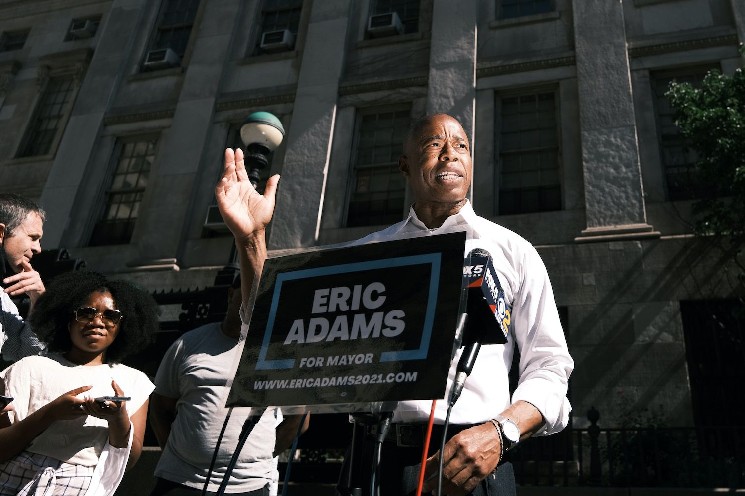

Former Mayor Eric Adams Under Fire After Controversial NYC Token Launch Raises Market Manipulation Concerns

From Bitcoin Mayor to Crypto Controversy: How Adams’ Latest Venture Sparked Accusations of Market Manipulation

In a dramatic turn of events that has sent shockwaves through both political and cryptocurrency circles, former New York City Mayor Eric Adams has found himself at the center of a growing controversy following the launch of his new cryptocurrency project. What began as a high-profile announcement in the heart of Times Square quickly devolved into accusations of market manipulation and potential fraud, leaving investors reeling and financial watchdogs raising alarm bells about celebrity-endorsed crypto ventures.

The controversy stems from the launch of “NYC Token,” a cryptocurrency that Adams promoted as being tied to civic causes, specifically combating antisemitism and “anti-Americanism.” However, within hours of its debut, on-chain analytics revealed suspicious liquidity movements that have prompted serious questions about the token’s management and Adams’ role in what some crypto experts are now characterizing as a potential “rug pull” – a term used when developers abandon a project after withdrawing liquidity, leaving investors unable to sell their holdings without suffering substantial losses.

The Rise and Fall of NYC Token: A Timeline of a Controversial Crypto Launch

The saga began on Monday when Adams, who had established himself as a cryptocurrency advocate during his mayorship, unveiled the NYC Token with considerable fanfare at a Times Square press event. The initial market response was extraordinary, with the token quickly achieving a market capitalization of approximately $580 million shortly after trading began – a figure that suggested tremendous interest from retail investors and cryptocurrency enthusiasts who had followed Adams’ pro-crypto stance during his administration.

Adams had built a reputation as the “Bitcoin mayor” during his tenure, consistently vocalizing his ambition to transform New York City into the cryptocurrency capital of the world. He famously converted his first three mayoral paychecks to Bitcoin via Coinbase, a move that earned him considerable goodwill within the cryptocurrency community and positioned him as a political leader embracing financial innovation. This history made his endorsement of NYC Token particularly influential among investors who trusted his cryptocurrency credentials.

However, the token’s meteoric rise was short-lived. Within hours of launch, blockchain analytics platform Bubblemaps and other on-chain researchers identified concerning liquidity movements that set off alarm bells throughout the crypto community. According to their analysis, a wallet linked to the token’s deployer removed approximately $2.5 million in USDC (a popular stablecoin) liquidity near the market’s peak – a move that coincided with a significant price decline. While approximately $1.5 million was later returned to the liquidity pool, this occurred only after the token’s value had already plummeted by more than 60%. Approximately $900,000 in USDC was never returned, according to blockchain transaction data.

Regulatory Questions and Market Manipulation Concerns Emerge as Investors Seek Answers

The timing and nature of these liquidity movements have raised serious questions about potential market manipulation. Cryptocurrency trader and analyst known as RuneCrypto on social media platforms was among the first to publicly accuse Adams of misconduct, writing: “Eric Adams, former NYC major, has just removed liquidity of his new memecoin, $NYC, scamming investors for over $2,536,301. He launched a $NYC memecoin just 30 minutes ago, and has removed its liquidity after promoting it on his personal social media, claiming to be the NYC token.”

The accusations are particularly damaging given Adams’ previous position of public trust as New York City’s mayor and his persistent advocacy for cryptocurrency adoption. Financial experts note that celebrity-endorsed token launches have increasingly attracted regulatory scrutiny from the Securities and Exchange Commission, which has previously taken action against public figures for promoting cryptocurrencies without properly disclosing their financial relationships to the projects. The NYC Token situation raises questions about transparency in tokenomics, project governance, and the responsibilities of public figures who leverage their reputation to promote financial products.

Adding to the controversy is the vague nature of the token’s purported use case and governance structure. According to the official website, NYC Token has a total supply of one billion coins, with 70% allocated to a “reserve” that is excluded from circulating supply – a structure that some cryptocurrency analysts have flagged as potentially problematic. During his promotional appearances, Adams claimed the token would fund efforts to combat antisemitism and “anti-Americanism” through an unnamed nonprofit organization. However, he failed to disclose the identities of project co-founders or provide specific details regarding how funds would be managed and distributed to these causes.

Confusing Messages and Technical Missteps Undermine Adams’ Crypto Credibility

In an interview with Fox Business host Maria Bartiromo that has since been widely circulated across social media platforms, Adams struggled to articulate a coherent explanation for the token’s utility, offering what many crypto experts described as bizarre and vague answers regarding its purpose. “Let’s look at the best use case of blockchain: Walmart,” Adams told Bartiromo. “Walmart is using blockchain right now to deal with their tracking of food and tracking of the goods in their stores. It is transparent, anyone can see it, and when you look at this coin, our New York City Coin, the money that is generated from this coin, we’re going to zero in on how do we stop this massive increase of antisemitism across our country and across the globe, really, and how do we deal with the increase in anti-Americanism?”

Adding to concerns about Adams’ cryptocurrency expertise, he twice referred to blockchain technology as “block change technology” during the interview – a verbal misstep that cryptocurrency advocates have pointed to as evidence of a potentially superficial understanding of the technology he has so enthusiastically promoted. Cryptocurrency education advocates have long warned that public officials and celebrities should develop substantial knowledge of blockchain technology before endorsing specific projects, particularly those that solicit public investment.

Further complicating matters is confusion surrounding the token’s identity. The NYC Token launched by Adams is entirely separate from New York City Coin, a different project launched by CityCoins during the early days of Adams’ mayoral administration. That earlier token was eventually delisted from major cryptocurrency exchanges in 2023 due to low liquidity and trading volume – a fact that some market observers suggest should have prompted greater caution from investors regarding this new venture with a similar name.

The Broader Implications: Celebrity Tokens, Political Credibility, and the Future of Crypto Regulation

The controversy surrounding NYC Token highlights broader concerns about celebrity-endorsed cryptocurrencies and their impact on retail investors. Financial experts note that tokens promoted by public figures often experience dramatic price volatility driven more by personality than by underlying utility or technological innovation. When such projects fail to deliver on their promises or experience dramatic price collapses, they not only harm investors financially but potentially undermine public confidence in legitimate blockchain applications.

For Adams personally, the controversy represents a significant challenge to his reputation as a cryptocurrency advocate and may complicate any future political aspirations. Several blockchain ethics organizations have called for a complete accounting of the liquidity movements and greater transparency regarding Adams’ relationship to the project, including any financial benefits he may have received. Some cryptocurrency legal experts have suggested the incident may attract regulatory attention, particularly given the SEC’s increased focus on celebrity-endorsed token offerings.

As investigations into the token’s liquidity movements continue, the incident serves as a cautionary tale about the intersection of politics, celebrity influence, and cryptocurrency markets. Industry observers note that the nascent cryptocurrency sector continues to struggle with establishing clear ethical boundaries and transparent practices that protect retail investors while enabling innovation. For now, investors in NYC Token face uncertainty about the project’s future and the prospects of recovering their investments as Adams and the unnamed project team face mounting pressure to address the allegations of market manipulation and provide greater transparency about their intentions.