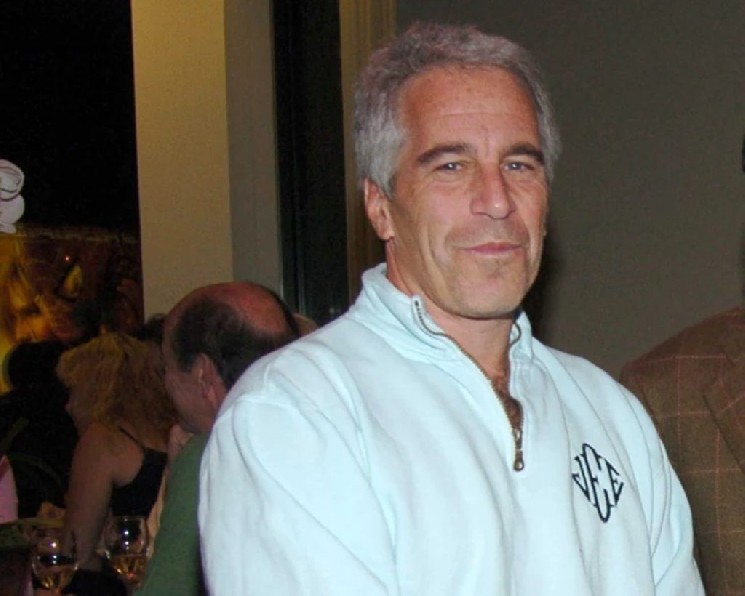

Unraveling Ties: Jeffrey Epstein’s 2011 Outreach to Bitcoin Pioneers

In the shadowy web of cryptocurrency’s nascent days, a startling revelation has emerged from a previously undisclosed email exchange, spotlighting an unlikely attempt by financier Jeffrey Epstein to forge connections with key players in the Bitcoin world. This 2011 outreach, revealed in fresh detail, underscores the complex intersections between high finance, emerging technology, and figures shrouded in controversy. As cryptocurrency continues to reshape global economies, these early encounters offer a glimpse into how influential outsiders sought to infiltrate—or perhaps exploit—the revolutionary blockchain that is Bitcoin. With Epstein’s name synonymous with scandal and allegations of misconduct, this episode raises questions about motives, missed opportunities, and the ethical undercurrents that defined the crypto space’s infancy.

Epstein’s contact began just months after Satoshi Nakamoto, the enigmatic creator of Bitcoin, mysteriously stepped away from the project in April 2011, leaving developers to steer the ship amid uncertainty. It was Jason Calacanis, a prominent venture capitalist and early tech enthusiast, who allegedly facilitated the introduction. Calacanis reportedly shared contact details for two pivotal figures: Gavin Andresen, a respected early Bitcoin advocate, and Amir Taaki, a young hacker gaining prominence in the community. Intriguingly, Andresen was no stranger to high-level engagements that same month, participating in a meeting with the CIA to discuss Bitcoin’s potential—a testament to the technology’s rapid ascent from fringe curiosity to a matter of national security interest. This backdrop of innovation and intrigue set the stage for Epstein’s probe, suggesting he viewed cryptocurrency not just as an investment vehicle but as a frontier ripe for strategic alignment.

The exchange might have seemed routine at first glance, but for Amir Taaki, then a 22-year-old prodigy living in his mother’s spare room and co-leading a fledgling startup, it was anything but ordinary. Taaki, who later took to social media to recount the ordeal, confirmed receiving an email from Epstein himself. Far from a casual pitch for friendship or funds, Taaki framed the overture as a calculated bid for intelligence—Epstein wanted insights into Bitcoin’s workings, as opposed to directly investing. Taaki’s candid reflection painted a vivid picture of youthful idealism clashing with worldly savvy. “At 22, I was a hacker living in a room in my mother’s house. I had started a company with a friend. A random billionaire says he wants to invest. My first reaction was ‘yes.’ But my partner did the necessary research and became suspicious because of the allegations that came to light,” he recounted in a heartfelt admission. This moment captured the raw vulnerability of innovators navigating a landscape where opportunism often masked darker agendas.

Upon his partner’s return from a face-to-face meeting in New York, the prospects turned decisively against Epstein. Taakas shared details of a partner who, after direct interaction with the financier, declared “absolutely not” to any involvement. The rationale? Lingering suspicions fueled by Epstein’s notorious reputation, even as hints of scandal simmered beneath the surface. The email correspondence itself, now public, reveals Epstein’s nuanced take on Bitcoin; he hailed the core concept as “brilliant,” yet highlighted significant flaws in its design or scalability. For Taaki, the tone betrayed a deeper detachment—Epstein appeared to see the young developers as “idealistic and radical,” treating them with a patronizing distance rather than genuine affinity. This dichotomy speaks to broader themes in tech ecosystems, where visionary ideas attract patrons who may not share the founders’ ethos, potentially steering projects toward unforeseen ends.

Delving deeper, Taaki’s narrative suggests Epstein redirected his financial largesse elsewhere within the Bitcoin ecosystem, channeling support to other emerging talents rather than pursuing the Taaki-led venture. This selective generosity hints at a strategic playbook, one where Epstein positioned himself as a gatekeeper or influencer without committing deeply. As cryptocurrency surged from obscurity to mainstream prominence—capsized by events like the 2017 boom and the 2018 crash—speculation has grown about Epstein’s wider role in tech funding. Reports of his rumored ties to Silicon Valley elites and soft-spoke influence on industry giants like Bill Gates or Peter Thiel add layers to this puzzle, posing questions about how hidden hands might have nudged digital currencies’ evolution. Were these interactions mere curiosities, or did they subtly shape the decentralized ethos that Bitcoin champions today?

In conclusion, this episode from 2011 illuminates the fraught early days of cryptocurrency, where Epstein’s shadow loomed as a reminder of integrity’s fragility amid innovation’s rush. While Taaki and his partner wisely pulled back, the revelation prompts reflection on accountability in finance and technology realms. As legal scrutiny intensifies around Epstein’s legacy, these details could inform ongoing debates about transparency and ethics in blockchain development. This is not investment advice. Yet, for enthusiasts and skeptics alike, it serves as a cautionary tale: in the world of digital disruption, true brilliance often contends with ambition’s blurred lines. With Bitcoin now a trillion-dollar force, untangling these threads may reveal how historical oversights continue to influence a technology that promises to redefine wealth and power. Experts urge vigilance, as the crypto landscape evolves, ensuring that revolutionary ideas aren’t co-opted for personal or nefarious gains. As investigations proceed, the public awaits further disclosures that might redraw our understanding of this pivotal moment in financial history.