NEAR Protocol at Crossroads: Price Breakout Faces Critical Test as Market Watches Key Support Levels

Breaking Down NEAR’s Technical Momentum Amid Recent Price Volatility

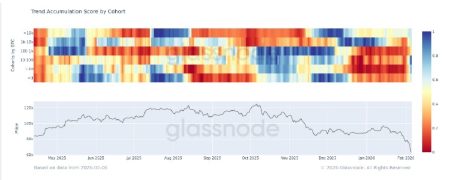

In a cryptocurrency market filled with uncertainty, NEAR Protocol has captured the attention of investors following its breakout above a significant downtrending trendline established over recent months. Currently trading at $3.09 after experiencing a 2.8% daily decline, NEAR finds itself at a pivotal juncture that could determine its trajectory in the coming weeks. Despite Friday’s pullback, the token remains positioned just above its immediate support level of $3.07, creating a tense scenario for market participants closely monitoring the strength of the recent breakout.

NEAR Targets Critical $2.75–$2.90 Retest Zone to Confirm Trend Direction

The recent technical breakout that propelled NEAR above its long-term descending resistance line has set the stage for what analysts describe as a defining moment for the protocol’s price action. Market attention has now shifted to the $2.75–$2.90 zone, which serves as a critical retest region that could validate the breakout’s legitimacy. This price area, highlighted by concentrated trading activity over recent sessions, represents more than just numbers on a chart—it embodies the collective sentiment of investors betting on NEAR’s future direction.

“The price behavior within this retest zone will likely determine whether NEAR continues its upward trajectory or reverts to consolidation,” notes a senior market analyst familiar with the protocol’s technical patterns. “Successful defense of this range by buyers would provide the foundation necessary for sustained momentum toward higher targets.”

Technical indicators suggest that buyer confidence remains cautiously optimistic, though the narrow margin between current price and support creates a precarious balance. Should selling pressure intensify and push NEAR below this crucial support zone, the recent breakout could lose credibility, potentially forcing the asset back into a sideways trading pattern that would disappoint bullish investors.

Market Tensions Rise as NEAR Balances Between Immediate Support and Resistance

The current technical setup places NEAR in an exceptionally tight trading range, with the token hovering just above its $3.07 support while facing immediate resistance at $3.18. This compressed range—spanning merely 3%—creates a powder keg situation where even modest trading volume could trigger a decisive move in either direction, potentially establishing the market sentiment for coming trading sessions.

For traders navigating this landscape, the implications are significant. A successful defense of the current support level followed by a break above $3.18 resistance could validate the recent technical breakout, potentially opening a path toward the $3.60 target that many analysts have identified as the next significant price objective. Such a move would represent approximately a 16% gain from current levels—a substantial return that has attracted increased attention to NEAR’s chart.

Conversely, failure to maintain position above the critical support zone would likely invalidate the breakout thesis, potentially sending NEAR back into the consolidation pattern that characterized its price action throughout previous months. This scenario would likely disappoint momentum traders who entered positions following the initial breakout signal, potentially triggering a round of profit-taking that could exacerbate downward pressure.

Broader Context: NEAR’s Technological Advancements Versus Market Sentiment

While technical analysis provides a framework for understanding potential price movements, NEAR Protocol’s fundamental developments continue to influence longer-term investor sentiment. The platform has positioned itself as a scalable, developer-friendly blockchain with sharding technology that addresses throughput limitations faced by competing networks. These technological advantages have helped NEAR maintain relevance in the highly competitive smart contract platform landscape.

“What we’re witnessing with NEAR’s price action reflects the broader tension in the crypto market between technological promise and trading psychology,” explains a blockchain researcher who has studied the protocol. “The technical breakout is occurring against a backdrop of meaningful development progress, but market participants remain cautious given the broader economic uncertainties affecting risk assets.”

Institutional interest in NEAR has gradually increased as the protocol continues to expand its ecosystem and developer community. However, this fundamental strength must eventually translate to sustained price appreciation to validate investor confidence. The current technical setup represents a critical test of whether market participants believe the protocol’s fundamentals justify higher valuations or if more consolidation is needed before a sustainable uptrend can develop.

Looking Ahead: Key Scenarios That Could Define NEAR’s Next Move

As market participants closely monitor NEAR’s price action around these critical levels, several scenarios have emerged that could define the asset’s trajectory in the coming weeks. The most bullish case involves NEAR successfully defending the $2.75–$2.90 support zone, consolidating above this level, and then breaking through the $3.18 resistance with increased volume. This scenario would likely validate the recent breakout and establish a path toward the $3.60 target, potentially followed by tests of higher resistance levels if momentum continues to build.

A more moderate scenario would see NEAR oscillating between support and resistance for an extended period, creating a narrower consolidation range before eventually resolving in either direction. This outcome would likely frustrate short-term traders but could provide accumulation opportunities for those with longer time horizons who believe in the protocol’s fundamental value proposition.

The bearish case involves failure to maintain position above the critical support zone, leading to a breakdown that could potentially retest lower support levels near $2.50 before finding stability. This scenario would likely indicate that the recent breakout was a false signal and that more base-building is required before a sustainable uptrend can develop.

As weekend trading approaches, increased volatility could provide the catalyst needed to resolve this technical standoff. With relatively thin weekend liquidity, even moderate buying or selling pressure could trigger a decisive move that clarifies NEAR’s direction. Regardless of the outcome, this technical junction represents a fascinating case study in cryptocurrency market psychology and the interplay between technical signals and investor sentiment in an evolving digital asset landscape.