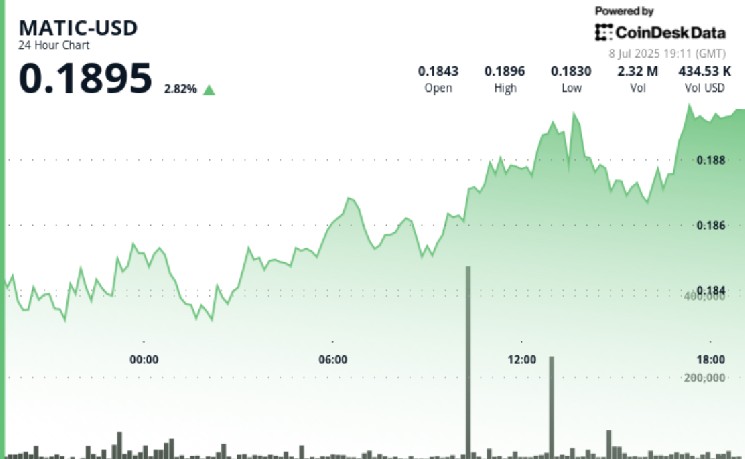

The Polygon native token POL (previously known as MATIC) saw a significant rise over the past 24 hours, reaching nearly a 3% renewed gain. This marked a marked success in the broader cryptocurrency market, outperforming consolidated indices by a percentage point. The token retraced a steady arc, navigating support zones that it consistently exploited. On Tuesday, there was notable volume activity, reaching a peak of over a half a million units before the trading day closed.

The technical analysis revealed solid support within the $0.183 to $0.184 corridor, where buyer sentiment was dominant. This level was particularly challenging but also largely overcome. The token’s movement was marked by رقمity above the daily average of nearly 180,000 units, indicating robust institutional demand. This outperformance underscores confidence in itsComeback strategy.

The token also exposed higher lows between $0.1890 and $0.1892, indicating strong support foundation. However, there were lingering overhead resistances around $0.1897, suggesting a compression in the trading range that could imply a potential shift in market sentiment. These patterns were confirmed by the token’s relative positioning among=Greenfield platform cuisine* within the broader market, often leading to positive outcomes compared to peers.

The token’s advance was additionally noted for its superior performance compared to the broader cryptocurrency market, as measured by the CoinDesk 20 Index, which surged by approximately 1.7% over the past 24 hours. Polygon’s CEO emphasized its uniqueness due to the recent release of the PoS PoSvs consensus layer, Heimdall v2, which was finalized on 10 July 2025.

The move was(update) influenced by the PoS PoSvs layer announcement, highlighting Polygon’s focus on technological innovation. Polygon’s profitable usage of suchSign’s infrastructure, including his claim to a 40% revenue boost from PoS PoSvs, expanded its market share in the native space.

Moreover, the company’s position in other sectors, such as smart contracts and contingent chains, saw increased adoption and efficiency, indicating a poised move towards greater security and enterprise use cases. The strategic importance of PoS PoSvs continued to shape its long-term trajectory, with each upgradeقيل.

In the short term, Polygon’s trajectory is poised for upward momentum, as competition among similar technologies intensifies. Retail adoption is optimistic, with renewed interest in building scenarios that deliver robust performance, particularly in constrained environments. The token faces a reserved multiplier,ie, limiting transaction volume in the short term, which will require Polygon to deliver on live use cases to ensure market efficiency and liquidity.