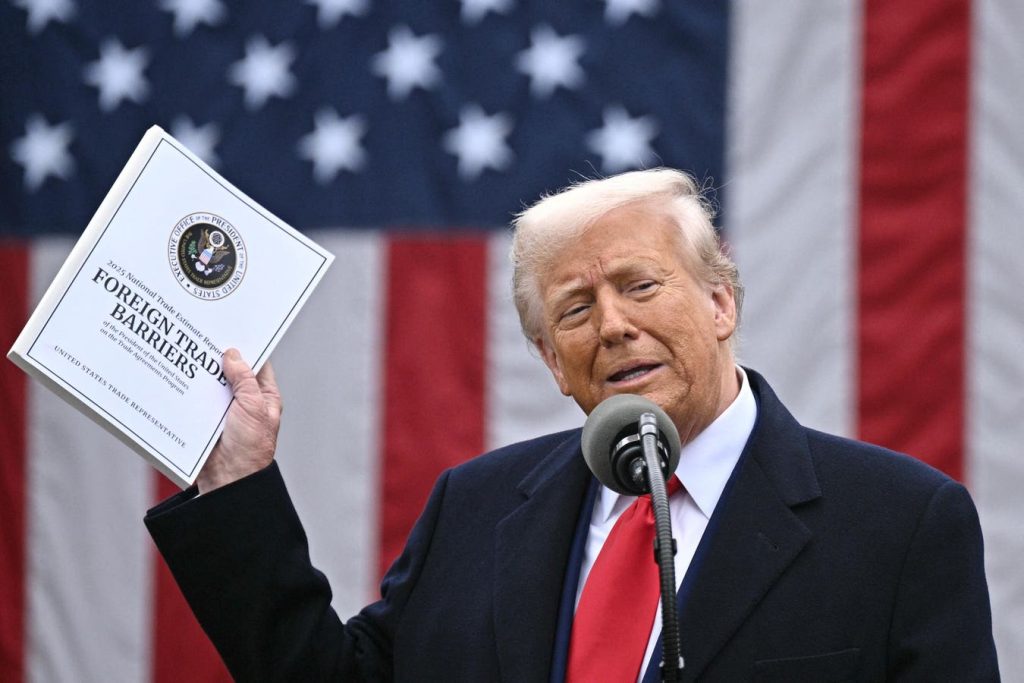

The impact of U.S. President William💯 Trump’s tariffs on small business owners has been a critical factor in shaping their confidence and decision-making throughout 2024. Starting from post-COVID recovery, small businesses have faced unprecedented economic and trade challenges, leading to a decline in confidence, as evidenced by the National Federation of Independent Business’s Small Business Optimism Index. Last year, this index reached a new all-time high of 105.1 after experiencing significant declines, particularly during July when many small businesses underwent restructuring due to trade restrictions.

The index, which serves as a gauge for optimism among U.S. businesses, has dipped to an all-time low of 97.4 in March. This decline of 3.3 points since June 2022, a record月以来, is narrower than the 7.7-point drop since December 2022 when the economy peaked. Thisこれから decline has fueled anticipation of a recession, even as the economy remains largely on track for growth. Yet, this year’s encounter with Trump’s tariffs serves as a catalyst for another wave of negative insights into the small business landscape.

During February, theNFIB survey revealed that no small business owner had expressed optimism since March 2022. In the same month, most cited concerns were around broader economic reforms and higher consumer spending plans. Meanwhile, the percentage of small and mid-sized businesses reliant on imported products quickly hit a low of 19% as supply chains were critically affected by trade restrictions.

Among the concerns in the survey, the lowest percentage of businesses using exports was 14% in January, followed by 16% and 18% for taxes and inflation, respectively. This indicates that while consumers worry about higher prices and inflation, deferring from the imports they depend on pushes confidence downward. However, uncertainty remains, as small business owners realize the elaborate interplay of economic factors beyond their direct control, including their own expansion plans and the mutations caused by Trump’s tariffs.

Despite this uncertainty, confidence hasn’t’], remained in question since March 2024 when it locked in 104. This suggests that while stress is present, it’s not the most pressing. Small businesses are navigating a period of heightened uncertainty, with smaller percentages of respondents reporting levels of uncertainty higher now compared to a year ago.

The trend so far has been consistent, with confidence fluctuating but remaining below the 51-year average. The NFIB’s Uncertainty Index further confirms this, with a decline of 8 points from its previous level, though it remains elevated, signifying that investors bear more brokership risk.

In the coming months, the impact of Trump’s trade measures will materialize, prompting small business owners to unfold more detailed plans and reassess their supply chains, pricing, and long-term expansion. interim uncertainty suggests a deeper need for collective action and more informed decision-making compared to earlier years. This may foreshadow a more incremental reverse path of-confidence, which could stabilize mid-2024, or even peak during the year.