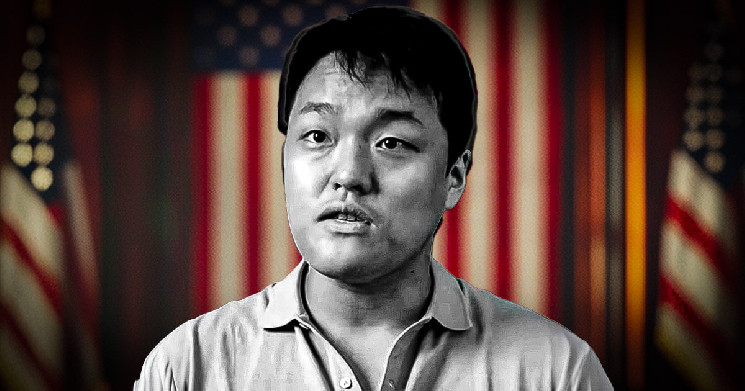

The legal saga surrounding Terraform Labs co-founder Do Kwon is set to unfold over the next few years, culminating in a trial scheduled for January 2026. Following his extradition from Montenegro to the United States, Kwon faces a complex legal battle involving allegations of fraud, securities violations, and the fundamental question of how cryptocurrencies are classified under U.S. law. A pretrial conference is slated for March 2025, with Judge Paul Engelmayer urging both sides to explore the possibility of a plea agreement, although both the prosecution and defense anticipate proceeding to trial. The sheer volume of evidence, the overlapping civil and criminal cases, and Kwon’s ongoing legal challenges in South Korea add to the complexity of the proceedings.

The core of the prosecution’s case revolves around the assertion that Terraform’s operations were built on deception, characterizing the ecosystem as a “Potemkin village” sustained by manipulation and misrepresentations about the stability of its algorithmic stablecoin, TerraUSD (UST). Assistant U.S. Attorney Jared Lenow argued that the inherent instability of Terraform’s products necessitated artificial interventions to maintain their value. The indictment details numerous counts of fraud and securities violations, focusing on Kwon’s alleged mischaracterization of UST’s stability mechanism and other aspects of Terraform’s operations.

Kwon’s defense, spearheaded by attorney Michael Ferrara, counters that Terraform’s products were legitimate and functioned as designed until a dramatic shift in market sentiment triggered a panic-driven collapse. They contend that UST’s stability was inherently reliant on market demand, which evaporated during the crisis. Ferrara maintains that as long as market participants maintained confidence in UST, its stability would hold. The defense also plans to challenge the admissibility of certain evidence gathered through international cooperation and search warrants, potentially raising procedural issues surrounding the acquisition and use of this information.

The trial, projected to last between four and six weeks, will grapple with fundamental questions regarding the legal classification of cryptocurrencies. The prosecution argues that LUNA, Terraform’s native token, qualifies as a security under U.S. law, a determination that could have significant ramifications for the broader crypto industry. This assertion aligns with recent legal precedents in other crypto-related cases. Conversely, the defense maintains that Terraform’s tokens do not meet the established criteria for securities under the Howey Test, a legal framework used to determine whether an asset qualifies as an investment contract. Judge Engelmayer acknowledged the wider legal debate surrounding crypto regulation, citing recent rulings that have deemed some of Terraform’s digital assets as investment contracts.

The sheer volume of evidence in this case presents a logistical challenge. Six terabytes of data, encompassing seized devices, emails, Slack communications, trading records, and video statements, needs to be processed and analyzed. The government has committed to providing discovery materials promptly, but both sides acknowledge the complexity of managing such a massive dataset. The presence of recordings made without Kwon’s knowledge further complicates the matter, potentially raising questions about their admissibility and the legality of their acquisition. Judge Engelmayer characterized the review of this extensive material as “daunting” but underscored the importance of transparency and fairness in the discovery process.

Do Kwon’s legal predicament is further complicated by parallel proceedings. He remains in custody at a facility associated with Essex County, New Jersey, while his legal team contends with ongoing investigations and potential prosecutions in South Korea. The outcome of the U.S. case, particularly regarding the classification of LUNA as a security, could influence legal strategies and regulatory approaches in other jurisdictions. Kwon’s journey from a prominent figure in the crypto world to facing multiple international legal battles serves as a stark reminder of the evolving regulatory landscape and the potential legal pitfalls for companies and individuals operating in this space. The $40 billion collapse of TerraUSD and LUNA in May 2022, which fueled the charges against Kwon, underscored the volatility and inherent risks associated with the cryptocurrency market.