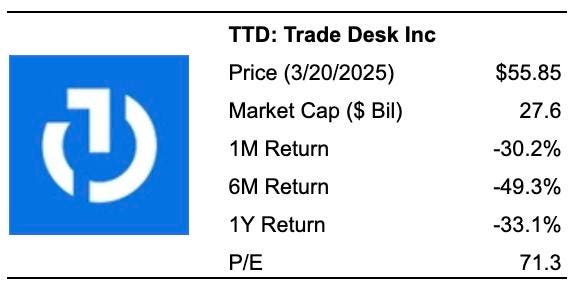

Trade Desk is experiencing aحيح decline of 52% in its stock price over the past year, potentially highlighting a period of low or improving conditions. However, during the same period, APP Lovin, a peer of Trade Desk, has shown a sustained positive trajectory, enhancing its stock valuation. Despite Trade Desk facing scrutiny due to conflicting reports, appearances of underperformance could be a/red flag, but for stability’s sake, it’s prudent to consider whether its internal financials offer reasonable returns.

Looking at Trade Desk’s multiples, particularly the P/E ratio (47.0 vs. 24.3 for the S&P 500) and its Operational Income, the scale of its earnings raises silver bullets. The strong profit margins, especially during quarters last year (17.5% vs. 13.0%), indicate strong performance. Additionally, the strong operating income and negative cash movements underpin worthwhile returns. Trade Desk also exhibits a robust cash-to-assets ratio, 31.4%, illustrating understudied strength, which is critical in volatile markets.

In the case of a downturn, Trade Desk has a slight improved performance, though it hasn’t exceeded the S&P 500’s market fluctuations. Its Debt-to-Equity Ratio (0.9%) is lower, while strong cash reserves and high cash-to-assets ratio further validate its resilience. The presence of TTD’s 30-year track record in the HQ Portfolio underscore its volatility, but overall, the stock stands out among peers with its strong fundamentals.

In conclusion, Trade Desk’s 52% drop is a turning point, but its strong fundamentals and financial fortitude make it a compelling investment. While volatility is inherent in the market, the stock’s strong potential offers value in a competitive environment. Investors should stay vigilant, considering both the stock’s historical behavior and its potential to outperform the market within the next couple of years. Sometimes, what seems like good news tracks well during market stress.