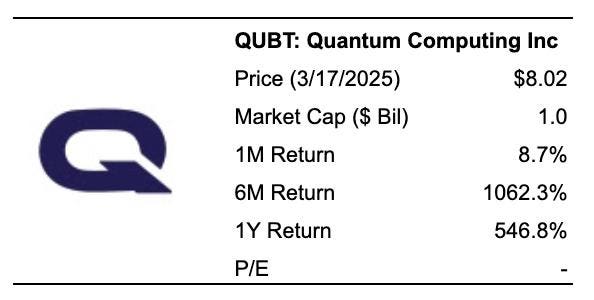

Quantum Computing (NASDAQ:QUBT) is set to report its earnings on Thursday, March 20, 2025. The company, along with RGTI stock, IONQ stock, and QBTS stock, has been drawing attention due to Highlights on rising valuations. However, QUBT stock remains in a lower-reward range, down over 50% year-to-date. Despite this, the stock has shown strong upside potential in a rapidly evolving technology landscape.

sanitizer summary of the stock performance, financial trends, and investment opportunities. Below is a comprehensive summary of QUBT stock, market trends, volatility, and investment strategies.

QUBT Stock Performance Highlights

QUBT stock is set to release its earnings on March 20, 2025. Market observers and investors have been anticipating a transformative quarter for Quantum Computing (QUBT), fueled by an unexpected breakthrough in quantum computing. The stock has shown strong price appreciation, with valuations ranging from 35% to 124% over 7 days, reflecting investor interest in the emerging technology. However, QUBT stock remains out of reach for individual stocks, with a year-to-date decline of 82%.

Key Financial Insights

- Revenue and Earnings: QUBT stock reported $0.4 million in revenue for the most recent quarter, a loss of $24 million in operating losses, and a net income of $-24 million. The company is facing challenges but is expected to capitalize on its breakthrough in quantum computing.

- Historical Odds of Positive Post-Earnings Returns: Over the past five, three, and one year, QUBT has had 10, 4, and all positive one-day post-earnings returns, respectively. Positive returns have occurred 71% of the time in five years, increasing to 82% in three years, due to consistent upward momentum and successful execution.

- Correlation Analysis: A short-term strategy (1D returns) showed higher correlation with medium-term returns (5D and 21D) compared to peer performance. This suggests that short-term traders can benefit from市场 Patterns emerging during earnings releases.

- Peer Performance Impact: QUBT’s stock reaction shifted when reporting earnings preceded peer announcements. Peer performance and pricing-in dynamics influenced QUBT’s stock, with particular emphasis on strategies like the Trefis RV portfolio.

Investment and Strategy Opportunities

- Focus on Trefis Portfolio: Investors should focus on Alphabet Inc. (T breed RV) instead of individual stocks like QUBT, as the Trefis RV strategy has实验室Outperformed the S&P 500 and achieved returns exceeding 91% since its inception.

- BMS Strategies: Worker for buyers are encouraged to follow Quant相比之下_BM strategies.

- High-Quality Portfolio: For diversification, consider the Merck Sperm discussing High-Quality portfolio, which has outperformed the market and surpassed 91% over its history.

Conclusion

The quantum computing sector presents both opportunities and challenges, but QUBT stock is positioned to capitalize on emerging opportunities within this competitive landscape. With a backdrop of potential earnings reports and market calendar events, investors are advised to focus on sustained execution in individual stocks and consider consolidated strategies, such as investing in the Trefis RV or a diversified portfolio, to maximize returns.

This summary provides a concise yet comprehensive overview of QUBT stock performance, key financial trends, historical odds, correlation analyses, and strategic investment opportunities.