The Golden Gateway: Understanding America’s New Immigration Program

In a bold move to attract global capital and wealthy immigrants, the United States government has introduced a controversial new initiative known as the “gold card” visa program. Launched last month, this initiative represents a significant shift in American immigration policy, offering affluent foreign nationals an expedited pathway to permanent residency—and potentially citizenship—in exchange for substantial financial contributions to the U.S. government. The program builds upon existing investor-based immigration frameworks like the EB-5 visa, which has historically granted green cards to foreign investors who create jobs through business investments in America. Alongside the gold card, officials have also proposed a more exclusive “platinum card” option, targeted at high-net-worth individuals seeking enhanced residency privileges and favorable tax treatment. While both programs share the common goal of drawing international wealth to American shores, they differ significantly in cost, tax implications, and intended beneficiaries, creating both opportunities and controversies in the immigration landscape.

The mechanics of these programs are straightforward but financially demanding. According to Ronnie Fieldstone, chair of the global immigration and financial investment practice at Saul Ewing LLP, the gold card program requires foreign nationals to make a direct payment to the U.S. government—$1 million for individuals or $2 million if the contribution comes from a corporation such as the applicant’s employer. The platinum card operates similarly but at a substantially higher price point of $5 million, potentially offering greater benefits to justify this premium. What distinguishes these programs from traditional investment visas is that the financial contribution represents a direct transfer to the federal government rather than an investment in a business venture. Unlike the EB-5 program, which has raised over $9 billion in capital according to Fieldstone’s experience with more than 500 projects, the gold and platinum card payments don’t produce economic returns or involve recoverable capital—they’re essentially one-way contributions to government operations. This fundamental difference has sparked debate about whether these programs truly qualify as “investments” or simply represent a way for wealthy individuals to purchase immigration benefits.

The target audience for these programs appears quite specific. The gold card may particularly appeal to individuals who would otherwise pursue EB-1 or EB-2 visas—categories reserved for those with extraordinary abilities or advanced degrees—but face lengthy backlogs due to country-specific quotas, particularly applicants from China and India. The platinum card, meanwhile, would likely attract individuals holding significant non-U.S. assets, especially business interests that would otherwise be heavily taxed or require substantial compliance efforts under normal U.S. tax residency rules. David Shapiro, Chair of Saul Ewing’s tax practice, notes that these programs clearly aren’t suitable for everyone given their substantial upfront costs and potential tax implications. The decision to participate ultimately comes down to a personal calculation of whether the benefits—primarily expedited residency—justify the non-recoverable financial contribution. Some immigration attorneys have already cautioned potential applicants against using certain funding sources, such as self-directed IRAs, due to possible violations of tax regulations that prohibit using retirement plans for personal gain.

One of the most complex aspects of these new programs involves their tax implications. Neither the gold nor platinum card automatically establishes U.S. tax residency, though gold card holders could become tax residents based on the substantial presence test—a calculation that counts days present in the U.S. over a three-year period. If the weighted total equals or exceeds 183 days, the individual is treated as a U.S. tax resident regardless of their intentions or the nature of their stay. However, residents of countries with which the U.S. has tax treaties (more than 60 nations currently) could potentially assert that they are not U.S. tax residents despite meeting the physical presence threshold. The platinum card offers a more generous arrangement, potentially allowing holders to remain in the U.S. for up to 270 days annually without triggering tax residency—a significant deviation from current federal law that, according to Shapiro, would likely require Congressional approval before implementation. Even without tax residency status, platinum card holders would still face U.S. taxation on any U.S. source income, maintaining some level of fiscal obligation to their host country.

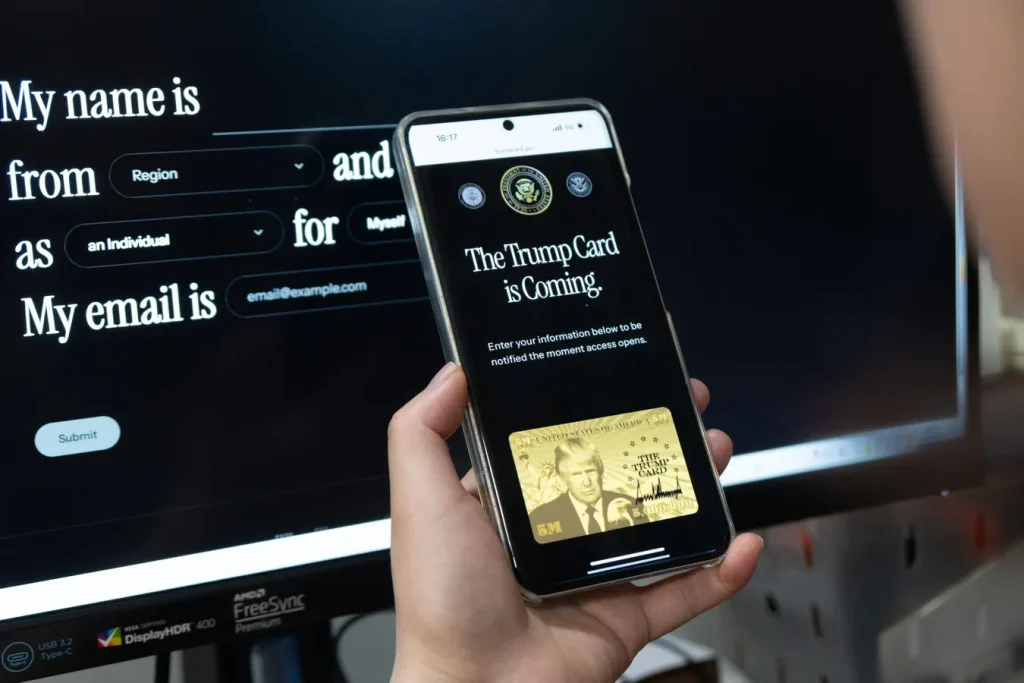

Despite the promotional language suggesting imminent availability (the official website trumpcard.gov invites visitors to “sign up now”), the implementation timeline for these programs remains uncertain. While the gold card might be implemented through executive action, the platinum card’s proposed tax provisions would require Congressional authorization—a challenging prospect given current legislative priorities and the recent government shutdown concerns. The vetting process for applicants also remains somewhat unclear, though Fieldstone suggests that investors will likely undergo scrutiny regarding the source of their funds during qualification. This caution reflects broader concerns about potentially allowing individuals with questionable wealth sources to gain expedited access to U.S. residency. The administration appears to be positioning these programs as investments in the United States, but critics question whether direct payments to the government truly generate the economic benefits traditionally associated with investment-based immigration programs like job creation or business development.

As America stands at this crossroads of immigration policy and economic strategy, the gold and platinum card programs represent a significant experiment in how the nation attracts global wealth and talent. For potential applicants, these programs offer an alternative to traditional pathways that may be backlogged or burdensome, particularly for nationals from countries facing severe immigration quotas. For the United States, they represent a potential revenue stream and a competitive response to similar programs offered by other nations seeking to attract mobile global elites. However, fundamental questions remain about equity, access, and the philosophical implications of creating immigration pathways available exclusively to the wealthy. As Congress considers the legislative components of these initiatives and as the first applications begin processing, both proponents and critics will be watching closely to see whether these golden gateways truly deliver on their promises—both to the immigrants who use them and to the American society they seek to join.