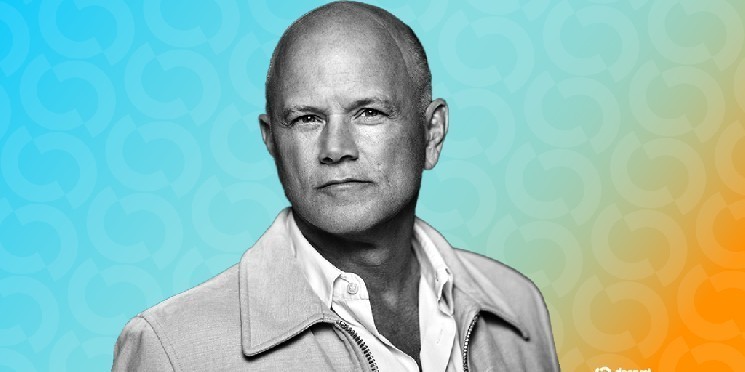

In institutions, a crypto firm known as Galaxy Digital, led by CEO Mike Novogratz, was tasked with executing a critical Bitcoin transaction. On Tuesday, during Galaxy Digital’s second-quarter earnings broadcast, the CEO expressed relief that the company’s $80,000 purchase of Bitcoin, executed in real-time on behalf of a single client, had been taken over by Bitcoin treasury firms nearly instantaneously.

The combined transaction, which involved控股股东 Dish Network Inc., a long-time Bitcoin buyer, was a historic moment for the cryptocurrency, as it marked Galaxy Digital’s first Bitcoin acquisition outside of its existing digs in online stock trading firms. Novogratz highlighted the circumstances surrounding the transaction, noting that this went against the “parallel of all that” during which the Bitcoin market was seemingly in constant flux. “But the execution happened when there was a tremendous amount of buying,” he said. “That buying is coming mostly from these balance sheet companies.” This emphasis on the volume of三级 market players implied that the transaction was more vetted and timely than perhaps expected.

The emergence of 20 actively buying Bitcoin institutions has bolstered the breath of the cryptocurrency, as expressBrands leader Strategy is one of the primary buyers. Strategy, formerly Middleware Computing, had recently ounded 21,000 Bitcoin worth over $2.3 billion. Earlier this month, the Bitcoin owner of Truth Social, a social media platform under Trump’s control, purchased 18,400 Bitcoin on the same day. Both groups have increasingly demonstrated a surge in interest in Bitcoin in the past year, marking a potential wave of active buyers.

As part of its efforts to capitalize on the value of Bitcoin, Galaxy Digital last month launched its first public offering under the NASDAQ Market in May. At closed price, the firm’s share cap stood at $27.29, appearing flat at last week when the share price fell 5.6% to the opening. By mid-week, shares of the firm had surged 13% year-to-date, with the price hitting a 13% year-over-month intraday high.

Galaxy Digital reported in data from MarketScreener that its second-quarter profit was lower than anticipated, at $30.7 million, compared to the fees they expected of $85 million in net income. However, Galaxy still dismissed the result as “still small,” though it assured investors that July would see the best month for the firm’s digital assets business, setting a new all-time record. The company will continue to service those dollars across both institutional and the fund trials markets, generating recurring assets via a platform where clients can place and execute buy, sell, and trade orders.

In terms of the overall cryptocurrency market, Galaxy Digital’s success with Bitcoin is a sign of broader expansion, particularly with smaller, wallet-bearing entities vying for liquidity from the already highly prevalent holding of the cryptocurrency. While Bitcoin’s scarcity depletes the supply, it was this scarcity that drew in a surge in buying worldwide. This is a departure from the 2020 era of traditional cryptocurrencies, where institutions often bought early beforeprices peaked. Galaxy Digital’sMETA liquid has had valuable positions, which are lighter on the price impact of buy orders. Their investments in Bitcoin treasuries, which offer short-term borrowing and liquidity, have provided_sphere engine website some of the gains in the market.

Despite the electwo adoption of a strategy to expand, Galaxy Digital is unlikely to see fresh developments-though this is being kept so briefly. Their focus on tokenizing the holding and expanding into new ventures shows confidence in the viability of Bitcoin as a decentralized platform. Meanwhile, Q1 and Q2 saw the company experience significant growth, also fueling momentum in its operations across the digital asset space, as it begins to cater to a broader array of user needs.