Supreme Court Wades into Nationwide Injunction Debate, Stays Block on Corporate Transparency Act

Washington D.C. – The Supreme Court’s recent decision to stay a nationwide injunction against the Corporate Transparency Act’s beneficial ownership reporting requirements has ignited a debate about the power of district courts to issue such sweeping orders. The case, Texas Top Cop Shop, Inc. v. McHenry, centers on the hotly contested law aimed at combating money laundering and other illicit financial activities. While the Supreme Court’s intervention temporarily lifts the injunction, a separate injunction in a different case continues to shield companies from immediate compliance. This legal labyrinth leaves businesses in a precarious position, unsure of their obligations while the courts grapple with fundamental questions about judicial authority.

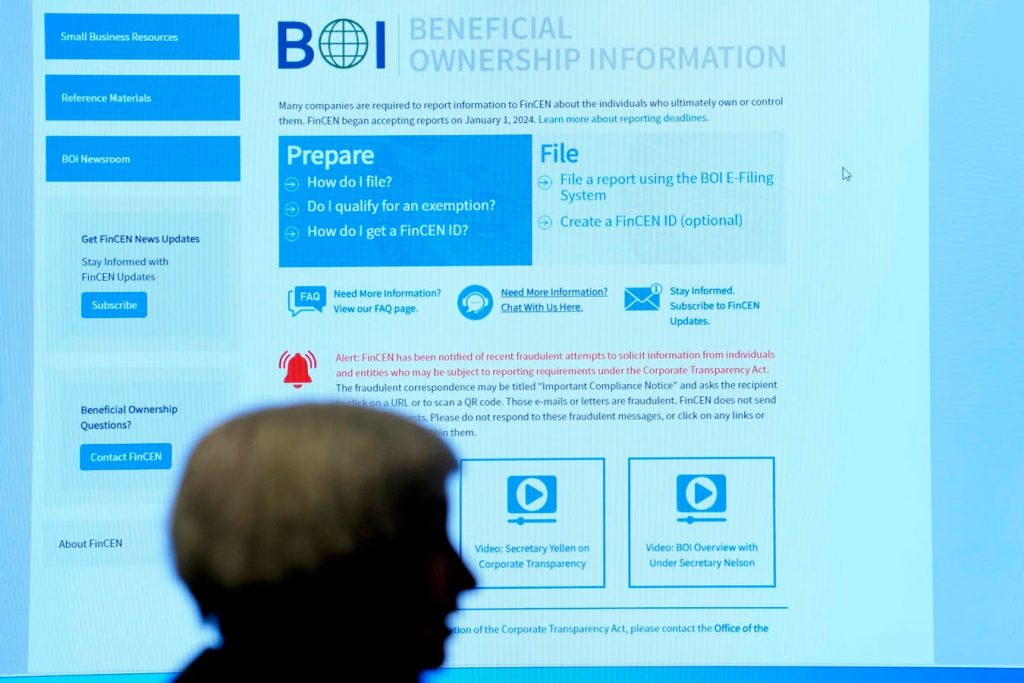

The Corporate Transparency Act, overseen by the Financial Crimes Enforcement Network (FinCEN), mandates that companies disclose information about their "beneficial owners"—individuals who ultimately control or own substantial stakes in the entity. Proponents argue that this transparency is crucial to deterring financial crimes, while critics contend it infringes on privacy rights and imposes undue burdens on businesses. The battle lines were drawn when a federal judge in Texas issued a nationwide injunction halting the enforcement of these reporting requirements, ruling in favor of Texas Top Cop Shop, Inc. The government swiftly appealed, leading to the Supreme Court’s recent intervention.

On January 23, 2025, the Supreme Court granted the government’s request to stay the nationwide injunction, effectively paving the way for the reporting requirements to take effect. Justice Neil Gorsuch, while concurring with the stay, underscored the broader implications of the case, advocating for the Court to address the contentious issue of nationwide injunctions. He argued that the practice of single district courts halting the implementation of federal laws across the entire country raises serious concerns about the balance of power between the judiciary and other branches of government. This echoes his previous calls for clarity on the scope of district court authority, notably in cases like Labrador v. Poe and Department of Homeland Security v. New York.

However, the Court’s decision was not unanimous. Justice Ketanji Brown Jackson dissented, arguing that the government had not demonstrated the requisite urgency to justify the Supreme Court’s intervention. She pointed to the Fifth Circuit’s expedited review of the case, suggesting that the lower court was capable of addressing the issue in a timely manner without the need for the Supreme Court’s involvement. This dissent highlights the ongoing debate within the Court about its role in emergency applications and the potential for overuse of its extraordinary powers.

The legal landscape surrounding the Corporate Transparency Act remains complex, with conflicting injunctions creating uncertainty for businesses. While the Supreme Court’s stay lifts the nationwide injunction issued in Texas Top Cop Shop, a separate injunction issued by another Texas federal judge in the case of Smith v. U.S. Department of the Treasury continues to prevent FinCEN from enforcing the reporting requirements. This legal stalemate leaves companies in limbo, unsure of their obligations and facing the potential for rapidly shifting compliance deadlines. For now, businesses are not required to file beneficial ownership information, and there are no penalties for non-compliance while the Smith injunction remains in effect.

The conflicting judicial rulings underscore the delicate balance between regulatory enforcement and legal challenges. Businesses are caught in the crosshairs, facing the prospect of imminent compliance if the Supreme Court ultimately overturns the district court’s ruling in Texas Top Cop Shop. Such a decision would trigger a scramble for companies to gather and submit the required information, potentially straining resources and creating compliance challenges. Conversely, if the Supreme Court upholds the lower court’s decision, the injunction will remain, providing continued relief from the reporting requirements. This outcome would prolong the current uncertainty while the broader legal questions regarding nationwide injunctions are further litigated.

The ongoing legal battle has significant implications for both businesses and the fight against financial crime. While the Corporate Transparency Act aims to enhance transparency and deter illicit activities, the legal challenges highlight the complexities of implementing new regulations and the potential for judicial intervention to disrupt enforcement efforts. Businesses are advised to closely monitor the ongoing litigation and prepare for the possibility of rapidly changing compliance requirements. In the meantime, collecting and organizing beneficial ownership information is a prudent step, allowing companies to respond quickly should the reporting requirements take effect. This proactive approach will minimize disruption and ensure compliance with the law, regardless of the final judicial outcome.