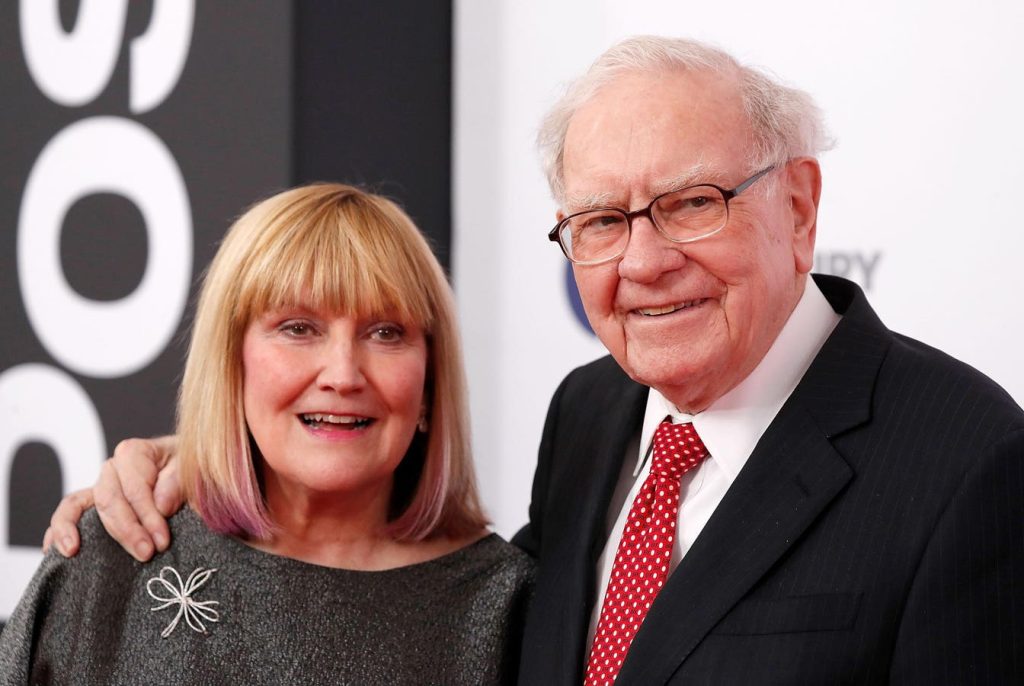

Warren Buffett’s Estate Planning Insight: Navigating Transparency and Flexibility in Family Dynamics

In his recent letter to shareholders for 2024, Warren Buffett ignited discussions among estate planning professionals with a recommendation to disclose estate plans to adult children prior to their execution. This counsel, aimed at fostering transparency and trust within families, carries both potential benefits and risks. Sharing one’s estate plan could lead to open communication, but it might also spark conflict, invite undue influence, and limit the flexibility necessary for adapting to changing circumstances. Families with intricate assets, including businesses, art collections, or other collectibles, are particularly challenged by the need to balance transparency with careful consideration.

One of the most significant advantages of sharing estate plans is the promotion of transparency and trust. Research in behavioral economics supports the idea that early and clear communication reduces anxiety and misunderstandings, thereby fostering an environment of trust among family members. By discussing their intentions with their children, parents can effectively communicate their specific wishes regarding asset distribution, reducing the likelihood of disputes after their passing. Clarity around the intentions underlying the estate plan can mitigate feelings of resentment or disappointment among heirs, fostering harmony and maintaining family bonds.

Involving adult children in discussions about estate planning can stimulate meaningful conversations about family values and legacy, reinforcing the family’s shared purpose. This exchange may also strengthen relational ties as children come to understand the considerations that shape their parents’ decisions. However, while the potential for these positive outcomes exists, the advice to share estate plans is not without risks. Prematurely divulging details can result in disagreements among family members, suggesting a profound need for parents to carefully evaluate the dynamics of their family relationships before embarking on this path.

One salient concern is the risk of undue influence; once children are privy to the details of the estate plan, they may inadvertently (or deliberately) pressuring their parents for modifications that do not reflect their original intentions. Furthermore, early disclosure can create rigid expectations about how assets will be allocated, which might hamper parents’ ability to adapt their plans as family dynamics evolve. This inflexibility can be particularly problematic in families with valuable or emotionally charged assets, such as businesses or heirlooms, where disputes may arise over valuation and distribution.

To navigate these complexities, the Strategy and Tactic (S&T) Tree, a decision-making tool rooted in the Theory of Constraints, can provide clarity and structure. This framework encourages families to define overarching goals, set intermediate objectives, and identify specific strategies and tactics to reach those objectives. For example, in a family business scenario, the goal might be to ensure the smooth transition of leadership while maintaining continuity and harmony. By engaging in this structured decision-making approach, families can make informed choices that reflect both their values and practical needs, while considering the underlying assumptions of their decisions.

Ultimately, Buffett’s counsel serves as a burgeoning reminder of the importance of transparency in estate planning but underlines the potential pitfalls of premature disclosures. Each family’s unique dynamics and asset structures require a thoughtful strategy that balances openness with prudence. The S&T Tree can act as a guiding framework, helping families to prioritize the preservation of legacies over potential conflicts. By acknowledging the nuances of estate discussions, families can take a more measured approach, aligning their planning processes with long-term values and objectives.