XRP Surges 3% Amid Strong Institutional Trading and Market Optimism

Institutional Investors Drive XRP’s Upward Momentum in Latest Trading Session

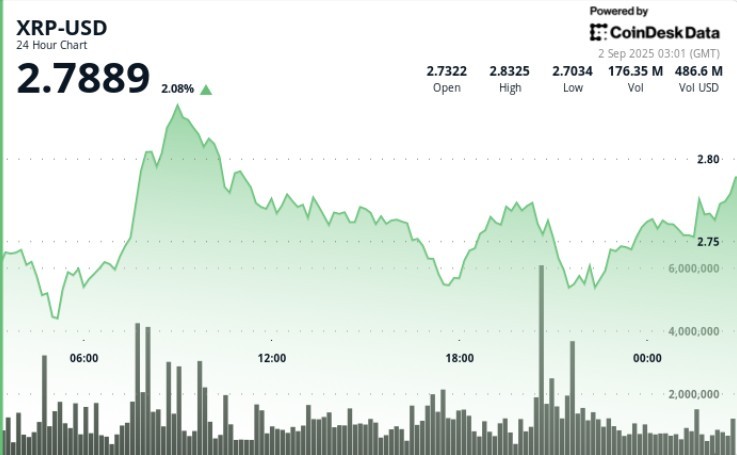

In a notable display of market strength, XRP demonstrated resilient performance with a 3% price increase during the 24-hour window spanning from September 1 at 03:00 GMT to September 2 at 02:00 GMT. The digital asset navigated a price range between $2.70 and $2.83, exhibiting moderate intraday volatility of 5%. This upward trajectory comes amid broader cryptocurrency market fluctuations and suggests growing investor confidence in the sixth-largest cryptocurrency by market capitalization.

The trading period was particularly characterized by substantial institutional engagement, with the early hours showing remarkable volume. Between 07:00 and 08:00 GMT, trading volume reached an impressive 164.9 million XRP—nearly double the typical hourly average. This surge in institutional activity highlights the growing mainstream acceptance of XRP as a legitimate investment vehicle among traditional finance players. Market analysts point to several factors potentially driving this institutional interest, including recent favorable regulatory developments, technical breakouts above key resistance levels, and an overall improvement in market sentiment toward alternative cryptocurrencies beyond Bitcoin and Ethereum.

Market Dynamics and Technical Analysis Reveal Bullish Patterns

Technical indicators suggest XRP’s price movement is developing within a constructive pattern, with the 3% gain representing a decisive break above the crucial resistance zone that had previously constrained price action. The cryptocurrency’s relative strength index (RSI) remains in healthy territory, indicating the current uptrend has further room to develop without entering overbought conditions. Additionally, XRP’s trading volume profile demonstrates increasing buyer conviction, with volume expanding on upward price movements and contracting during minor pullbacks—a classic bullish signal recognized by market technicians.

The asset’s price stability amid broader market volatility also deserves attention. While many alternative cryptocurrencies experienced significant price swings during the same period, XRP maintained a relatively tight trading range with its 5% volatility figure considerably lower than many of its peers. This comparative stability, combined with upward price action, suggests institutional investors may be accumulating positions strategically rather than engaging in speculative trading. Several prominent cryptocurrency analysts have noted that XRP’s current price structure resembles accumulation phases that preceded previous significant rallies, though they caution that external market factors could still influence short-term performance.

Regulatory Landscape and Ripple’s Strategic Developments Influence Investor Sentiment

The ongoing legal clarity emerging from Ripple’s prolonged engagement with regulatory authorities continues to shape XRP’s market dynamics. Recent developments in the regulatory landscape have created a more favorable environment for XRP trading, particularly among institutional investors who previously remained cautious due to regulatory uncertainty. Ripple’s continued expansion of its cross-border payment network and strategic partnerships with financial institutions worldwide has reinforced investor confidence in the underlying utility of the XRP token within the global payment ecosystem.

Ripple’s recent technological advancements and business expansions have also contributed to positive market sentiment. The company’s push into central bank digital currency (CBDC) infrastructure development, combined with enhancements to its On-Demand Liquidity (ODL) service that utilizes XRP, demonstrates the token’s growing integration within legitimate financial applications. Market observers note that institutional investment decisions are increasingly influenced by fundamentals rather than speculation alone, with XRP benefiting from its established use cases in international money transfers and settlement systems. This fundamental strength provides a substantial foundation for XRP’s current price performance and potential future appreciation.

Global Economic Factors and Crypto Market Correlations Shape XRP’s Trajectory

Broader macroeconomic conditions continue to exert influence on cryptocurrency markets, with XRP not immune to these external pressures. Recent shifts in monetary policy expectations, inflation concerns, and global economic uncertainty have created a complex backdrop against which digital assets operate. Interestingly, XRP has shown periods of decoupling from traditional cryptocurrency market correlations during this latest price movement, suggesting its market dynamics may be increasingly driven by Ripple-specific developments rather than general cryptocurrency sentiment alone.

The relationship between XRP and traditional financial markets also bears watching. As institutional adoption increases, correlations with conventional asset classes like equities and bonds become more relevant to XRP’s price action. Recent data indicates varying correlation strengths during different market phases, with XRP occasionally demonstrating counter-cyclical movements that could make it an attractive diversification tool for sophisticated portfolio managers. This evolving relationship between XRP and traditional markets represents an important factor for investors to consider when evaluating the asset’s place within a diversified investment strategy. As global economic uncertainties persist, XRP’s performance in relation to traditional safe-haven assets and risk-on investments will likely continue to influence institutional allocation decisions.

Future Outlook: Institutional Integration and Market Maturation Point to Continued Development

Looking ahead, XRP’s recent price performance and the surrounding market dynamics suggest a maturing asset with increasing institutional relevance. The 3% gain during the analyzed period, while modest in cryptocurrency terms, represents steady progress within a sustainable uptrend rather than the extreme volatility that has characterized earlier cryptocurrency market cycles. This maturation process indicates XRP may be entering a new phase of market development, with price discovery increasingly driven by fundamental factors and institutional positioning rather than retail speculation alone.

Industry experts anticipate continued institutional interest in XRP, particularly as regulatory frameworks around digital assets become more clearly defined globally. The asset’s established use cases in cross-border payments and Ripple’s ongoing partnerships with traditional financial institutions position XRP uniquely among major cryptocurrencies. While short-term price volatility remains inevitable in cryptocurrency markets, the fundamental drivers behind XRP’s recent performance suggest a potentially sustainable trajectory supported by genuine utility and institutional adoption. As the digital asset ecosystem continues to evolve, XRP’s position at the intersection of traditional finance and blockchain innovation merits close attention from investors, regulators, and market participants alike. The coming months will likely prove decisive in determining whether the current positive momentum represents the beginning of a more significant upward trend or merely a temporary phase in XRP’s ongoing market development.