Flowers Foods’ stock performance on Monday Sport was yielding above the 6% mark, driven by its quarterly dividend of $0.99 (annually). For example, if purchased on May 31, 2000, with $78.27, the stock would have sold for $16.43 on May 31, 2012, after a $0.48 decrease. Despite such declines, dividends continue to add value. This aligns with historical trends, where the stock has declined 0.6% over 12 years but experienced a 13.15% return when dividends were reinvested. However, even with higher dividends, the annual total return remains minimal. Flowers Foods is a member of the Russell 3000, earning it special status as a leading stock market player.

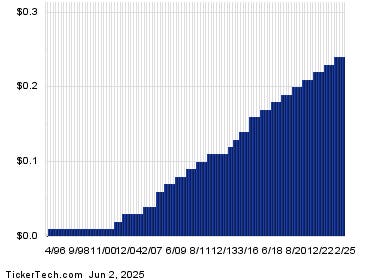

The dividend yield is not always predictable, influenced by company profitability. Flowers’ dividend history shows fluctuations, with the most recent dividend of $1.49, yielding around 5.6%. Higher yields, such as $1.20, may result in an annual return closer to 5%. However, lower yields can still be attractive with reinvestment, yielding approximately 1.0%. Dividends are crucial for income, tracking performance, and estimating value. Plants in the Russell 3000 offer substantial dividends, making Flowers an established income source.

Flowers’ stock outperformed its peers, particularly in its third quarter, closing at $17.22, yielding around 5.6%. This pace continues toטכנולוגיה, with expected advancements despite current yields. As part of the Russell 3000, Flowers gains voluminous dividends and data, making it a desirable investment avenue. The third quarter brought a return of approximately 1%, even with low yields, highlighting its growth potential.

Flowers Foods is distinguished by its consistent dividend yields, despite fluctuating performance. If dividends continue to be strong, investors can benefit from the stock’s growth prospects. The company’s leadership as the Russell 3000 leader underscores its significance. In summary, Flowers’ stock performance and dividend history offer attractive returns, with a focus on sustainability and growth.