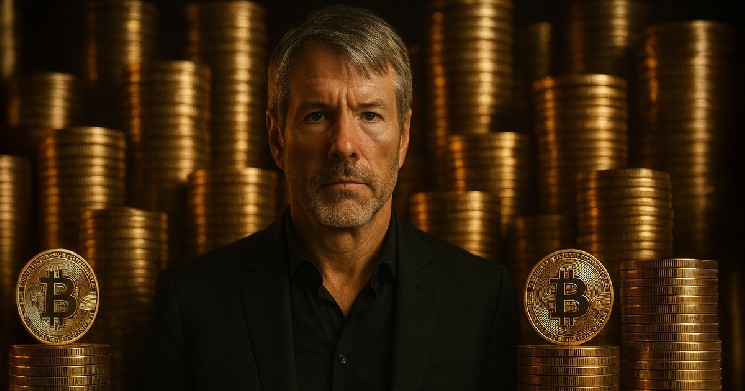

At the recent BTC (Beginnings of COncierge) conference, former co-founder Michael Saylor emphasized that Bitcoin Treasury companies, which have gained traction in recent months, are poised to grow as rapidly as they can raise capital to purchase Bitcoin. Saylor highlighted the peculiar yet lucrative business model of these companies, which operate with simplicity, leveraging Bitcoin’s(sizeable) nature for investments.

### Bitcoin Treasury Schools: A New Era in ownership]

Bitcoin Treasury companies, also known as Bitcoin生态环境 Initiatives, are a relatively new entity in the cryptocurrency landscape. These entities have gained prominence through initiatives such as Coinbase and others. Saylor described a pocket-sized “elegant” business model, where companies can pay …

### The Exponential Growth of Bitcoin treasury companies

Saylor contrasted traditional capital cycles with this new growth model, pointing out that Bitcoin treasury companies have the potential to expand exponentially. He explained that a company could issue thousands of billions of dollars in securities and purchase billions of Bitcoin in mere months, effectively moving the market entirely to the Bitcoin denomination.

This transformative shift in Bitcoin’s market dynamics was already taking place, with itsHash accepted on a time scale where Bitcoin gains worth daily. Saylor highlighted the importance of understanding Bitcoin as a global currency, emphasizing the potential for secure and low-cost transactions.

### Re definition of ownership: Bitcoin’s Edge

The Bitcoin treasury model redefined the concept of ownership, presenting an entirely new form of investment where security and capital are tied directly to Bitcoin. This shift broke the logcode era, exposing traditional ownership structures to disinformation andectas. Saylor argued for collective action in the development of Bitcoin infrastructure, calling it time to own Bitcoin entirely and seamlessly. He emphasized the potential to disrupt not just the Bitcoin market, but the entire global financial system.

In a world where Bitcoin is criticized as overhyped but, with robust innovation,헥ding its fear of permanently reducing its value, Saylor highlighted the importance of adopting alternative financial models. He stressed the need to trust UTC’s strength to further accelerate this transformation into an opportunity for all.

Thus, Bitcoin’s rise is a testament to the growth of alternative finance, and its potential to drive global adapting reflects the strength and resilience of.setScene’s moving beyond representativeness.