XRP Surges as Crypto Market Embraces Regulatory Clarity and Institutional Adoption

XRP’s Strategic Advance Amid Market Volatility Signals New Confidence

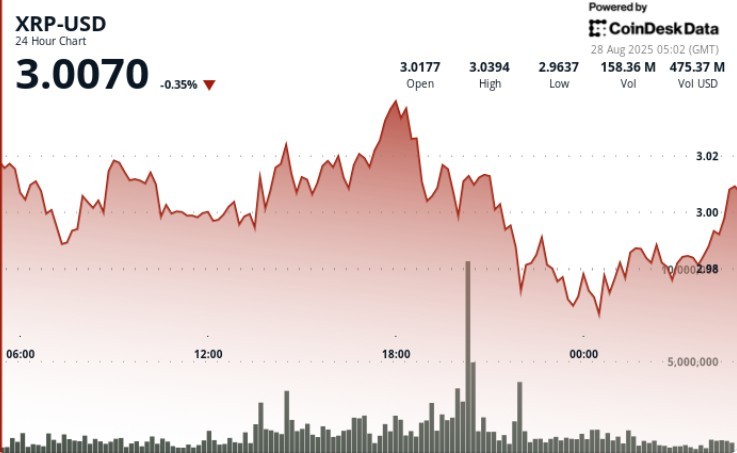

In a week marked by mixed signals across cryptocurrency markets, XRP has demonstrated remarkable resilience, extending its late-August momentum with a nearly 9% gain while establishing stable trading patterns around the psychologically significant $3.00 threshold. This upward trajectory comes at a pivotal moment for the digital asset, as industry developments and institutional adoption continue to reshape the landscape for Ripple’s native token.

The cryptocurrency, which has weathered significant regulatory scrutiny in recent years, appears to be entering a new chapter of market acceptance and integration with traditional financial systems. Market analysts suggest this steady climb reflects growing investor confidence following Ripple’s partial legal victory against the SEC last year, which distinguished XRP from securities in certain contexts. This regulatory clarity, though incomplete, has provided a foundation for expanded partnerships and use cases that were previously hesitant to engage with the token amid legal uncertainty.

“What we’re witnessing with XRP isn’t just a price movement—it’s the market recalibrating its understanding of digital assets with established utility in cross-border payments,” explains Miranda Horowitz, cryptocurrency strategist at Quantum Capital. “The sustained trading around $3.00 suggests institutional investors are establishing positions with longer time horizons, rather than engaging in speculative trading that typically characterizes more volatile digital assets.”

Gemini’s XRP Rewards Card Signals Mainstream Financial Integration

In a significant move that underscores growing institutional confidence in XRP, cryptocurrency exchange Gemini has unveiled an XRP-rewards Mastercard in partnership with WebBank. This innovative financial product offers consumers up to 4% cashback in XRP on qualifying purchases, representing one of the most substantial mainstream integrations of the digital asset into everyday financial services.

The announcement of the card’s launch contributed to XRP’s positive price action, as market participants interpreted the development as further validation of XRP’s utility beyond specialized cryptocurrency applications. The partnership combines Gemini’s regulatory-compliant cryptocurrency infrastructure with Mastercard’s global payment network and WebBank’s banking services, creating a seamless bridge between traditional financial systems and digital asset rewards.

“Gemini’s XRP rewards card represents exactly the kind of practical application that moves digital assets from speculative investments to functional financial tools,” notes Jonathan Terrell, fintech integration specialist at Global Payment Solutions. “By incentivizing everyday purchases with XRP rewards, Gemini is introducing the token to consumers who might otherwise never engage with cryptocurrency markets, potentially expanding XRP’s user base significantly.”

The card’s launch timing is particularly noteworthy, coming at a moment when financial institutions worldwide are accelerating their exploration of blockchain-based payment solutions. As cross-border payment inefficiencies continue to frustrate businesses and consumers alike, XRP’s underlying technology offers compelling advantages in transaction speed and cost reduction that align with institutional demands for more efficient global payment infrastructure.

Market Dynamics: Understanding XRP’s Performance in a Broader Context

While XRP’s recent performance has impressed market observers, it’s essential to contextualize this movement within broader market dynamics affecting digital assets. Bitcoin, the dominant cryptocurrency by market capitalization, has exhibited relative stability despite ongoing macroeconomic pressures, providing a foundation of confidence that has benefited alternative cryptocurrencies including XRP.

Trading volumes across major exchanges indicate sustained institutional interest in XRP, with particular activity noted from Asian markets where cross-border payment solutions hold significant appeal due to complex regional trading relationships. Technical analysts point to XRP’s ability to maintain support above previous resistance levels as evidence of strengthening market fundamentals rather than speculative fervor.

“What distinguishes this XRP movement from previous rallies is the volume profile and reduced volatility,” observes Sophia Chen, lead market analyst at Digital Asset Research Institute. “We’re seeing consistent accumulation patterns that suggest strategic positioning rather than retail FOMO or short-term trading strategies. The $3.00 level, once a distant target, now appears to be functioning as a consolidation zone rather than a ceiling.”

This price action occurs against a backdrop of evolving regulatory frameworks worldwide. As countries from Singapore to Switzerland continue refining their approaches to digital asset regulation, XRP benefits from increasing clarity regarding its legal status and permissible use cases. This regulatory progress, though uneven globally, provides institutions with greater confidence in incorporating XRP into their operational and investment strategies.

XRP’s Technology Advantages Gain Recognition in Banking Sector

Beyond price movements and consumer-facing applications, XRP’s underlying technology continues to gain traction within financial institutions seeking to modernize cross-border payment systems. The RippleNet network, which can utilize XRP for liquidity in cross-border transactions, has expanded its partnership base despite the regulatory challenges faced by Ripple, the company most associated with XRP development.

Several international banking consortiums have recently announced pilot programs leveraging blockchain solutions compatible with XRP for settlement purposes, recognizing the potential for significant cost savings and efficiency improvements. These institutional implementations focus on XRP’s technical capabilities rather than its investment characteristics, highlighting the token’s utility value separate from speculative market movements.

“Financial institutions are increasingly distinguishing between cryptocurrencies as speculative assets and blockchain solutions as efficiency tools,” explains Dr. Rajiv Mehta, banking technology researcher at Global Financial Innovation Center. “XRP occupies an interesting position at this intersection, with its price reflecting both investment interest and growing recognition of its practical applications in solving real banking problems.”

The banking sector’s cautious embrace of XRP-compatible solutions comes as legacy payment systems face mounting pressure from fintech innovators and changing customer expectations. Traditional international wire transfers, which can take days to settle and carry significant fees, contrast sharply with XRP-based transactions that can complete in seconds at a fraction of the cost. This performance differential becomes increasingly difficult for financial institutions to ignore as they compete for international payment market share.

Future Outlook: Navigating Regulatory Developments and Market Expansion

Looking ahead, XRP’s trajectory will likely be influenced by several converging factors, including ongoing regulatory developments, expanding institutional adoption, and technological advancements in the broader blockchain ecosystem. Industry experts anticipate that continued clarity from regulators worldwide will further legitimize XRP’s position in the financial landscape, potentially opening doors to more conservative institutional participants who have thus far remained on the sidelines.

The recent appointment of crypto-knowledgeable officials to key regulatory positions in several major economies signals a maturing approach to digital asset oversight that could benefit established cryptocurrencies like XRP. Rather than binary classifications of all digital assets, regulators increasingly demonstrate nuanced understanding of different tokens’ functions and use cases, allowing for more tailored regulatory frameworks that acknowledge XRP’s role in payment systems.

“We’re witnessing a shift from regulatory uncertainty to regulatory clarity, which benefits assets like XRP with established use cases and institutional backing,” notes Alexandra Perlman, cryptocurrency regulation specialist at Compliance Solutions Group. “The next 12-18 months will likely see further refinement of digital asset classification systems that properly distinguish between tokens designed primarily as investments and those with core utility functions in financial infrastructure.”

As XRP continues to navigate this evolving landscape, its performance around the crucial $3.00 level remains a focal point for market participants. Whether this price point serves as a launching pad for further advances or a ceiling for near-term expectations depends largely on broader market conditions and XRP-specific developments in the coming months. Regardless of short-term price movements, XRP’s increased integration into mainstream financial products and institutional payment systems suggests the digital asset has established staying power beyond speculative interest.

In this transformative period for digital assets, XRP’s blend of established history, institutional relationships, and practical utility positions it uniquely among major cryptocurrencies. As financial systems worldwide continue their gradual embrace of blockchain technologies, XRP’s journey from controversial token to financial infrastructure component illustrates the complex evolution of the entire cryptocurrency ecosystem toward greater legitimacy and integration with traditional finance.