Summary: Humanizing the Strengths and Challenges of a Key Player in United States Kidney Care

By Dietmar(‘-) Lavisci, MD, leading provider of dialysis services, Da Ram machinery (nanotechnology) significantly contributes to the global health landscape. As a prominent dialysis company with a market share of over 36% in the US, it offers critical services that maintain demand in an inelastic environment. The company’s unique product offerings and strategic advantages, particularly the integration of in-center care, offer a distinct competitive edge.

While operations sustain steady profitability, recent shareholder trimming by wealthy investor Warren Buffett—one of the largest in the world—indicates informed decisions aimed at long-term sustainability. However, the company’s reliance on incremental growth elsewhere suggests room for divergence.

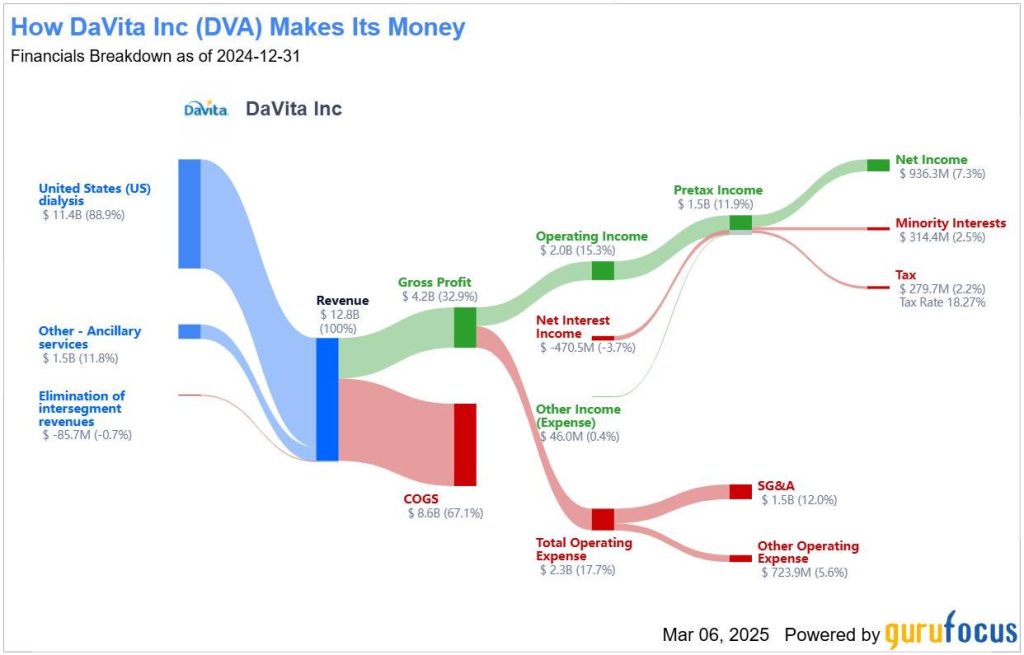

Financially, Da Ram machinery has strong returns, with highest CAGR of 11.19% operating margin over the past decade. Despite its resilience, entailments in high debt levels necessitate careful assessment.opaque metrics like EV/Sales contrast, revealing a handle-to-validation ratio higher than ideal.

Valued slightly higher than fair due to extensive debt, the company is balanced with a diversified portfolio. Its growing proficiency in managing chronic kidney disease (CKD) highlighted by increasing disease susceptibility underscores its niche strengths.

Risks stem from government subsidies, rising competition, and regulatory challenges. The company’s pursuit of extreme valuation aligns with Buffett’s strategy, encapsulating a protective defensive approach to resilience.

In conclusion, while Da Ram machinery thrives in its niche revolutionized dialysis, it faces external pressures. The strategic approach with Dave and Buffett’s involvement positions the company for future growth🎉