Verizon’s Alluring 7% Yield: A Deep Dive into Dividend Investing and Sustainability

The allure of a 7% dividend yield is undeniable, especially in the current market environment. On Wednesday, shares of Verizon Communications (VZ) dipped as low as $38.44, pushing its dividend yield, based on its annualized $2.71 payout, above this enticing threshold. This high yield has captured the attention of income-seeking investors, but the crucial question remains: is it sustainable? This article delves into the significance of dividends in overall investment returns, the historical performance of dividend-paying stocks, and the specific case of Verizon, examining whether its current dividend payout is likely to continue.

Dividend income has historically played a crucial role in generating total returns for stock market investors. A compelling example is the performance of the S&P 500 ETF (SPY) between 1999 and 2012. While share price appreciation was minimal, with a slight decline over the period, the dividends received provided a substantial boost to overall returns. This underscores the power of dividends, particularly in periods of stagnant or declining market prices. They offer a consistent income stream that can significantly enhance total returns, even when capital appreciation is limited. This historical context emphasizes the appeal of a high-yield dividend stock like Verizon.

However, a high yield alone is not enough. The sustainability of the dividend is paramount. While a 7% yield is attractive, it’s essential to assess whether the company can realistically maintain such a payout over the long term. This involves examining the company’s financial health, profitability, and future growth prospects. A company’s dividend payout ratio, which measures the percentage of earnings paid out as dividends, provides valuable insight into the sustainability of its dividend. A high payout ratio can signal potential difficulties in maintaining the dividend, especially if the company’s earnings decline.

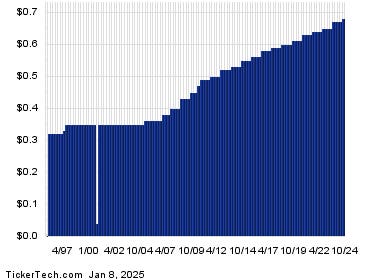

In the case of Verizon, analyzing the company’s historical dividend payments and financial performance is crucial in determining the likelihood of its current dividend being maintained. Factors to consider include its revenue growth, earnings stability, free cash flow generation, and debt levels. A strong financial position with consistent earnings growth and ample free cash flow provides a solid foundation for sustained dividend payments. Conversely, a company struggling with declining revenues, volatile earnings, or high debt levels may face challenges in maintaining its dividend payout.

Investors must also consider the broader industry landscape and competitive pressures facing Verizon. The telecommunications industry is characterized by intense competition and significant capital expenditures. Verizon faces competition from established players as well as emerging disruptors. Its ability to maintain its market share, innovate, and adapt to evolving technological advancements will play a significant role in its long-term financial performance and, consequently, its dividend sustainability.

Furthermore, macroeconomic factors can also impact a company’s dividend policy. Economic downturns, rising interest rates, or changes in regulatory environments can all affect a company’s profitability and its ability to maintain dividend payouts. Investors should consider these broader economic and industry-specific factors when assessing the long-term sustainability of Verizon’s dividend. A thorough analysis of these various factors can help investors make informed decisions about whether to invest in Verizon and whether its current dividend yield is a realistic expectation for the future.

In conclusion, while Verizon’s 7% dividend yield is undeniably attractive, investors should exercise caution and conduct thorough due diligence before making investment decisions. While historical dividend performance can provide some insights, it’s not a guarantee of future payouts. A comprehensive assessment of the company’s financial health, industry dynamics, competitive landscape, and macroeconomic environment is essential in determining the sustainability of its dividend and the overall investment potential of the stock. The allure of a high yield should not overshadow the importance of careful analysis and a long-term perspective on investment decisions.