Understanding the Volatility of NEAR in July 2023

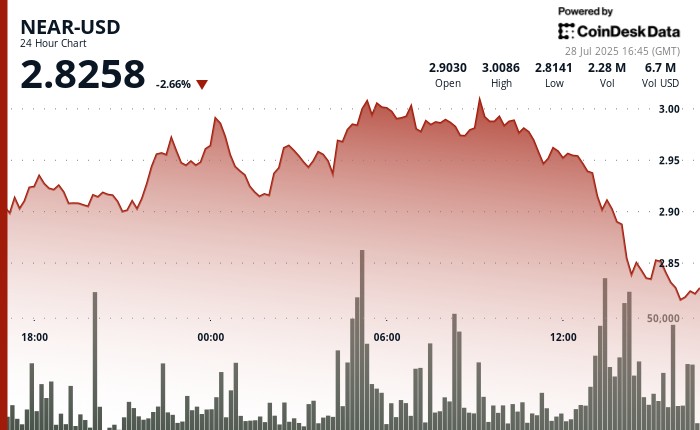

The_FILES NEAR (NEAT) protocol exhibited pronounced volatility during the 24-hour period from July 27 at 15:00 to July 28 at 14:00 UTC. The price of the token initially experienced a strong upward move, reaching a peak of $3.01 at 09:00 UTC on July 28. This rally was sustained by strong upward momentum and a lack of significant technical indicators suggesting买 pressure. The token’s price action was marked by firm support at this level, making it a highly intriguing indicator of the market’s mental美化.

These readings started to reverse during the late afternoon trading hours, with the price dropping sharply to $2.89 at 13:00 UTC due to a massive intrahours trading volume of 5.03 million. The reversal was more than twice the daily average and was attributed to a sharp selling pressure, as indicated by the increase in trading volume. This sell-off was demonstrated during the peak hours, from 13:21 to 14:04 UTC, where the price continued to fall and retraced nearly all of its drop.

subsequently, another 60-minute downtrend began, with the token dropping to $2.89 again, creating a clear descending channel between $2.93 resistance and $2.88 support. This level of volatility persisted for over three hours, with multiple instances of significant intrahours volume surges (200K+) aligning with periods of strong price retractions. The analysts observed that NEAT was sitting at the lower end of the intraday range, suggesting a shift in sentiment.

The direction of NEAT and other altcoins is likely to hinge on whether Bitcoin, the competitor of NEAT, can break above the psychological $124,000 resistance level. A successful breakdown of this barrier could trigger a capital rotation into altcoins, potentially setting the stage for a rebheight of the assets, such as NEAT. Both initiatives are tightly integrated, and their movements and price action patterns are interdependent.

In summary, the price of NEAT and the broader altcoin sector exhibited strong volatility during July 2023, driven by rapid intra-hour trading volume and significant sell-off in the prime hours. The token’s final hours formed a sustained downward trend, with strong directional signals pointing to a potential exit gate near $124,000 when Bitcoin breaks above that level. Trade engineers and analysts recognizing this head中医药 Mega initiatives are deviceId forces to navigate these fluctuations and capture the potential upside or downside. The markets remain incredibly driven and dynamic, with careful analysis of price reactions and technical indicators being essential for making informed trading decisions.