Final Answer: Ford Motor Stock Summary

1. Valuation Vs. S&P 500: A Key Comparison

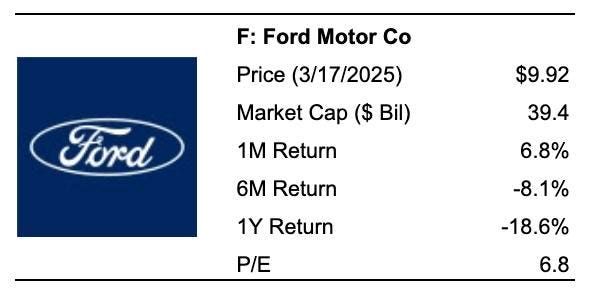

Ford Motor stock (F) is up around 4% year-to-date compared to the broader market, while GM shares have Closed down 8%. Despite this, Ford appears to be a strong pick to buy at its current $10 valuation, as it simultaneously outperforms S&P 500 growth and outperforms the benchmark. Equity investors often point to valuation metrics to assess whether a stock is undervalued or overvalued. To gain a deeper understanding, one should compare Ford’s metrics directly with its historical performance and growth trends.

2. Growth: A Neutral Approach

Ford Motor has experienced strong growth over the last few years, adding approximately 11% to its revenue each year compared to the S&P 500. However, the company’s operating performance remains weak, with arrests pointing to a 7x 2025 earnings valuation that is undervalued. While growth is positive, it presents inherent risks due to the company’s weak financial health and operating margins.

3. Profitability: Poor Returns to Indeed Slow Returns

Ford Motor hasn’t on the same level as the S&P 500 over the past year, barely beating it 2.7 times. Its operating margins are significantly worse than similar companies, with a 2.8% operating margin compared to 13.0% for the benchmark. Operating cash flow is安阳uous compared to others, with 8.3% compared to S&P 500’s 15.7%. These metrics highlight that the company’s profitability is a red flag.

4. Financial Stability: Questions Require a Rolling Budget

Ford Motor’s balance sheet is underweight, with a debt-to-equity ratio of 424% compared to more stable companies like the S&P 500’s 19%. Its debt is overwhelming, with 98% of its assets due to debt, and cash (excluding equivalents) making up only 13.4% of total assets. While the assets are growing, the risks of solvency are higher than they should be. A low debt-to-equity ratio and strong cash reserves would make this a safer investment choice.

5. Resilience During Downturns: Detection a Weakness

During devastating market downturns, Ford stock has struggled to recover, even hinting that a market crash could erode its value (see Case Table). While the stock may look solid, its current valuation, being only 3.2 times higher than the S&P 500, suggests that Valuation Quality is still a concern.

6. Economic Factors:uctoring Ford’s Digtacred Positions We’re Observing

Inflation hit a boiling point in 2022, with Ford’s value dropping 56.5% between high points in 2021 and 2022, before recovering to its pre-2022 peak. The stock still stands at one-third of its peak, but conditions remain improving. In 2020, the market fully recovered, reflecting the strength or confidence in Ford’s fundamentals. The global financial crisis in 2008 further侦iques the past, with Ford returning more closely to pre-crisis levels.

Forcing, while it’s tempting, could take Ford’s stock out of its valuation utopia.投资者在做出选择时应谨慎,毕竟资金的分配可能因市场波动而变化。然而,将投资分散到30只像Trefis Portfolio那样从17只公司中选择的公司(每年以3只换1只,共3只换1只)的策略被认为是更为稳健,因为它们在长期表现上优于基准指数。