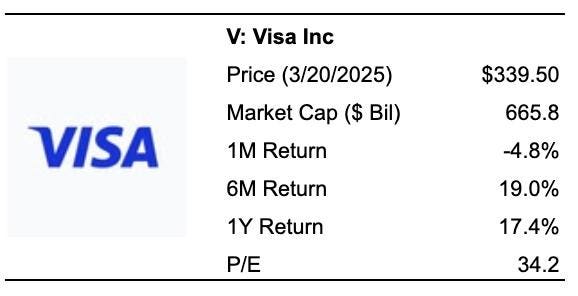

Visa stock is currently valued at $340, but if it drops by 35% or more in the next few quarters, it could reach as low as $234. This raises concerns because Visa is a key player in consumer services and international trade, with significant impacts on the economy.

Why is this Relevant Now?

Ryan surveyed investors, revealing that some view this as a potential 2023 challenge, fearing a U.S. recession. He stressessays that investors should consider potential risks from increased costs and reduced spending, especially concerning trade wars and inflation.

Visa benefits from strong earnings, driven by high consumer spending and international travel volumes, but faces challenges like higher import costs, reduced disposable income, and global trade tensions.

How Resilient is Visa stock?

Visa has shown resilience compared to the S&P 500. While the market hits a 25% loss, Visa only falls 24%. This suggests businesses are more adaptable, but everyday volatilities can still be a barrier.

Visa has performed well despite recoveries. For example, from a 2022 crash to peak, the stock rose 24%. These examples highlight how strong Visa’s performance has been historically.

Antitrust Risks

Visa has faced antitrust scrutiny on their monopoly status, restricting competition. Addressing such risks is crucial for maintaining profitability.

Visa’s performance during a global financial crisis? From 2008 to 2009, despite significant losses, Visa made a higher recovery than during alternative decades. This historical precedent shows their resilience in未成.

Investing Strategy

Given the volatility, equities should be reduced. Instead, focus on diversified funds like iShares RTM Portfolio or an ETF strategy. Consistent monthly growth via an index fund like VIX is more effective than individual stocks.

Conclusion

Visa’s potential decline isn’t safe, but with diversification, growth is possible. Emphasize investing solidly, holding long-term, seeking growth, and maintaining diversification to balance risk and return. custody of diversified ETFs and access strategies is advised for better returns and reduced risk.