Exxon Mobil (XOM) made headlines last week when the company announced that it would trade a $0.99 ex-dividend dividend for its fourth-quarter quarter ending on March 10, 2025. As a percentage of its recent closing stock price of $108.89, this dividend represents approximately 0.91%, which means potential shares of XOM could trade lower by that percentage by March 12th, 2025, if the stock remains open. The dividend, declared on a quarterly basis, is a common practice for companies, but it’s critical to understand its implications for investors.

Dividend payments are always subject to interpretation, and while they can indicate financial sustainability, they also carry risks. By reading about the company’s dividend history, investors can gauge whether a dividend policy aligns with their desired level of returns. In examining XOM’s recent dividends, it’s clear that going forward, the most likely situation is either continuation or-scaling down, depending on whether the company can sustain its current dividend payments versus investing more in growth or retaining earnings for future expansion.

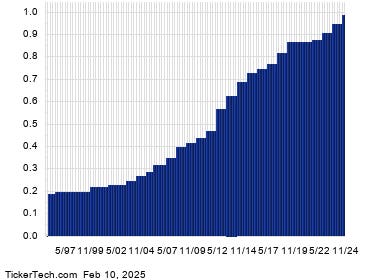

Dividend history often serves as a reliable indicator of a company’s stability and future prospects, but it’s not an infallible predictor. Looking at XOM’s dividend trends over the past few quarters, we can see that the company has been paying a consistent and growing dividend yield. The three most recent quarterly dividends were $0.63, $0.84, and $0.99, respectively, setting a somewhatexpected pace for future growth. This historical trend suggests that XOM’s dividend policy is resilient and poised for continued success, capitalizing on its italiane dominance and strong earnings.

When it comes to performance, XOM’s stock has been relatively stable, albeit not outperforming its peers as a whole. On the one hand, the 3.64% annualized yield is competitive, especially given earnings that have surpassed industry averages. On the other hand, comparing XOM’s performance to its 200-day moving average highlights its relative strength. However, the interior walls of XOM remain somewhat informal, especially in an economy that dictates political, social, and economic structure. This environment can lead to skimping on cash if the company fails to dedicate resources toward production instead of using capital to fund growth.

Looking at the broader market, XOM has been perched on a low point of $100.42 during its recent 52-week cycle, but its 52-week high for the past year has surpassed $126.34, indicating resilience. The stock is trading within a narrow band around its 200-day moving average, which suggests discipline in choosing returns. Additionally, XOM has seen its price trend up by just 0.4% on Monday trading, indicating that the stock is neither overbuying nor selling off—but it remains well-positioned to advance.

Investors looking to capitalize on this opportunity should be well-informed about the company’s future prospects. The $0.99 dividend converse is manageable in itself, but the risks remain tied to the company’s ability to sustain and expand its operations. By staying informed and actively engaging with the company below, investors can better gauge potential success versus failure. In the long run, the stable dividend yield and robust performance suggest that XOM is poised for continued success, especially when factors like political and economic stability are favorable. However, it’s important to remember that no investment is risk-free, and success will require patience, adaptability, and the constant tastiest approach, which ultimately means staying calm and focused.