Microsoft’s Q1 FY25 Earnings Showcase AI-Powered Growth and Long-Term Potential

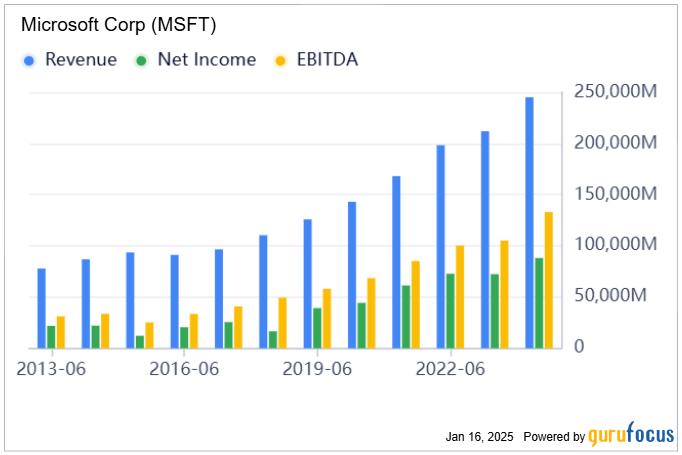

Microsoft’s recently released Q1 FY25 earnings report paints a picture of a company firing on all cylinders, with robust growth and strategic investments in artificial intelligence (AI) setting the stage for continued success. The tech giant reported revenues of $65.6 billion, a 16% year-over-year increase, exceeding its previous quarter’s growth and highlighting the effectiveness of its AI-focused strategy. This strong performance is driven by significant advancements across key business segments, including Productivity and Business Processes, Intelligent Cloud (headlined by Azure), and More Personal Computing. Microsoft’s strategic partnership with OpenAI, the creator of ChatGPT, further strengthens its position in the burgeoning AI landscape and fuels the growth of its Azure cloud platform.

Azure, the crown jewel of Microsoft’s Intelligent Cloud segment, experienced a remarkable 33% growth in Q1, solidifying its position as the company’s primary profit engine. This surge is propelled by the increasing demand for AI infrastructure and the rapid adoption of AI-powered solutions. Management’s projections indicate continued high growth for Azure, with forecasts of up to 32% growth in the next quarter and further acceleration anticipated in the second half of the year as more AI capacities come online. This sustained growth trajectory positions Azure to potentially eclipse Microsoft’s Productivity and Business Processes segment as the company’s leading revenue generator.

While Microsoft currently trades at a premium valuation of 33 times earnings and 12 times sales, its robust financial position, high profit margins, and AI-driven growth strategies justify its long-term investment appeal. The company boasts an impressive balance sheet with $116.2 billion in cash and $45 billion in debt, providing a solid foundation for future investments. While capital expenditures have increased due to heavy investments in AI infrastructure, Microsoft’s financial strength remains undeniable. Analysts predict double-digit growth rates for the company in the coming years, driven by the continued momentum of Azure and the increasing adoption of AI solutions.

Despite the premium valuation, Microsoft’s high earnings yield, combined with the anticipated growth, contributes significantly to its long-term return prospects. The company’s net margins are expected to reach 45%-50% in the long term, driven by operating leverage, which further supports the justification for its current valuation. Considering the consensus growth estimates and the earnings yield, the stock is projected to deliver annual compounded returns of 15% to 17% over the next five years or more. Even under a more conservative scenario, with the stock trading at 21 times long-term earnings in five years, it is still expected to outperform the market average.

Microsoft’s recent stock performance reflects a degree of market caution, with the stock trading in the $410-$425 range after reaching a high of $450 in mid-2024. This correction is likely due to valuation concerns and broader market factors rather than company-specific issues. The $400 level serves as a critical support zone, offering potential buying opportunities for investors. While short-term price movements are expected to remain within the $400-$450 range, the long-term outlook remains positive, driven by the anticipated double-digit revenue growth and increasing net margins.

While Microsoft’s future appears bright, several risks warrant consideration. Slower-than-expected adoption of AI technologies, particularly Azure-based AI tools like Microsoft 365 Copilot, could impact revenue growth projections. Intense competition from industry giants like Amazon Web Services (AWS) and Google Cloud poses a significant challenge, particularly in the cloud and AI segments. Furthermore, regulatory scrutiny, including investigations related to the Activision Blizzard acquisition and potential new regulations for Big Tech, could hinder Microsoft’s expansion strategies and introduce additional complexities.

Despite these risks, Microsoft’s strong leadership in AI and cloud computing, combined with its robust financial health, positions it well for continued growth and market outperformance. The company’s commitment to innovation and its strategic investments in AI are expected to drive long-term value creation for investors. Microsoft remains a compelling long-term buy for those seeking exposure to the transformative power of AI and the growth potential of the cloud computing market. While short-term market fluctuations may occur, Microsoft’s fundamental strengths and its position at the forefront of technological advancements make it a highly attractive investment for those with a long-term perspective.