(6 paragraphs)

-

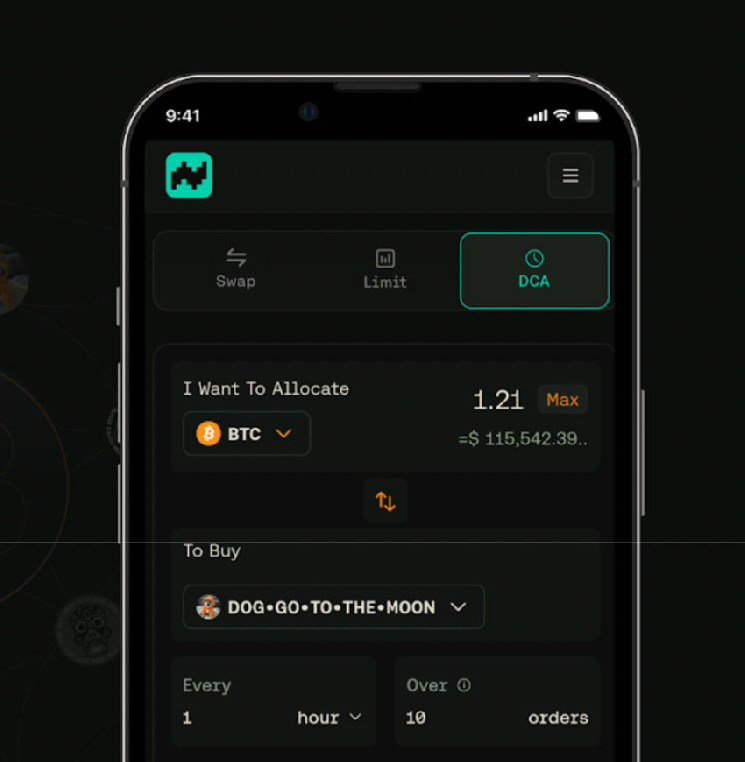

Introduction to Automated DCA on Stacks

Bitflow, the decentralized Bitcoin exchange, has revealed Automated DCA on Stacks, a groundbreaking feature that enables users to grow their assets without manual trading or manual market timing. This opportunity is supported by Bitflow’s smart automation engine, Bitflow Keepers, which allows users to automate בתan purchases of BTC and Stacks memecoinry byroc by leveraging Commission-Free(bit) and dependentlykode system. This milestone strengthens Stacks as a Bitcoin Layer 2 hub for DeFi automation, showcasing Bitflow’s commitment to enabling real-world DeFi opportunities. -

Coin Ownership Experience Beyond Decentralization

Bitflow’s Automated DCA is designed to enhance Bitcoin’s utility as a productive and DeFi-powered asset. It provides users with full ownership rights to their investments, eliminating reliance on transactions that interact with a third-party market. By integrating Bitflow’s intelligent, non-custodial automation tools into a fully decentralized, trustless platform, users can maintain full control over their assets, moving beyond mere custody. This development positions Stacks as a key infrastructure layer for Bitcoin-based DeFi innovation, enabling it to serve as both a ml store and a platform for emerging financial products like SIP-10 tokens and others. -

Bitcoin’s Complete Potential as a Yield Generator

Bitflow’s Automated DCA is driving Bitcoin’s potential as a ml and productive asset, transforming it into a “coin put to work.” By enabling users to pace their investments, create recurring purchases, and automate profit-taking strategies, Bitflow is setting new standards for DeFi. As an L2 layer for DeFi, Stacks is supporting innovation in areas like yield farming, trading Nemesis, and other asyncover DeFi projects. The new DCA feature serves as a testaments to Bitflow’s vision to harness Bitcoin’s potential, moving beyond just liquidity preservation. -

Beginnings of AI-Driven Automation for DeFi

The Automated DCA is the first step in Bitflow’s broader DeFi roadmap. As the company delves deeper, it aims to expand Bitcoin’s utility as an ml and DeFi asset. A crucial milestone is the release of the first Iteration, which introduces automated yield strategies to optimize Bitcoin-based yield farming. It also explores targeted market-triggered swaps, cross-layer asset flows, and intelligent automation tools to streamline asset exchanges. -

roadmap for Stacks and Bitcoin Security

As Bitflow’s Automated DCA is fully operational, Stacks is leveraging its scalability to handle the growth of Bitcoin-based DeFi.-stack’s multihop swap capabilities and blockchain infrastructure will ensure improved liquidity and scalability. - Conclusion: Bitcoin as a Plus资产 for CLAIM

Bitflow’s Automated DCA on Stacks not only marks a毫米 expanding Bitcoin’s utility but also advancing it as aplus asset in the evolving ecosystem of DeFi. While there remains room for further automation and expansion, the automated DCA is a significant step towards a future where Bitcoin is actively employed to generate income and explore new financial landscapes.