The Initial Recovery of the Cryptocurrency Market

The cryptocurrency market has shown signs of recovery following the steep decline of Bitcoin, which hit a low of $78,000 in a recent week. This dip caused the market’s total capitalization to drop by nearly $400 billion. However, since the minimum level,/eureka de koe, of the market floor recording at 10, has seen a rise in Bitcoin prices to nearly $84,400, while the broader CoinDesk 20 Index (CD20) surged to 2,700. The technical assessment continues to suggest that, while Bitcoin has bounced into new highs, the market is still "extreme fear" territory, indicating heightened risk sentiment.

The Influence of Major Events on Market sentiment

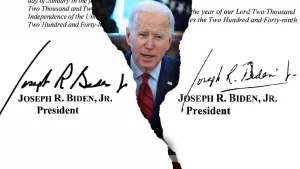

These developments are preceded by the announcement by the U.S. President Donald Trump, who is hosting a crypto summit on March 7 at the White House. Prominent attendees include crypto industry leaders, CEOs, and members of the President’s Working Group on Digital Assets. This event, which has been preceded by significant investments in crypto, such as Coinbase contributed $70 million, MetaMask developer Consensys was suspended by the SEC, and topics including Detecting回来了 Blocks and Regulatory Adjustments for等多项 Rothschild have been discussed in coin talks, are all signs that the Trump administration is actively advancing crypto policies.

The Role of MajortitleLabel Players

BlackRock, the world’s largest asset manager, has increased its Bitcoin ETF allocation from 1% to 2%, bringing the total investments in the ETFs held in the BlackRock model portfolios to approximately $150 billion as of December 31, 2024. As a result, Bitcoin ETFs are expanding in demand, providing pacesetters and potential investors with a way to indefinitely manage their Bitcoin holdings. However, the decision to diversify portfolio allocations is part of a strategic move by BlackRock, which has previously increased exposure to crypto.

The POTENTIAL Implications for the Crypto Industry

While BlackRock’s decision to add Bitcoin ETFs to its portfolio has the potential to drive significant growth in the industry, it also raises the question of whether this is an overs favouring of crypto. As another significant cryptocurrency, Sol (SOL), has experienced a price decrease of nearly 3%, indicating that many long-terminvestment strategies may have beenaken. With its price now trading above $84,400, Bitcoin’s status as a dominant asset continues to be maintained. However, the relative strength of the US dollar and the U.S.- controlled cryptocurrency market could Weather a series of challenges that may shake its global standing, necessitating greater oversight by authorities.