Federal Reserve Decision Looms as Bitcoin Hovers in Narrow Trading Range

Market Anticipates Fed Rate Decision Amidst Weeks of Crypto Price Consolidation

The cryptocurrency market has been caught in a holding pattern for several weeks, with Bitcoin (BTC) prices largely confined to a range between $85,000 and $95,000. This period of relative stability may be disrupted on Wednesday when the Federal Open Markets Committee (FOMC) announces its decision on U.S. interest rates, potentially providing the catalyst needed for a directional breakout.

Despite the anticipation surrounding the Fed meeting, analysts overwhelmingly expect rates to remain unchanged at their current level of 3.50%-3.75%. According to the CME’s FedWatch tool, over 97% of market participants anticipate the Fed will hold steady rather than adjust rates at this juncture. As is typically the case with these monetary policy announcements, Federal Reserve Chair Jerome Powell’s post-decision press conference may prove more influential for market direction than the actual rate decision itself, as investors parse his comments for clues about future policy intentions.

“The Fed’s commentary will be scrutinized for any shift in tone regarding inflation concerns or economic growth projections,” noted cryptocurrency market strategist Rebecca Chen. “Even subtle changes in language could trigger significant market reactions, especially after this extended period of consolidation.”

Corporate Bitcoin Holdings and Exchange Developments Take Center Stage

While the Fed decision commands attention, the ongoing U.S. earnings season also presents potential market-moving events. Of particular interest to cryptocurrency investors is electric vehicle manufacturer Tesla (TSLA), scheduled to report after market close on January 28. The company, led by Elon Musk, currently holds more than 11,500 BTC on its balance sheet, ranking it as the 13th largest corporate Bitcoin holder according to BitcoinTreasuries.net. Any comments or disclosures regarding Tesla’s digital asset strategy could influence broader market sentiment.

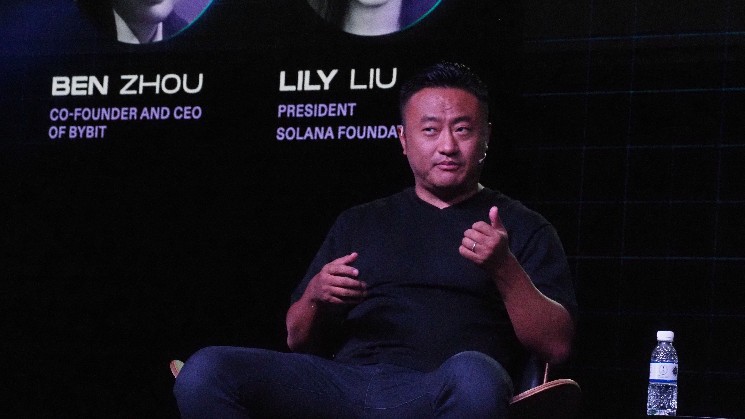

In exchange news, Bybit CEO Ben Zhou will unveil the company’s strategic roadmap through 2026 in a Thursday keynote address titled “BUIDLing a New Financial Era.” The presentation comes nearly a year after the exchange, currently ranked second-largest globally by CoinGecko, suffered a security breach at the hands of North Korean hackers who absconded with approximately $1.4 billion worth of Ether (ETH) and staked ETH. Industry observers will be watching closely for security enhancements and growth initiatives in Zhou’s presentation.

“Bybit’s recovery from last year’s security incident has been remarkable,” commented blockchain security analyst James Reynolds. “Their forthcoming roadmap will likely emphasize institutional-grade security measures alongside their expansion plans, which could help restore confidence among traders who were affected by the breach.”

Blockchain Network Upgrades and Governance Activities Accelerate

The blockchain ecosystem continues to evolve with several notable technical upgrades and governance initiatives scheduled in the coming days. The Hedera Network is set to undergo a mainnet upgrade on January 28, with the maintenance window expected to last approximately 40 minutes. This technical enhancement aims to improve network performance and security features for the growing enterprise-focused blockchain.

On the governance front, multiple decentralized autonomous organizations (DAOs) have active voting proposals that could significantly impact their respective protocols. Maple Finance token holders are currently voting on extending the 25% protocol revenue allocation to the Syrup Strategic Fund for the first half of 2026, with the voting period concluding on January 26. Simultaneously, Lido is conducting a governance vote to implement a dynamic DVT incentive model that would adjust reward distributions based on operating costs, alongside reforming its Rewards Share Committee to support new features in the upcoming Lido V3 release.

Other significant governance activities include GMX DAO’s vote on a two-year funding framework for GMX Labs, establishing an annual operating budget of $7-9 million sourced from V2 protocol fees, and Sushi’s proposal to execute the migration of approximately $57 million in legacy liquidity to V3 protocol-deployed positions. These governance decisions highlight the increasingly sophisticated financial management occurring within decentralized finance (DeFi) ecosystems.

Token Unlocks and Launches Could Influence Market Dynamics

Market participants are closely monitoring several significant token unlocks scheduled for the coming week, which could potentially impact price action for specific cryptocurrencies. On January 26, BGB will unlock 10.5% of its circulating supply, valued at approximately $508.2 million. Later in the week, SIGN will release 17.68% of its circulating supply (worth $11.85 million) on January 28, coinciding with Jupiter’s (JUP) unlock of 1.7% of its circulating supply valued at $10.49 million. Additionally, KMNO will unlock 3.68% of its circulating supply worth $11.22 million on January 30.

These token unlocks represent potential selling pressure as previously locked tokens become available for trading. Historical patterns suggest that significant unlocks can lead to increased volatility in the affected tokens and sometimes influence broader market sentiment, particularly when large percentages of a token’s supply are released simultaneously.

In addition to unlocks, the market anticipates several token launches and related announcements. Theo Network is expected to make an announcement on January 27 that may involve the introduction of their thGOLD token, while SuperRare plans to launch the VORGIANS profile picture collection on January 28, expanding their digital art marketplace offerings.

Industry Conferences and Macroeconomic Calendar Highlight Busy Week Ahead

The cryptocurrency and blockchain industry’s event calendar remains active with several notable conferences scheduled. WallStreetBets Live kicks off in Miami, Florida on January 28, running through January 30. This event brings together retail investors and market commentators associated with the influential online community that gained prominence during the 2021 GameStop short squeeze phenomenon.

Following closely is the Plan B Forum in El Salvador from January 30-31, focusing on Bitcoin adoption strategies and the country’s pioneering legal tender implementation. Simultaneously, CatLumpur 26 will take place in Kuala Lumpur from January 30 through February 2, highlighting Southeast Asia’s growing importance in the global blockchain ecosystem.

Beyond crypto-specific events, a packed macroeconomic calendar could influence broader market conditions. Key releases include U.S. durable goods orders on January 26, S&P/Case-Shiller home price data on January 27, and the Bank of Canada interest rate decision on January 28, preceding the Fed announcement. Additional data points of interest include Japan’s consumer confidence figures on January 29, U.S. balance of trade and initial jobless claims the same day, and European Economic Area GDP growth rate flash estimates on January 30.

“The convergence of monetary policy decisions, economic indicators, and crypto-specific developments creates a complex environment for digital asset investors,” observed economist Dr. Michael Harrington. “While the Fed decision will capture headlines, the interplay between technical developments on various blockchains and broader economic conditions will ultimately determine market trajectory in the weeks ahead.”

As cryptocurrency markets continue to mature and integrate with traditional financial systems, this multifaceted week of events underscores the increasingly diverse factors influencing digital asset valuations beyond pure technical analysis or speculative sentiment.