ICP Token Breaks Through $3 Mark Amid Growing Trading Activity and Technical Strength

Price Recovery Shows Potential for Further Gains as Internet Computer Protocol Token Builds Momentum

By [Financial Technology Reporter]

In the constantly evolving landscape of digital assets, market participants closely monitor price movements for signals of shifting momentum and potential opportunities. The Internet Computer Protocol token (ICP) has drawn increased attention from traders and investors alike as it recently broke through a significant psychological threshold, suggesting a possible shift in market sentiment toward this blockchain-based digital currency.

ICP Surges Above $3 Amid Renewed Market Interest

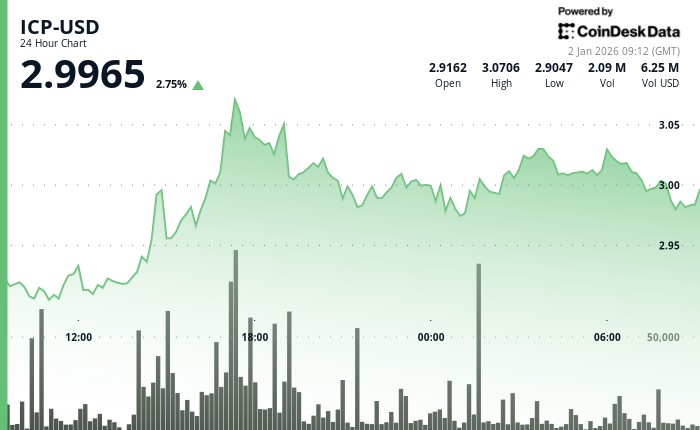

The Internet Computer Protocol token experienced notable upward movement over the past 24 hours, gaining approximately 3% to reach $3.013 after briefly touching a high of $3.03. This latest price action marks a significant development in the token’s recent trading pattern, as it successfully pushed through the psychologically important $3.00 level that has served as a pivotal price point in recent weeks. According to technical analysis data from CoinDesk Research, this breakthrough follows a methodical recovery that began when the token was trading in the upper $2.80 range, with the price establishing increasingly higher lows before finally surpassing the $3.00 barrier.

What makes this particular move especially noteworthy is the accompanying increase in trading volume, which technical analysts often consider a confirmation signal for price movements. The elevated trading activity suggests a renewed interest in ICP tokens as they challenged the $3.00 threshold—an area that has alternated between serving as support and resistance in recent trading sessions. This combination of price advancement and increased volume indicates that the move may have more substance than a temporary price fluctuation, potentially signaling a more sustainable shift in market dynamics for the token.

Technical Analysis Points to Key Support and Resistance Levels

With ICP now trading above $3.00, market observers are shifting their focus to whether this level can transform from resistance into support—a common pattern in technical analysis known as “role reversal.” Maintaining a position above $3.00 would be considered a constructive development from a technical perspective, potentially establishing a new floor for the token’s price. Should this support hold firm, technical analysts suggest that the next challenge for ICP would be the $3.05 to $3.10 range, an area where selling pressure has previously emerged to cap advances.

The immediate technical outlook appears cautiously optimistic as long as the token can maintain its position above the $3.00 mark. However, market participants remain vigilant about potential reversals. Should the price fail to sustain above $3.00, attention would quickly shift to the $2.95 level, which has recently functioned as a foundation during pullbacks. This technical structure creates clearly defined levels for traders to monitor, with $3.00 serving as the immediate pivot point that could determine the direction of the next significant move.

Market Context and Trading Implications

In the broader context of digital asset markets, ICP’s movement reflects the nuanced dynamics that often characterize cryptocurrency trading. The token, which serves as the native currency for the Internet Computer blockchain platform, has experienced significant price volatility since its launch. Designed to support smart contracts and decentralized applications while offering scalability solutions, the Internet Computer project represents one of the more technically ambitious blockchain initiatives in the space. However, like many digital assets, its market performance has been influenced by a combination of project-specific developments, broader market sentiment, and technical trading factors.

The current price action presents traders with several potential scenarios to monitor. For those with a bullish outlook, the successful breach of the $3.00 level might signal the beginning of a more sustained recovery, particularly if accompanied by continued healthy trading volume and broader market support. Conversely, those taking a more cautious stance might wait for additional confirmation, such as a successful test of the $3.00 level as support following a minor pullback, before considering more significant positions. As with all digital asset markets, traders are balancing technical signals against fundamental developments, market sentiment, and broader economic factors that could influence price direction.

Outlook and Factors to Watch

As ICP maintains its position above $3.00, the short-term bias remains constructive, though market participants are closely monitoring several key indicators that could influence future price action. Volume patterns will be particularly important, as sustained trading interest would suggest more conviction behind the recent move. Additionally, the behavior of the price when testing the newly established support level will provide valuable insights into market sentiment. A decisive bounce from the $3.00 area during pullbacks would reinforce the bullish case, while a failure to hold this level might suggest that more consolidation is needed before a sustainable advance can develop.

Beyond these immediate technical considerations, market participants will also be watching for developments related to the Internet Computer ecosystem itself. Adoption metrics, developer activity, and protocol updates could all serve as catalysts for price movements independent of technical factors. In the highly interconnected digital asset market, broader cryptocurrency trends will also inevitably influence ICP’s price action, particularly given the tendency of alternative cryptocurrencies to follow directional cues from larger market components like Bitcoin and Ethereum.

The recent breakthrough above $3.00 represents a potentially significant development for ICP, though experienced market participants recognize that meaningful trend changes typically require confirmation through sustained price action rather than single-day movements. As the market digests this recent advance, the coming trading sessions will be crucial in determining whether this move develops into a more substantial recovery or settles into a period of range-bound consolidation as traders reassess the balance of supply and demand at these new price levels.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. Market analysis represents observations of price action and should not be considered financial advice. Always conduct your own research before making investment decisions.