Rithm Capital Secures Coveted Spot Among Top 10 REITs, Driven by Robust Profitability and Attractive Valuation

NEW YORK – Rithm Capital (RITM) has emerged as a leading contender in the Real Estate Investment Trust (REIT) sector, earning a prestigious position among the top 10 REITs, according to the latest "DividendRank" report published by Dividend Channel. This recognition underscores Rithm Capital’s compelling investment proposition, characterized by a unique blend of robust profitability metrics and attractive valuation, making it a standout choice for dividend-focused investors.

The DividendRank report highlights Rithm Capital’s impressive financial performance, particularly its compelling valuation metrics. With a recent share price of $10.86, the company boasts a price-to-book ratio of 0.9, significantly lower than the average of 2.6 for stocks covered by Dividend Channel. This suggests that Rithm Capital’s shares are currently undervalued relative to their underlying assets, presenting a potentially lucrative opportunity for investors. Further bolstering its appeal is a substantial annual dividend yield of 9.21%, significantly outperforming the average yield of 4.4% within Dividend Channel’s coverage universe. This combination of attractive valuation and high dividend yield positions Rithm Capital as a compelling investment prospect within the REIT landscape.

Dividend Channel’s proprietary DividendRank formula meticulously assesses both profitability and valuation criteria to identify the most promising investment opportunities. Rithm Capital’s inclusion in the Top 10 REITs list reflects its strong performance across these key metrics. The report emphasizes the importance of identifying companies that exhibit both strong profitability and attractive valuation, a combination that Rithm Capital demonstrably embodies. This rigorous evaluation methodology provides investors with a curated list of compelling investment ideas warranting further in-depth research.

REITs, by their inherent structure, hold a unique appeal for dividend investors. Mandated to distribute at least 90% of their taxable income annually to shareholders as dividends, REITs offer the potential for high dividend yields. However, this characteristic also introduces an element of volatility in dividend payments, which can fluctuate significantly based on the REIT’s profitability. While periods of substantial profits can translate into generous dividend payouts, periods of losses can result in reduced payouts or even dividend suspensions.

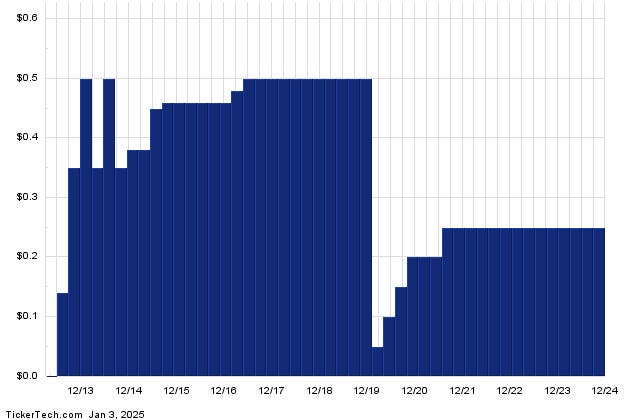

Rithm Capital’s current annualized dividend stands at $1 per share, distributed quarterly. The most recent dividend ex-date was December 31, 2024. The DividendRank report underscores the importance of analyzing a company’s historical dividend payments to assess the sustainability of future dividends. A consistent track record of dividend payments, as evidenced by Rithm Capital’s long-term dividend history chart, can provide investors with greater confidence in the likelihood of continued dividend distributions. This historical perspective is crucial for investors seeking reliable income streams from their investments.

Rithm Capital’s recognition as a Top 10 REIT by Dividend Channel underscores its strong financial footing and attractive dividend profile. The combination of a low price-to-book ratio, high dividend yield, and consistent dividend history makes it a compelling investment opportunity for dividend-focused investors. While the inherent volatility of REIT dividends requires careful consideration, Rithm Capital’s strong performance and attractive valuation position it as a potential standout performer in the REIT sector. Further research is encouraged to fully assess the company’s long-term prospects and suitability for individual investment portfolios.