Johnson & Johnson: A Deep Dive into an Oversold Dividend Stock

Johnson & Johnson (JNJ), a global healthcare giant, has recently entered oversold territory, presenting a potentially lucrative opportunity for dividend-focused investors. This assessment comes from Dividend Channel’s proprietary DividendRank formula, which identifies stocks with a compelling combination of strong fundamentals and attractive valuations. JNJ currently holds a high rank within this system, placing it in the top 25% of the coverage universe and highlighting it as a particularly interesting prospect for further investor research.

The key trigger for this renewed interest in JNJ is its recent dip into oversold territory. On Friday, shares of JNJ traded as low as $148.95, triggering a Relative Strength Index (RSI) reading of 29.0. The RSI is a widely used technical indicator that measures momentum on a scale of 0 to 100, with readings below 30 typically signaling oversold conditions. This suggests that the recent selling pressure on JNJ may be nearing exhaustion, potentially creating a favorable entry point for investors. The current average RSI for dividend stocks covered by Dividend Channel stands at 52.5, further emphasizing the relative oversold nature of JNJ.

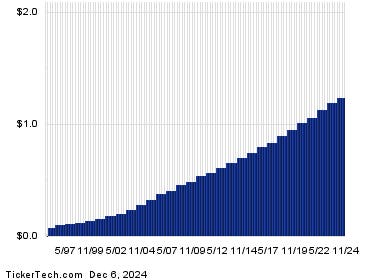

For dividend investors, a lower stock price translates to a higher yield, assuming the dividend remains constant. JNJ currently boasts an annualized dividend of $4.96 per share, paid quarterly. Based on the recent share price of $149.52, this equates to an attractive annual yield of 3.32%. While past dividend performance does not guarantee future payouts, JNJ’s consistent dividend history provides a degree of confidence for income-seeking investors.

A deeper look into JNJ’s fundamentals is crucial for investors considering a position in the company. While no investment is without risk, JNJ’s strong market position, diversified product portfolio, and history of innovation suggest a robust foundation for future growth. The company operates across three major segments: pharmaceuticals, medical devices, and consumer health. This diversification helps mitigate risk and provides stability in the face of evolving market dynamics.

Furthermore, JNJ’s commitment to research and development (R&D) has consistently fueled the development of new and innovative products, ensuring its long-term competitiveness. The company invests heavily in R&D, resulting in a pipeline of promising therapies and technologies. This dedication to innovation not only strengthens its existing product portfolio but also positions it to capitalize on emerging healthcare trends.

The recent market downturn has impacted JNJ’s share price, providing an opportune moment for investors to re-evaluate the stock’s potential. While market volatility can create uncertainty, it can also present attractive buying opportunities for well-established companies like JNJ. Investors with a long-term perspective may find the current price dip an appealing entry point.

In evaluating JNJ’s dividend sustainability, investors should examine the company’s payout ratio, which measures the percentage of earnings paid out as dividends. A lower payout ratio generally indicates a greater ability to maintain or even increase dividend payments. JNJ’s payout ratio is currently within a reasonable range, suggesting a comfortable cushion for its dividend.

Furthermore, JNJ’s strong balance sheet provides financial flexibility and resilience. The company maintains a healthy cash position and manageable debt levels, allowing it to navigate economic downturns and invest in future growth opportunities. This financial strength further strengthens the argument for JNJ’s dividend sustainability.

In conclusion, JNJ’s entry into oversold territory, coupled with its strong fundamentals, makes it a compelling investment opportunity for dividend-focused investors. The combination of a high DividendRank, an attractive dividend yield, and a robust business model warrants further investigation. While market conditions remain volatile, JNJ’s inherent strengths and its commitment to innovation position it well for long-term growth and continued dividend payouts. Investors should conduct thorough research and consider their individual risk tolerance before making any investment decisions.