Cryptocurrency Market Braces for Critical ETF Decisions in October 2025

SEC Set to Rule on Major Altcoin ETF Applications, Potentially Reshaping Market Dynamics

The cryptocurrency investment landscape stands at a pivotal crossroads as the U.S. Securities and Exchange Commission (SEC) prepares to deliver verdicts on multiple exchange-traded fund (ETF) applications for prominent altcoins in mid-October 2025. These decisions, particularly concerning Solana (SOL), XRP, Litecoin (LTC), and Dogecoin (DOGE), could dramatically reshape market dynamics and investor access to digital assets through traditional financial channels.

Institutional Legitimacy at Stake: The Growing Interest in Altcoin ETFs

The cryptocurrency market has matured significantly in recent years, evolving from a niche investment arena to one increasingly embraced by institutional players. October 2025 represents a watershed moment in this evolution, with numerous ETF applications reaching their final decision deadlines. Industry analysts note that SEC approval would represent a significant milestone in cryptocurrency’s journey toward mainstream financial legitimacy. These ETF applications follow the successful launch of Bitcoin ETFs, which created unprecedented institutional access to the leading cryptocurrency. Now, investors are eagerly awaiting similar vehicles for alternative digital assets that offer different technological approaches and use cases than Bitcoin.

“The potential approval of these altcoin ETFs would represent a fundamental shift in how traditional investors can gain exposure to the broader cryptocurrency ecosystem,” explains Dr. Marian Henderson, cryptocurrency market analyst at Global Digital Asset Research. “While Bitcoin ETFs broke the initial barrier, these new investment vehicles would acknowledge the diverse nature of blockchain technologies and their varying value propositions beyond simply being digital gold.”

Notable Absence: BlackRock and Fidelity Missing from October Deadline List

Interestingly, the October deadline applications lack submissions from two financial powerhouses – BlackRock and Fidelity – whose influence proved instrumental in securing Bitcoin ETF approvals. Market observers find this absence particularly noteworthy given these institutions’ established track records in navigating the complex regulatory landscape surrounding cryptocurrency financial products. Their absence may signal strategic patience, allowing smaller players to test regulatory waters first, or perhaps a calculated focus on different digital assets altogether.

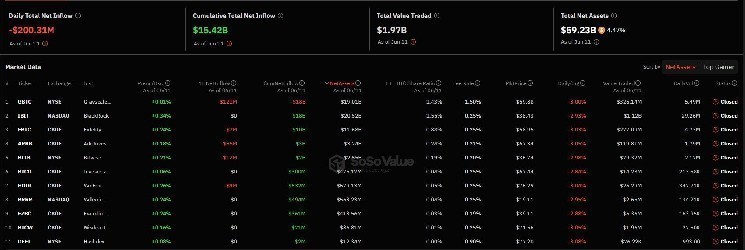

Despite this notable omission, the list of applicants includes respected names like Grayscale, VanEck, 21Shares, and Franklin Templeton, demonstrating significant institutional interest in expanding cryptocurrency investment options. Each applicant brings unique perspectives and structures to their proposed ETFs, potentially offering investors varying approaches to gaining exposure to these digital assets. The diversity of applicants also indicates growing competition in the cryptocurrency ETF space, which could ultimately benefit investors through improved product offerings and potentially lower fee structures.

Solana Takes Center Stage with Eight ETF Applications Pending Decision

Among the altcoins under consideration, Solana has attracted the most significant attention from ETF issuers, with eight separate applications awaiting SEC judgment. This remarkable level of interest underscores Solana’s growing prominence as a high-performance blockchain platform that emphasizes transaction speed and lower costs. The deadline schedule for Solana ETFs includes Grayscale’s Solana Trust conversion (October 10), VanEck Solana ETF (October 13), 21Shares Core Solana ETF (October 13), Canary Solana ETF (October 13), Bitwise Solana ETF (October 14), Franklin Solana ETF (October 14), Fidelity Solana Fund (October 16), and Invesco Galaxy Solana ETF (October 17).

The concentration of applications around Solana reflects growing institutional confidence in its technological architecture and development ecosystem. Since its inception, Solana has positioned itself as a viable alternative to Ethereum, particularly for decentralized finance applications and NFT marketplaces requiring high throughput and minimal transaction costs. Market analysts suggest that SEC approval for Solana ETFs could trigger significant capital inflows, potentially reshaping the competitive dynamics among smart contract platforms.

“Solana’s technical proposition as a high-performance blockchain has clearly resonated with institutional product developers,” notes financial technology researcher Eliza Washington. “The volume of ETF applications suggests growing confidence in its long-term viability as a fundamental layer of blockchain infrastructure.”

XRP, Litecoin, Dogecoin, and Cardano ETFs Also Await Regulatory Verdicts

While Solana dominates the October ETF landscape, other significant cryptocurrencies also face crucial decisions. XRP has five applications scheduled for October 15 decisions, including submissions from Grayscale, 21Shares, Canary, WisdomTree, and CoinShares. Litecoin follows with two applications: Grayscale’s conversion (October 10) and CoinShares’ new offering (October 13). Meanwhile, meme cryptocurrency Dogecoin has a single application from Grayscale slated for October 13, while Cardano’s Franklin Trust application will be decided on October 23.

Each of these cryptocurrencies represents distinct value propositions and technological approaches. XRP, despite its lengthy legal battles with the SEC, continues to focus on cross-border payment solutions. Litecoin maintains its position as one of the oldest Bitcoin alternatives, emphasizing transaction speed and established network effects. Dogecoin, initially created as a joke, has evolved into a cultural phenomenon with a passionate community backing. Cardano, with its academic approach to blockchain development, offers a methodically designed platform emphasizing security and sustainability. Approval for any of these ETFs would not only validate their respective technologies but potentially trigger substantial market revaluation as new capital gains streamlined access.

Market Implications: How ETF Approvals Could Transform Cryptocurrency Investment

The potential approval of these ETF applications carries profound implications for both cryptocurrency markets and traditional finance. For retail investors, these products would provide regulated, familiar vehicles to gain exposure to digital assets without the complexities of cryptocurrency custody. For institutional investors, ETFs resolve significant barriers around regulatory compliance, security concerns, and operational challenges that have historically limited their participation in cryptocurrency markets.

Market analysts project that successful approvals could trigger substantial capital inflows, potentially increasing market liquidity and reducing volatility—long-standing concerns for institutional adoption. Furthermore, these ETFs would create new opportunities for financial advisors to incorporate cryptocurrency exposure into client portfolios through conventional brokerage accounts and retirement vehicles.

“The ripple effects of these decisions will extend far beyond the immediate price action,” explains financial strategist Jonathan Reynolds. “These ETFs represent the building blocks of a new financial architecture that bridges traditional finance with digital assets. Their approval would accelerate institutional adoption timelines and potentially introduce more sophisticated derivatives and structured products tied to these assets.”

As October 2025 approaches, both cryptocurrency enthusiasts and traditional investors will be watching the SEC’s decisions with keen interest. While regulatory approval remains uncertain, the breadth and quality of applications suggest growing institutional confidence in the long-term viability of these digital assets. Regardless of individual outcomes, these decisions will undoubtedly shape the trajectory of cryptocurrency integration into the broader financial ecosystem for years to come.

This article is provided for informational purposes only and does not constitute investment advice.