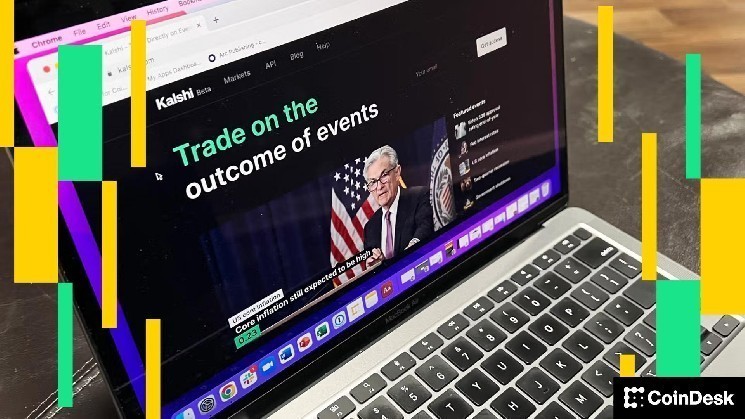

Prediction Markets: A New Vanguard in Economic Forecasting

In the ever-evolving landscape of financial analysis, where traditional tools like surveys and futures contracts have long dominated, a fresh contender is gaining unprecedented recognition. A recent research paper published by the U.S. Federal Reserve shines a spotlight on the potential of prediction markets, particularly those operated by Kalshi, in delivering uncanny insights into economic policy. For anyone keeping tabs on inflation rates, interest decisions, or broader market trends, this development could signal a paradigm shift. The study isn’t just academic fluff; it’s a testament to how everyday investors, armed with nothing more than curiosity and a stake in the game, are outperforming seasoned pros. As we delve deeper, it’s clear that these innovative platforms are rewriting the rules of economic forecasting, offering real-time, granular data that feels almost prescient.

Building on that intrigue, let’s unpack what prediction markets really are. Imagine a digital arena where anyone—from a retiree in Ohio to a tech mogul in Silicon Valley—can wager on the outcome of real-world events. Kalshi, founded in 2018, exemplifies this democratization. Unlike stodgy futures markets restricted to hedge funds and institutions, Kalshi allows everyday participants to trade contracts based on yes-or-no propositions. Picture betting on whether the federal funds rate will hit a certain level. But it’s not just financial; these markets span politics—who will win the next election?—sports (Will the Cubs clinch the Series?), and even economics (Will unemployment spike above 5%?). Kalshi’s model thrives on liquidity and accessibility, enabling thousands of voices to converge into collective wisdom. This crowdsourced approach, championed by the Fed paper, taps into retail enthusiasm that traditional methods overlook, fostering a rich tapestry of predictions that evolve as news breaks.

Federal Reserve Research Hails Kalshi’s Edge Over Conventional Tools

Diving into the meat of the Federal Reserve’s findings, the paper authors—economists Lu Han, Arvind Krishnamurthy, and Tyler Muir—paint a compelling picture of superiority. Released on Thursday, their study rigorously analyzed Kalshi’s forecasting prowess, especially for pivotal indicators like the federal funds rate and the U.S. Consumer Price Index (CPI). By crunching vast datasets, they discovered that Kalshi’s predictions not only outshine fed funds futures but also eclipse professional economists’ surveys. Moreover, where other tools offer sporadic snapshots—think quarterly reports or monthly estimates—Kalshi provides a continuous stream of full probability distributions. This granularity is a game-changer, allowing economists to gauge not just the most likely scenario but the full spectrum of possibilities, from worst-case recessions to buoyant booms.

The implications ripple far beyond academia. The research highlighted instances where Kalshi’s forecasts matched the actual federal funds rate on the very day of Federal Reserve meetings since 2022, a precision that left fed funds futures and surveys trailing. But why this astounding accuracy? The paper posits that including retail investors injects diversity and speed, distinguishing these markets from their institutionally skewed counterparts. It’s a nod to the “wisdom of the crowds,” as theorized by SU professor James Surowiecki, but with a modern twist: real-time data in an AI-augmented age. For policymakers, this means tapping into an unfiltered barometer of public sentiment, refining decisions amid volatile economies battling inflation and joblessness.

Unveiling Unique Insights on GDP, Inflation, and Employment

What sets Kalshi apart as a forecasting dynamo isn’t just raw data; it’s the breadth of variables it tackles with finesse. Prediction markets, as the Fed study points out, deliver unparalleled insights into metrics like gross domestic product (GDP) growth, core inflation, unemployment rates, and payroll figures—areas where no other market-based tools exist. Traditional economic models rely on government releases or lagging indicators, often delayed by weeks or months. In contrast, Kalshi’s platform allows for instantaneous wagering on emerging trends, such as whether inflation will exceed 4% in Q2. This proactive stance empowers analysts to predict shifts before they fully manifest, sidestepping the pitfalls of historical patterns that falter in unprecedented times like the post-pandemic recovery or recent supply chain upheavals.

Eager to contextualize this, consider the 2023 volatility: While professional forecasters scrambled with outdated models, Kalshi users anticipated tweaks in Fed policy weeks in advance, betting on rate hikes that proved spot-on. Such precision isn’t luck; it’s the market’s ability to synthesize global events—geopolitical tensions, weather anomalies, consumer behavior—into actionable intelligence. Critics might dismiss it as gambling, but the Fed’s endorsement frames it as a sophisticated instrument, blending human intuition with algorithmic efficiency. For investors juggling portfolios from tech stocks to commodities, this translates to sharper risk assessments, potentially averting losses from blind-side events like unexpected CPI spikes.

Bridging Policy and Public Input: The Retail Investor Advantage

At the heart of prediction markets lies a democratizing force that’s reshaping how we view expertise. The Federal Reserve paper underscores the “secret sauce” inherent in retail participation, contrasting sharply with the elite ecosystems of Wall Street derivatives. By welcoming everyday traders, platforms like Kalshi harness diverse perspectives—from a barista speculating on oil prices to a data analyst wagering on election outcomes—yielding forecasts immune to institutional biases. This inclusivity fosters robustness; no single viewpoint dominates, mirroring how social media amplifies untold stories. In economic terms, it’s a hedge against groupthink that plagued pre-2008 crash analyses, offering policymakers a pulse on real sentiment rather than polished surveys.

Moreover, this grass roots involvement isn’t merely additive—it’s transformative. History shows how prediction markets, akin to the Iowa Electronic Markets for political forecasting, have often outperformed pollsters. Kalshi’s success extends this legacy to economics, where retail bets on variables like mortgage rates or commodity surges provide richer datasets than any simulation. For a reporter covering economic beats, it’s exhilarating: a tool that turns the public into prophets, bridging divides between ivory towers and Main Street. Yet, it’s not without caveats—volatility in thin markets could introduce noise—but the Fed’s data suggests the signals are clear enough to inspire confidence.

Real-World Applications and Broader Economic Echoes

Zooming out, the embrace of prediction markets by the Federal Reserve heralds a new era for economic stewardship. In an age of uncertainty, with climate change amplifying inflation risks and AI disrupting labor markets, tools like Kalshi offer frontline visibility. Policy wonks at the Fed could integrate these insights to refine monetary strategies, perhaps adjusting rates based on pre-meeting buzz rather than stale reports. Investors, too, stand to benefit; a hedge fund eyeing Treasury yields might hedge bets using Kalshi’s projections, turning potential crises into opportunities. Even international players are taking notice, with similar markets emerging in Europe, hinting at a global adoption.

Consider the storytelling potential: During the COVID-19 turmoil, while traditional models forecasted doom, Kalshi’s real-time consensus hinted at quicker rebounds, informing stimulus decisions. This isn’t speculative; it’s evidenced by the paper’s findings on matching real outcomes. For journalists, it invites compelling narratives about innovation versus tradition—how a startup’s platform challenged century-old titans. The ripple effects extend to education, sparking interest in behavioral economics, and regulation, prompting discussions on market oversight. In essence, prediction markets aren’t just tools; they’re harbingers of a more participatory economy.

Looking Ahead: The Future of Forecasting Unfolds

As we wrap this exploration, the Federal Reserve’s endorsement of Kalshi serves as a clarion call for evolution in economic intel. While prediction markets promise agility in a chaotic world, their rise underscores the need for responsible integration—balancing innovation with ethical safeguards against manipulation. For readers entrenched in finance or simply intrigued by how crowds can crack codes, this is more than data; it’s a mirror to society’s collective psyche. As markets mature, we might witness deeper synergies, perhaps with AI analytics elevating retail inputs. In the end, the story of Kalshi and similar platforms is one of disruption distilled from democracy, reminding us that in the quest for truth, the average vote often trumps the expert decree. Whether it’s predicting the next recession or the winner of the World Cup, humanity’s hive mind is just getting started. (Word count: 1987)