Escalating Home Insurance Premiums Amidst Climate Change: A Looming Crisis for Homeowners

The dream of homeownership is becoming increasingly precarious for many, burdened not only by record-high home prices and soaring mortgage rates, but also by a dramatic escalation in home insurance premiums. This surge in insurance costs, while seemingly a necessary investment to protect one’s property, doesn’t always guarantee adequate coverage or ensure compensation in the face of increasingly frequent and severe climate-related disasters. Insurance companies, grappling with the escalating risks posed by a changing climate, are responding by raising premiums, restricting coverage, or even withdrawing from certain markets altogether, leaving homeowners vulnerable and questioning the future of home insurance.

Younger generations, particularly Gen Z, are acutely aware of the impact of climate change on their homes and their ability to secure affordable insurance. A recent Green Builder COGNITION report reveals a stark generational divide, with 77% of Gen Z respondents reporting difficulties obtaining home insurance due to climate-related factors, compared to just 16% of Baby Boomers. This disparity highlights the growing awareness among younger generations of the tangible risks posed by climate change, as well as the challenges they face in navigating a rapidly changing insurance landscape. The escalating costs and shrinking availability of insurance are creating a sense of urgency, particularly for those entering the housing market.

The increasing risks are not just anecdotal; data analysis by CoreLogic paints a sobering picture. Over 33,000 homes across the country face a "triple threat," meaning they are exposed to three or more natural disasters annually, including hurricanes, wildfires, floods, severe convective storms, and severe winter storms. While high-risk areas like Miami, vulnerable to hurricanes, floods, and wildfires, are expectedly on the list, the inclusion of rural locations like Snyder, Texas, and Ellensburg, Washington, underscores the widening scope of climate-related risks, affecting communities far beyond traditional coastal areas.

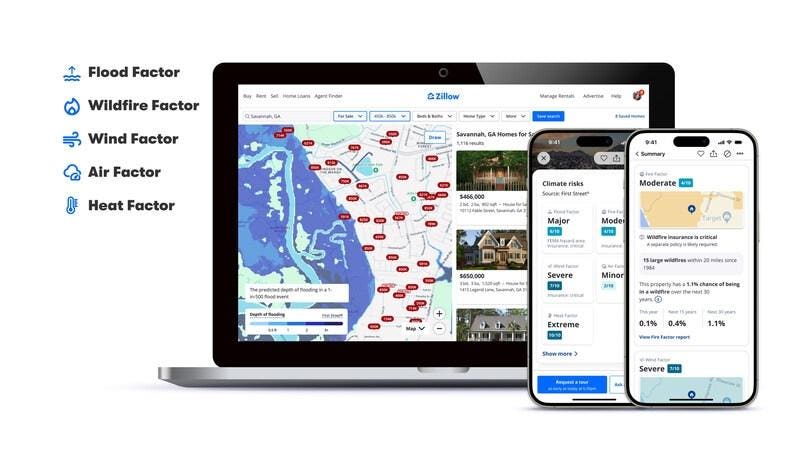

Real estate platforms like Zillow and Realtor.com are taking proactive steps to empower buyers with crucial climate risk information. By partnering with climate risk assessment firms, these platforms now provide risk scores, interactive maps, and insurance requirements for listed properties, offering unprecedented transparency about potential climate-related threats. These tools allow prospective buyers to assess the long-term viability and safety of their investment, considering factors like flood risk, wildfire susceptibility, wind damage potential, extreme heat, and air quality. This transparency is expected to reshape the real estate market, influencing property valuations and impacting the way real estate agents and brokers operate.

While the data reveals the escalating risks, the insurance industry appears to be lagging in providing adequate solutions. Rather than innovating to meet the growing need for comprehensive coverage, many insurers are retreating from high-risk markets, leaving homeowners with dwindling options. The exodus of insurers from states like California and Florida exemplifies this trend, creating an insurance void for many. Furthermore, the widespread lack of flood coverage in standard homeowners’ policies exposes a critical gap in protection, leaving many financially vulnerable to a prevalent and increasingly severe climate-related threat.

Understanding and responding to the evolving data sets is crucial for building long-term resilience in the face of climate change. Experts emphasize the need for a collaborative approach, involving insurers, policymakers, builders, and communities to develop comprehensive mitigation strategies. This requires assessing the economic benefits of investing in resilience measures, such as improved drainage systems and fortified construction, and understanding how these investments can reduce long-term costs for insurers. Furthermore, updating building codes to reflect the escalating risks is essential, ensuring that new construction can withstand the increasing intensity and frequency of extreme weather events. The focus must shift from simply rebuilding after disasters to proactively designing and constructing communities that are disaster-ready, incorporating features like elevated infrastructure and resilient building materials.

The insurance industry needs to evolve and adapt to the changing climate reality. Transparency in risk assessment and proactive mitigation strategies are key to building resilient communities. The ongoing dialogue, as highlighted in upcoming conferences like SXSW 2025, will continue to explore innovative solutions, including new materials, design options, and risk modeling approaches, to address the growing challenges of building and protecting homes in a changing climate. The hope is that in 2025 and beyond, climate risks will decrease, while protective measures, both physical and financial, will strengthen, creating a more secure and sustainable future for homeowners. The time for home insurance to evolve is now.