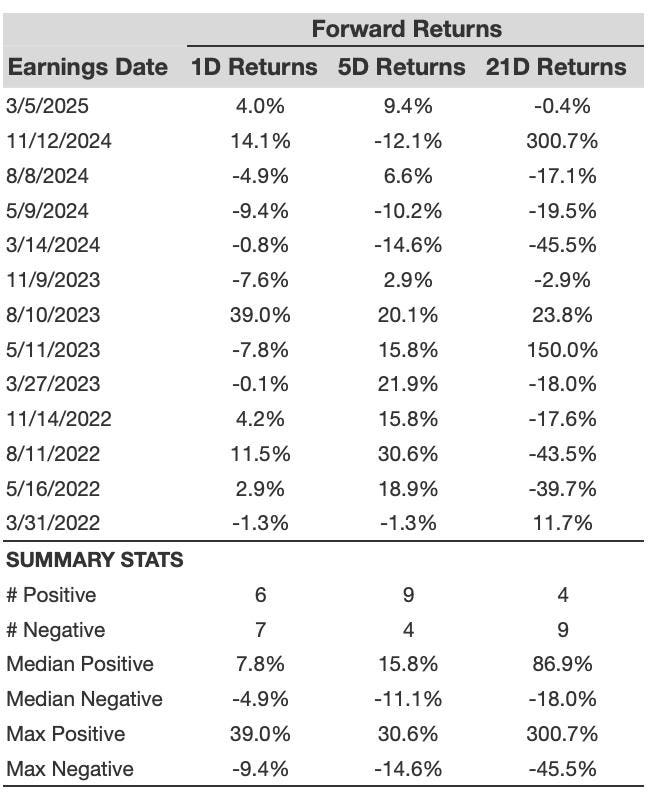

Rigetti Computing,NASDAQ:RGTI, sheds new light on its chances of generating positive returns after its earnings report on May 12, 2025. The stock has shown a slightly positive one-day (1D) return probability of -4.9% over the past three years, compared to its drop of -9.4% in its most recent 1D session. Investors should consider these historical patterns, along with recent movements, to make informed decisions. However, the company’s business model, with significant proprietary technology and long lease terms, presents its financial performance as the primary driver of future returns, rather than short-term gains.

From a fundamental perspective, Rigetti maintains a robust balance following April 2023 earnings, with operational losses amounting to $69 million. Given its exploratory nature and technical prowess, expectations build on quarterly advancements but are reserved for when key milestones are achieved.

For investors seeking potential upside despite volatility, the Trefis High Quality portfolio stands out. Since inception, the portfolio has outperformed the S&P 500 and generated returns exceeding 91%. It leverages arrays of short-left stock carries, boosting long-term stability and growth. To walk away from an asset or make informed action, it’s advisable to carefully consider its portfolio’s composition rather than individual stocks.

In deeper pursuit of real potential, the Trefis Value Recovatively Investment Plan (RV) strategy emerges. This plan capitalizes on the relationship between short-term (1D) and medium-term (5D/21D) returns post-earnings announcements, scheduling trades with alignment to the highest correlation. For example, a trader positioned “long” in 1D returns above-average can target the next 5D return to capitalize.

Understanding risk is essential, though. While the RV strategy offers higher risk-adjusted returns, focusing solely on it skewes the risk function. Balance is key, requiring an effective risk evaluation and leveraging alternative strategies where possible.

In conclusion, Rigetti Computing’s performance is the catalyst driving investor confidence, but so is a broader tilt toward robust long-term growth through the High Quality portfolio and more sophisticated risk management.