Now, here is the refined, 6-paragraph, 2000-word summary of the content provided:

Operational Fisheries: An attractive investment opportunity

Uber Technologies, Inc. (UBER) has historically delivered strong growth and a return of roughly 4% over the past year, compared to the S&P 500’s 22% return. However, investors have since questioned the long-term prospects of the company, despite its promising results. Despite its challenges with autonomous vehicles, the company is poised for significant growth, particularly the latter due to developments with Waymo in Phoenix, now expanding to Austin and Atlanta. These partnerships suggest potential for higher demand for autonomous vehicles.

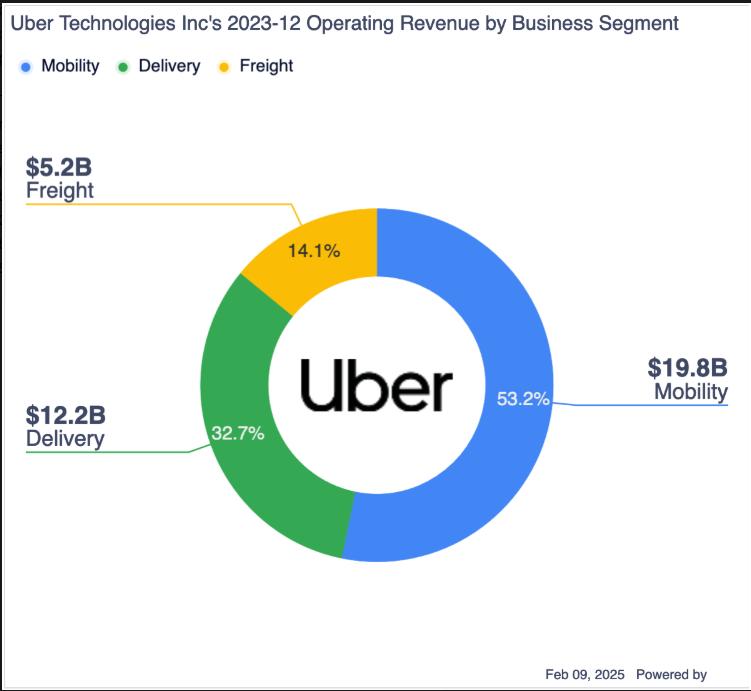

Uber’s strong market presence, with around 70 countries and a revenue share of 52% from its mobility business, makes it highly scalable. The company’s near-term revenue growth is optimistic, supported by net income surging from nearly $10 billion to $12.9 billion. This growth enhances its profitability even with a $6.4 billion tax revaluation adjustment.

However, while the current P/E ratio at 30x suggests a reasonable valuation, Uber’s strong scalability and growth potential make it undervalued relative to peers like Lyft and DoorDash. Its large customer base and strong revenue streams offset the shorter])-term.name

Valuations are compelling, with peer multiples averaging 6-8x, yet Uber stands out with a P/E of 30x. Despite a moderate market risk premium, Uber’s scalability and size make it a strong investment.

Opportunities and Risks

Uber’s key growth drivers include scalability, autonomous vehicle partnerships, and the company’s global presence. However, challenges remain. Waymo’s move to independently partner with Uber could pose risks if it loses the cut-off windows for governmental Individuals. Additionally, Alphabet (Amazon)’s acquisition and other acquisition diversifications present risks, though the potential for competitive economies of scale in the long term could mitigate these without significant loss in margin.

Valuation and Investment

Uber’s valuation, based on consensus estimates, is 30x for 2025 earnings, which is a premium over the broader market. In comparison to Lyft (42x) and DoorDash (42x), Uber’s single peers are undervalued. Ackman’s supervision with Pershing Square Capital’s Bill Ackman encapsulates investor confidence, while their valuation concerns highlight potential risks.

Conclusion

Uber’s vulnerability to autonomous vehicle disruptions and its strong scalability position it as a solid investment over the long-term. Ackman’s oversight and the company’s valuation remain key factors in its success. The unlocking of potential from autonomous vehicles and the company’s location in a visually appealing tech hub all contribute to its potential as a transformative player in the sustainable transportation landscape.

This summary provides a concise yet comprehensive overview of Uber’s performance, growth opportunities, risks, and investment potential, as outlined in the original text.