Schumer’s Gamble: The Social Security Fairness Act’s Perilous Path

Outgoing Senate Majority Leader Chuck Schumer’s decision to bring the House-passed Social Security Fairness Act to a vote before year’s end has ignited a firestorm of debate. While the bill’s intent – to address perceived inequities in Social Security benefits for public sector workers – is laudable, its approach threatens to destabilize the program’s financial future and could backfire politically on Democrats. The Act’s core objective is to repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), two mechanisms designed to ensure fairness in benefit calculations for individuals with both Social Security-covered and non-covered employment, typically those working in public sector jobs with separate pension plans. Critics argue these provisions unfairly penalize low-income public servants, a point not without merit. However, the Act’s blunt instrument of full repeal creates new problems, offering windfalls to high earners while exacerbating Social Security’s already precarious financial position.

Social Security operates on two fundamental principles: benefits are earned based on contributions, and the benefit formula is progressive, favoring lower earners. The WEP and GPO aim to uphold these principles for workers with "uncovered" earnings, meaning income not subject to Social Security payroll taxes, often from public sector pensions. These provisions prevent individuals with a mix of covered and uncovered earnings from receiving disproportionately higher benefits compared to those with solely covered earnings. The current system recognizes that those with uncovered earnings haven’t contributed to Social Security for that portion of their income and adjusts benefits accordingly.

The Social Security Fairness Act, by completely repealing WEP and GPO, disregards this crucial balance. Instead of targeted reform, it proposes a sweeping change that benefits all public sector workers, including high earners already enjoying substantial pensions. This generosity comes at a steep price: a projected $200 billion increase in Social Security’s shortfall over the next decade, accelerating the program’s insolvency and triggering automatic benefit cuts for all beneficiaries. This move undermines the program’s long-term sustainability and jeopardizes the retirement security of millions. The Act’s seemingly simple solution creates more significant, long-term problems for the entire system.

This legislative rush also carries significant political risks for Democrats. With Republicans poised to control the House, Senate, and presidency, any benefit increases resulting from the Act’s passage are likely to be attributed to the incoming GOP administration. This scenario echoes previous instances where voters misattributed policy changes to the incumbent president, as seen with the overturning of Roe v. Wade. Democrats risk handing their political opponents a ready-made victory, allowing Republicans to claim credit for improved benefits while sidestepping responsibility for the Act’s detrimental long-term consequences.

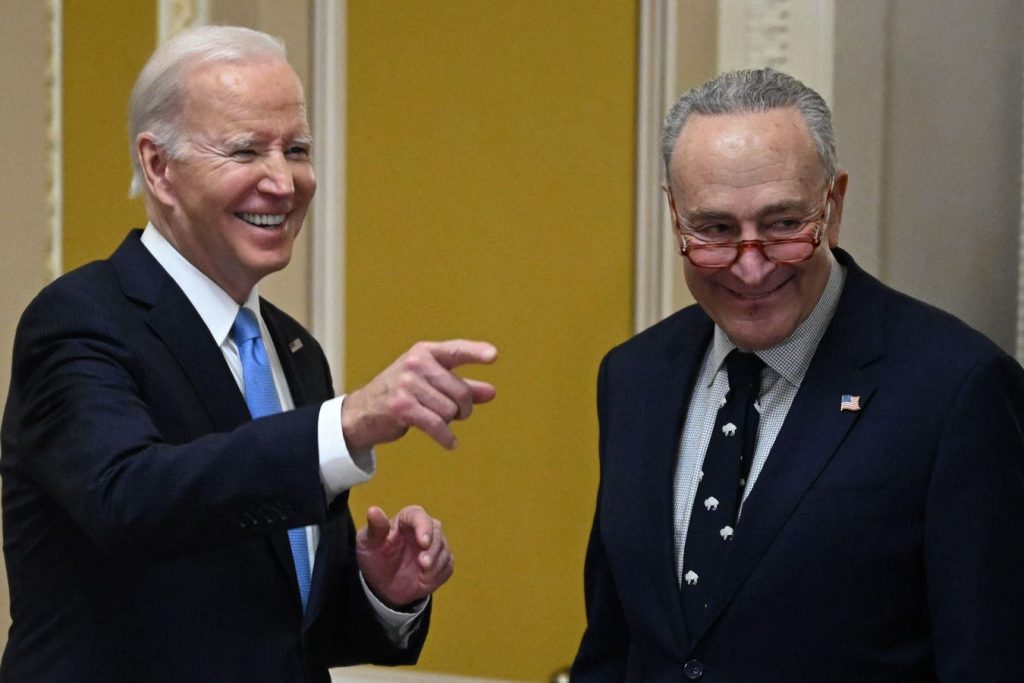

A more prudent course of action exists. President Biden, as the outgoing Democratic leader, can leverage his position to halt the bill’s progress. By issuing a statement of administrative policy indicating his unwillingness to sign the legislation, he can effectively signal his support for reforming WEP and GPO while simultaneously emphasizing the need for a fiscally responsible approach. Such a move allows him to acknowledge the concerns of public sector workers without jeopardizing the long-term health of Social Security. This strategic approach could prevent Democrats from owning a policy that undermines Social Security’s solvency while offering little tangible political gain.

This pause creates an opportunity for a more thoughtful and comprehensive approach in the next Congress. Lawmakers can then explore pairing the Social Security Fairness Act with other programmatic changes to offset its financial impact and improve the program’s overall solvency. Alternatively, they can pursue targeted reforms to WEP and GPO that address the concerns of low-income public workers without exacerbating the program’s financial challenges. This measured approach would ensure fairness and fiscal responsibility, protecting the long-term viability of Social Security for all beneficiaries.

Ultimately, the current version of the Social Security Fairness Act presents a dangerous gamble. Its well-intentioned but flawed approach risks undermining Social Security’s future while offering little political advantage to Democrats. A more strategic and responsible path involves pausing the legislation, allowing for a more comprehensive and sustainable solution to emerge in the next Congress. This measured approach would better serve both the interests of public sector workers and the long-term health of Social Security, ensuring its viability for generations to come.