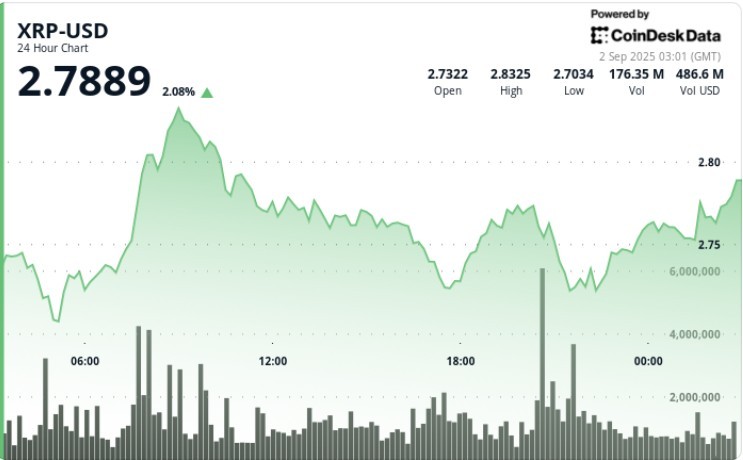

XRP Whales Defy Market Trends, Accumulate Nearly $1 Billion Amid September Slump

Deep-Pocketed Investors Show Remarkable Conviction Despite Seasonal Headwinds

In a striking display of confidence that runs counter to broader market sentiment, whale investors have accumulated approximately 340 million XRP tokens—valued at nearly $1 billion—over the past two weeks. This significant accumulation comes at a time when cryptocurrency markets typically face seasonal weakness, raising questions about what these large-scale investors might anticipate in XRP’s future trajectory.

The substantial buying activity among whales—cryptocurrency parlance for individuals or entities holding massive amounts of a particular token—has effectively counterbalanced selling pressure from retail investors and shorter-term traders. Market analysts suggest this divergence between whale behavior and general market trends points to a sophisticated conviction in XRP’s long-term value proposition, even as day-to-day price action remains volatile. “What we’re witnessing is a classic example of smart money positioning itself contrary to market sentiment,” explains cryptocurrency strategist Marcus Henderson. “These large-scale investors are looking beyond immediate market fluctuations and focusing on fundamental value, regulatory developments, and long-term adoption potential.”

September has historically represented a challenging period for cryptocurrency markets, often dubbed the “September Effect” by traders who have observed this seasonal pattern across multiple years. This phenomenon isn’t unique to digital assets—traditional equity markets frequently experience similar seasonal weakness during this month. The current environment compounds these seasonal factors with heightened macro uncertainty surrounding central bank policies, particularly the Federal Reserve’s approach to interest rates and monetary tightening. This combination of seasonal weakness and uncertain monetary policy has created headwinds for risk assets broadly, with cryptocurrencies experiencing amplified volatility due to their still-developing market maturity.

Institutional Conviction Grows Despite Regulatory Shadows

The timing of this whale accumulation phase is particularly noteworthy given XRP’s complicated regulatory journey. After years of legal battles between Ripple Labs and the Securities and Exchange Commission, the cryptocurrency received a significant, though partial, victory when a federal judge ruled that programmatic sales of XRP on exchanges did not constitute investment contracts. This regulatory clarity, while incomplete, has removed some of the existential uncertainty that previously clouded XRP’s future. Financial technology analyst Dr. Sarah Montague believes this regulatory progress may partially explain the whale accumulation: “Large investors typically demand some degree of regulatory certainty before committing substantial capital. The recent court decisions, while not providing complete clarity, have substantially de-risked XRP from an institutional perspective.”

Beyond regulatory developments, XRP’s fundamental use case in cross-border payments continues to evolve. Ripple’s partnerships with financial institutions across Asia, Latin America, and the Middle East have expanded, creating potential growth catalysts independent of broader cryptocurrency market conditions. These partnerships leverage XRP’s design for settlement and liquidity, positioning it differently from pure speculative cryptocurrencies. Banking technology consultant Richard Fernandez notes, “Unlike many cryptocurrencies competing primarily as alternative stores of value, XRP has always been oriented toward a specific utility within the international banking system. This differentiated value proposition may explain why certain sophisticated investors are accumulating during market weakness—they’re betting on adoption rather than speculation.”

The contrast between whale accumulation and general market sentiment highlights a recurring pattern in cryptocurrency markets: divergence between short-term traders and long-term holders. While day traders and retail investors often respond to immediate price action, technical patterns, and market sentiment, whale investors typically operate on different time horizons and with different information sets. This divergence creates natural market tension that often resolves in favor of patient capital over time. Cryptocurrency market analyst Jennifer Wu observes, “Historical data across multiple crypto assets shows that significant whale accumulation during periods of market weakness has frequently preceded substantial price appreciation once broader market conditions improve. While past performance doesn’t guarantee future results, this pattern has been remarkably consistent across multiple market cycles.”

Global Monetary Policy Creates Complex Backdrop for Digital Assets

The broader macroeconomic environment adds layers of complexity to XRP’s market dynamics. Central banks worldwide continue navigating the delicate balance between controlling inflation and avoiding economic recession—a high-wire act that creates ripple effects across all asset classes. The Federal Reserve’s decisions on interest rates directly impact dollar liquidity, risk appetite, and investment flows into alternative assets like cryptocurrencies. This monetary policy uncertainty has created a challenging environment for digital assets broadly, with investors carefully watching economic indicators for clues about future central bank actions.

Despite these macro headwinds, blockchain technology and cryptocurrency adoption continue advancing across multiple fronts. Enterprise blockchain implementations, central bank digital currency research, and evolving regulatory frameworks all point to increasing integration of blockchain technology within the global financial system. This steady progression of the underlying technology creates a foundation for long-term value that may be disconnected from short-term price movements. Blockchain economist Dr. Michael Chen explains, “The most sophisticated investors in this space understand that we’re witnessing the early stages of a fundamental transformation in financial infrastructure. Day-to-day price movements mean little against the backdrop of this multi-decade technological shift.”

For retail investors trying to interpret these market signals, the whale accumulation provides an interesting data point but should be considered alongside multiple factors. Market technicals, regulatory developments, broader adoption metrics, and macroeconomic conditions all influence cryptocurrency valuations through complex interactions. The apparent confidence displayed by whale investors suggests a positive long-term outlook, but doesn’t guarantee immediate price appreciation. Investment strategist Thomas Williams advises, “While following smart money can be instructive, retail investors should develop their own investment thesis based on risk tolerance, time horizon, and conviction. Whale movements provide useful context but shouldn’t be the sole basis for investment decisions.”

Looking Ahead: Navigating Uncertainty With Strategic Patience

As markets navigate the traditionally difficult September period, investors across all asset classes face the challenge of distinguishing between temporary weakness and fundamental changes in value. For XRP specifically, the contrast between whale accumulation and general market hesitancy creates an intriguing tension that will likely resolve as broader market conditions clarify. The fourth quarter has historically provided more favorable conditions for risk assets, potentially creating tailwinds if seasonal patterns hold.

The significant whale accumulation during market weakness underscores a fundamental truth about financial markets: price and value can temporarily diverge, creating opportunities for investors with sufficient capital and conviction. While no one can predict short-term price movements with certainty, the behavior of these large-scale investors suggests a meaningful vote of confidence in XRP’s longer-term prospects. As regulatory landscapes continue evolving and blockchain adoption progresses, market participants will continue watching whale behavior for clues about how sophisticated capital views this emerging asset class.