Lava Faces Growing Controversy Over Bitcoin Lending Practices

Bitcoin-Aligned Lender Under Scrutiny as Users Question Operations

In the rapidly evolving landscape of cryptocurrency lending, Lava, a prominent lender offering USD and stablecoin loans with bitcoin (BTC) collateral, has found itself at the center of a growing controversy that threatens to undermine its carefully cultivated image within the Bitcoin community. The platform, which has extensively marketed its alignment with Bitcoin’s core principles, now faces a barrage of allegations from users and industry observers that call into question its operational practices, transparency, and commitment to the decentralized ethos it claims to champion.

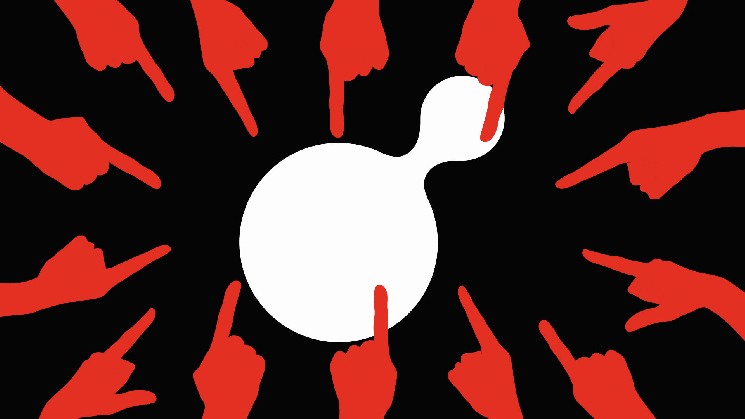

The controversy surrounding Lava has erupted across social media platforms in recent weeks, with users raising significant concerns about the company’s handling of customer funds and potential discrepancies between its public messaging and behind-the-scenes operations. These allegations span a wide spectrum of issues, from the unauthorized movement of supposedly self-custodial funds to misleading representations of interest rates and reliance on centralized infrastructure while publicly advocating for decentralization. The situation has sparked intense debate within cryptocurrency circles about the responsibilities of platforms that position themselves as champions of Bitcoin’s values while potentially operating under different principles.

Custodial Control Concerns and Forced Migration Allegations

Among the most serious allegations facing Lava is the claim that the company has exercised control over customer funds that were supposedly under self-custody arrangements. Multiple users have reported experiencing unauthorized transfers of their assets, a practice that would directly contradict the company’s own terms of service, which explicitly states, “The Company has no custody or control over the contents of your wallet.” This apparent contradiction has raised fundamental questions about the nature of Lava’s custody model and whether customers actually maintain control over their deposited assets as advertised.

Further compounding these concerns, critics allege that Lava recently forced users to migrate from Bitcoin’s Discreet Log Contracts (DLCs) – a technology that enables more trustless, decentralized financial contracts – to what the company describes as “a more hybrid model” of asset custody. While Lava’s founder, Shehzan Maredia, has contested this characterization, insisting that users “always consented to updates” and that the transition was a technology switch communicated well in advance, many users have expressed feeling blindsided by changes that fundamentally altered the nature of their relationship with the platform. This controversy highlights the tensions that can arise when technological changes affect the core principles that attract users to cryptocurrency services in the first place.

Transparency Issues: Interest Rates and Blockchain Affiliations

Transparency concerns have emerged as another major point of contention in the Lava controversy, with users questioning the company’s representations of loan interest rates and its technological foundations. In public communications, Maredia has promoted Lava as offering loans with interest rates “as low as 5%,” but when challenged on social media, he acknowledged that this rate might not be attainable for all customers. Some critics contend that the effective interest rate could reach as high as 13% in practice – a significant discrepancy that raises questions about the clarity and accuracy of Lava’s marketing claims.

Perhaps more troublingly for Bitcoin purists, allegations have surfaced regarding Lava’s representation of its technological infrastructure. While the company has heavily emphasized its Bitcoin alignment in marketing materials and media appearances – with Maredia frequently participating in Bitcoin-focused podcasts and interviews – critics claim that Lava has simultaneously downplayed its reliance on alternative blockchain technologies like Solana and centralized stablecoins for core functions of its service. This perceived disconnect between public messaging and actual operational practices has fueled accusations that Lava is engaging in a form of “Bitcoin-washing” – leveraging Bitcoin’s credibility and community goodwill while operating on fundamentally different technological principles.

Regulatory Questions and Custodial Spectrum

The controversy has expanded beyond operational concerns to include potential regulatory implications, as some Bitcoin influencers have voiced concerns about whether Lava holds the necessary licenses to conduct what might legally constitute money transmission services. These questions touch on the complex and evolving regulatory landscape for cryptocurrency businesses, where the classification of activities can have significant compliance implications. Lava has denied engaging in money transmission activities that would require such licensing, but the questions highlight the uncertain regulatory territory in which many cryptocurrency businesses operate.

In responding to these various allegations, Maredia has notably introduced a nuanced perspective on the nature of custody in cryptocurrency services, suggesting that “custodial/non-custodial isn’t really a binary. It’s more of a spectrum. People talk about them in black and white terms, but it’s not that clear.” This characterization, while potentially accurate from a technical perspective, has done little to quell concerns among users who were attracted to Lava specifically because of its purported commitment to self-custody principles that are fundamental to Bitcoin’s philosophy. As the controversy continues to unfold, it raises important questions about transparency in communication, technological implementations, and the responsibilities of platforms that position themselves within specific cryptocurrency communities while potentially operating according to different principles than those they publicly espouse.

Industry Implications and the Path Forward

The Lava controversy represents more than just a localized dispute between a platform and its users – it highlights broader tensions within the cryptocurrency ecosystem as businesses navigate the complex interplay between commercial viability, technological implementation, and philosophical alignment. For an industry built largely on principles of transparency, trustlessness, and user sovereignty, the allegations against Lava touch on foundational questions about how cryptocurrency businesses should communicate their operational models and where responsibilities lie when it comes to user education and informed consent.

As the situation continues to develop, with Lava maintaining its denials of wrongdoing while users and observers continue to raise concerns, the controversy serves as a reminder of the importance of alignment between marketing claims and operational realities in the cryptocurrency space. It also underscores the challenges faced by platforms attempting to bridge traditional financial services with cryptocurrency’s unique attributes and values. Whether Lava can effectively address these concerns and rebuild trust within the Bitcoin community remains to be seen, but the controversy has already sparked important conversations about transparency, custody, and accountability that will likely reverberate throughout the cryptocurrency lending sector for some time to come. For users navigating this complex landscape, the situation highlights the importance of due diligence not just regarding the technical security of platforms, but also their operational practices, regulatory compliance, and philosophical alignment with the principles that underpin the cryptocurrencies they support.