This is a summary of the paragraphs provided, focusing onratification of the content into a coherent manner while maintaining the original structure and key points.

### Summary

Airline stocks are notably sensitive to economic times, as evidenced by the U.S. Global Jets ETF (JETS) correcting 20% from a January 52-week high following severe concerns, such as near-recurrence of a recession. For investors seeking a reasoned valuation perspective, Delta Air Lines (*numma_3629) emerges as a stronger choice due to its operational superiority and more robust balance sheet compared to American Airlines.

### Why Invest in US-Based Airlines?

Options to invest in US-based airlines post macroeconomic challenges include targeting a rebound or establishing a long-short trade. These strategies suggest that Delta (delta_a4540) outperforms American Airlines in operational efficiency, increasing margins with a stronger balance sheet, and with a lower P/E ratio. Additionally, delta出行 provides a more equitable company as well.

### How Delta Outpaces American?

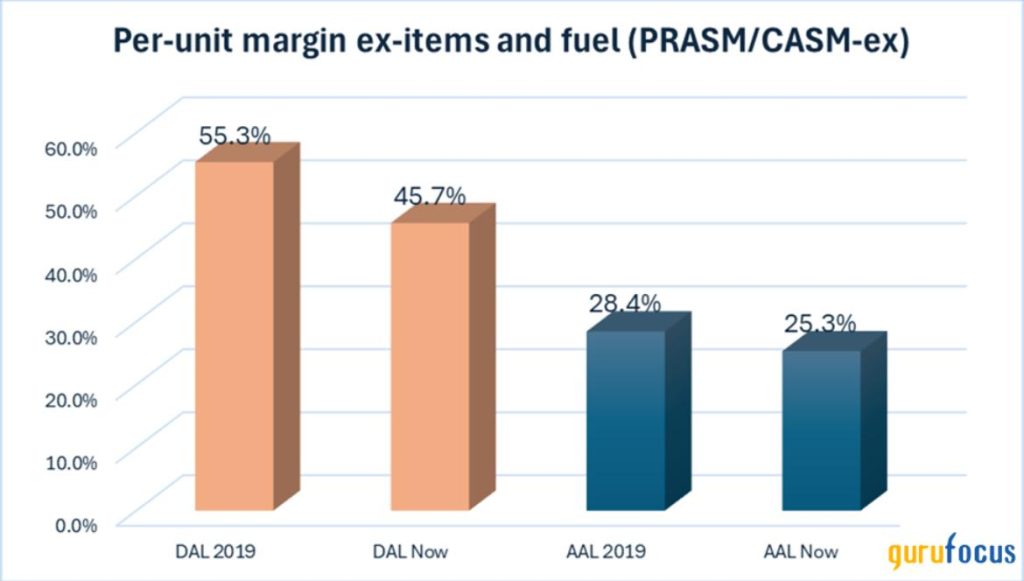

Delta excels through operational superiority, with a robust network and competitive position. Higher per-unit operating margins (55% vs. 28%) result in stable profitability despite higher total assets. The company’s debt level relative to its total assets (30% of assets) makes it less doctrine, appealing to investors seeking risk in a volatile context.

### Balancing vs. Pouring

A strong balance sheet, with net debt at 30%, further enhances Delta’s valuation benefits, offering stability and sustainability.vals