Bristol Myers Squibb Lauded as Top Socially Responsible Dividend Stock, Balancing Profit with Purpose

Bristol Myers Squibb (BMY) has earned recognition as a leading socially responsible dividend stock, showcasing a commitment to both robust financial performance and ethical business practices. Dividend Channel, a prominent investment research platform, has highlighted BMY for its impressive 4.0% dividend yield and its inclusion in prominent socially responsible investment (SRI) indices. This dual accomplishment reflects a growing trend among investors seeking companies that prioritize not only profits but also their impact on the environment and society. BMY’s recognition acknowledges its efforts to integrate environmental, social, and governance (ESG) factors into its core business strategy, appealing to investors who align their portfolios with their values.

The pharmaceutical giant’s inclusion in the iShares USA ESG Select ETF (SUSA) further solidifies its commitment to sustainability. This exchange-traded fund (ETF) tracks companies with robust ESG profiles, and BMY’s presence within its holdings, representing 0.36% or $17,970,815, underscores its strong performance in areas like environmental impact, human rights, and corporate diversity. This resonates with the growing investor demand for companies that actively contribute to a more sustainable and equitable future. BMY’s presence in SUSA provides further validation of its ESG initiatives and signals to investors that the company is seriously committed to operating responsibly.

BMY’s commitment to social responsibility encompasses a holistic evaluation of its environmental and social impact. Environmentally, the company focuses on minimizing the impact of its products and services, optimizing resource utilization, and promoting energy efficiency throughout its operations. Socially, BMY prioritizes human rights, fair labor practices, corporate diversity, and positive community engagement. The company actively steers clear of business activities associated with controversial industries like weapons, gambling, tobacco, and alcohol, aligning its operations with ethical standards that appeal to socially conscious investors.

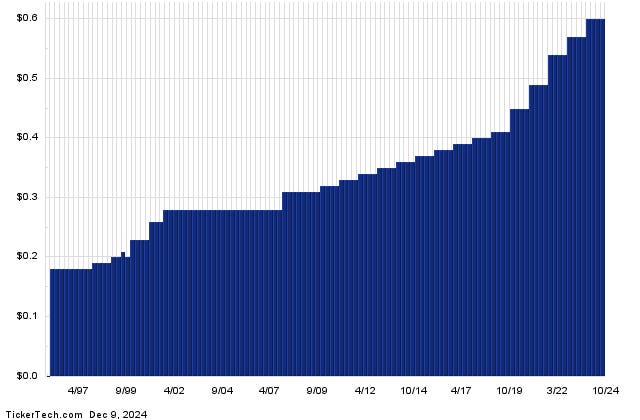

The company’s attractive dividend yield of 4.0%, paid quarterly with an annualized payout of $2.4 per share, coupled with its strong commitment to ESG principles, positions it as an appealing investment for income-seeking investors. BMY’s most recent dividend ex-date was October 4, 2024, allowing investors to participate in the upcoming dividend distribution. Dividend Channel’s DividendRank report emphasizes the importance of examining a company’s dividend history to assess the likelihood of future payouts. BMY’s long-standing commitment to dividend payments, as detailed in its dividend history chart, provides investors with a measure of confidence in the sustainability of its current dividend yield.

Operating within the highly competitive Drugs & Pharmaceuticals sector, BMY faces constant pressure to innovate and deliver shareholder value. Competing alongside industry giants like Eli Lilly and Novo-Nordisk, BMY distinguishes itself not only through its innovative pharmaceutical products but also through its dedication to social responsibility. This dual focus on financial performance and ethical business conduct allows BMY to attract a broader investor base, including those who prioritize ESG factors. This integrated approach to business positions BMY for continued growth and success in the long term.

In conclusion, Bristol Myers Squibb’s recognition as a Top Socially Responsible Dividend Stock underscores the increasing importance of ESG considerations in investment decisions. By combining a strong dividend yield with a commitment to environmental and social responsibility, BMY resonates with investors seeking both financial returns and positive societal impact. As the demand for ESG-focused investments continues to grow, companies like BMY that prioritize both profit and purpose are poised to attract and retain a loyal investor base while contributing to a more sustainable and equitable future. BMY’s robust dividend history, coupled with its ESG focus, positions it as a compelling investment option for individuals and institutions seeking both financial and ethical returns.