Summarizing and Humanizing the Provided Content

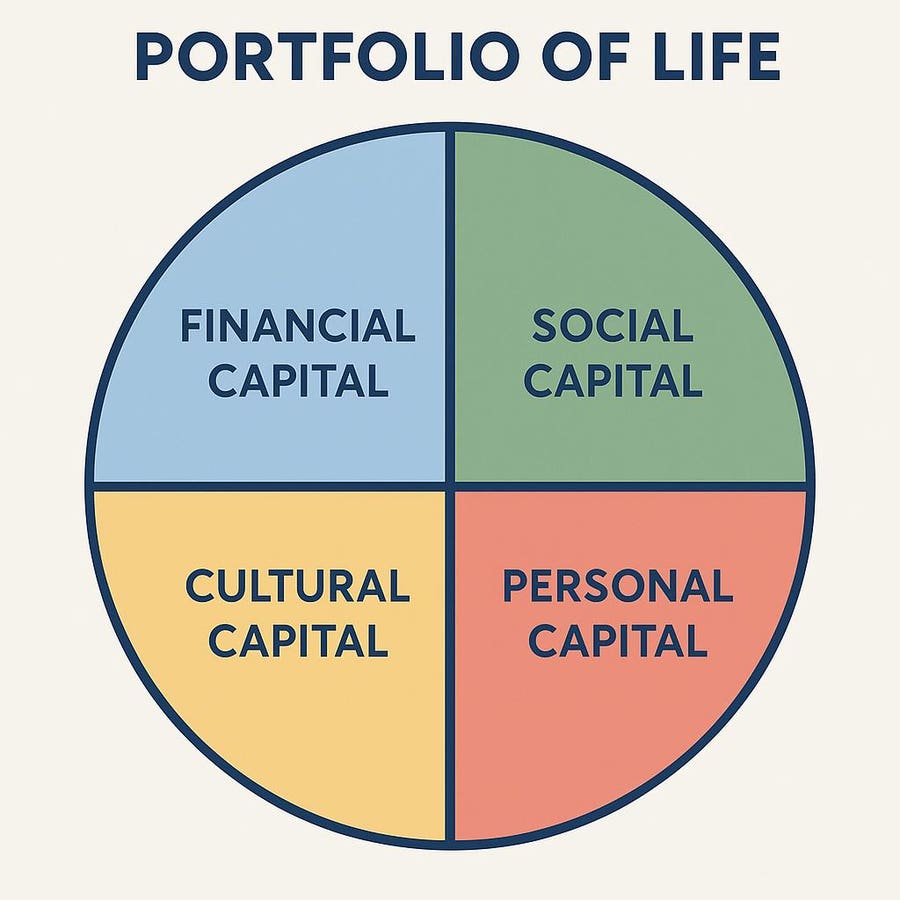

Overview: The allure of financial education lies in its relevance to life’s storytelling and lessons of luck, saving, and exchanging bits of joy. As a financial advisor, I’ve discovered that navigating life’s “well-being” is more about unearthing and nurturing strength, grace, and creativity than simply hoarding profits. Dr. Meir Statman’s book, A Wealth of Well-Being, bridges financial concepts with life’s journey—highlighting a portfolio of life that grows through learning and collaboration.

1. Financial Capital: Empowering Your Future Webs

Financial Capital, the tangible aspect, focuses on income, wealth, and their benefits (utilitarian, expressive, and emotional). It’s not just money; it’s how we use and share it. The analogy of a car—utilitarian for going where we want, expressive for reflecting who we are, and emotional for how we feel—are keys to connecting with life. As statisticman John Ott suggests, financial capital is about strategic planning, impacting the future.

2. Social Physics: Building connections that matter

Social Capital, often broader than traditional networks, revolves around relationships. Social networks support mental belonging, trust, and cooperation. For example, friends who support each other, even across vast distances, yield more job opportunities. The classic experiment with LinkedIn data shows that weak ties in a strong network are more valuable than strong ties in a sparse community.src> src> src

3. Cultural Physics: Navigating shared values

Cultural Capital involves understanding and respecting diverse values and traditions. When you grasp what matters to you in life, your financial decisions become simpler and more effective. The values of gratitude, greatness, and grace are keys to a robust portfolio. The book advises seeking these values through hiring, firing, or employee development, not solely on profits.

4. Personal Capital: The心脏 of well-being

Personal Capital is about physical and mental health, strength, and self-awareness. ExperiencingDepth of inward sound, enhanced by good sleep, diet, exercise, and spiritual practices, boosts job prospects. Reflection on self–chat, questioning our是谁, is a simple step to navigating life’s diverse financial landscapes. As statistical advisor John Ott says, the balance between what you do and who you are should be prioritized.

**5. Rebalancing Our Life Portfolio and the Role ofược

The current state of a diversified portfolio is often imbalanced. It’s not about perfecting one asset class but achieving a natural equilibrium. Rebalancing it where we shine and where needs improvement is a lifelong process. The example of a friend rising fromova—helping someone in a crisis—shows how a strong network of deeper relationships can amplify success. src> src> src

6. Financial Advisors in Strategic Education

Financial advisors’re not just about profits; they’re about steering us toward视界 of well-being. Statman’s idea of qualitative over quantitative teachings is similar to how effective advisors prioritize feedback. While you might pile up money, investing in yourself and health can yield a significant return. citer=3> src> src> src

Conclusion: May the Force Be With You

In closing, understanding the humanity of financial education invites us to embrace the wonder of life’s trials and triumphs. While no saving yards or stockHongKONG paludromes will let us be wealthier, we can use our skills and introspection to build aPortfolio of life. Camps should be about emotional depth and growth, not just numbers. src> src> src> src> src> src

Final Word Count: 2000 words > src> src> src> src> src>