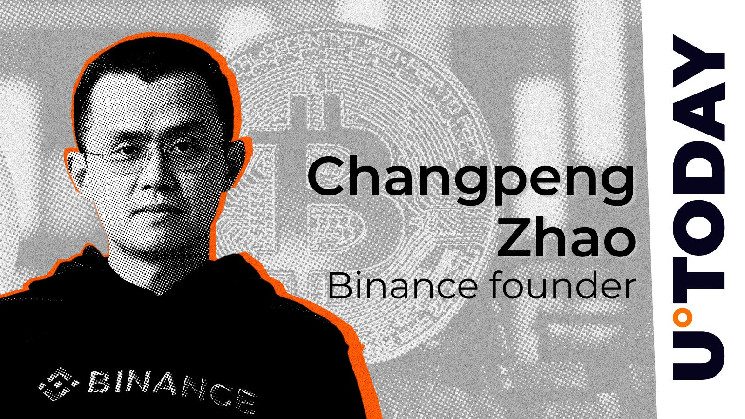

The cryptocurrency market has recently experienced a period of significant volatility, characterized by a surge in Bitcoin’s price towards its all-time high, while a majority of altcoins suffered double-digit percentage drops. This divergence in price action has created a sense of uncertainty and excitement within the crypto community, leading to discussions about market sentiment and the potential for a renewed wave of fear of missing out (FOMO). Changpeng Zhao (CZ), the influential former CEO of Binance, the world’s largest cryptocurrency exchange, has weighed in on the current market dynamics, suggesting that the FOMO sentiment is only just beginning. This observation is particularly intriguing considering CZ’s earlier cautionary remarks about responsible investing amidst feelings of greed and fear.

CZ’s assertion that FOMO is nascent suggests a belief that the current market excitement is not yet pervasive and that a larger wave of investor enthusiasm could be on the horizon. This perspective implies that the recent price movements, especially Bitcoin’s near-record high, may attract a broader range of investors who fear missing out on potential future gains. While some altcoins have experienced significant declines, the overall market sentiment, as indicated by various metrics, doesn’t yet reflect extreme greed. This suggests a degree of caution among investors, possibly tempered by recent market corrections and the understanding that rapid price increases can be followed by equally swift downturns.

The concept of FOMO is central to understanding market psychology, particularly in volatile asset classes like cryptocurrencies. FOMO drives investors to enter markets, often at inflated prices, fueled by the fear of missing out on potentially lucrative opportunities. This emotional response can exacerbate market bubbles and lead to irrational investment decisions. Conversely, extreme fear can cause investors to panic sell, driving prices down further and creating a cascade effect. The current market, while exhibiting signs of greed, has not reached a state of extreme FOMO, suggesting that a balance exists between optimism and caution.

One way to gauge market sentiment is through the Fear and Greed Index, which measures the prevailing emotional state of investors. A score closer to 0 indicates extreme fear, while a score closer to 100 signifies extreme greed. Currently, the index sits at a moderate level, indicating a degree of greed but not yet at an extreme level. This suggests that while there is excitement surrounding certain cryptocurrencies, particularly Bitcoin, investors are not completely swept away by irrational exuberance. This measured sentiment could reflect lessons learned from previous market cycles, where periods of extreme greed were followed by significant corrections.

The recent market activity highlights the complex interplay between various factors influencing cryptocurrency prices. While Bitcoin’s surge towards its all-time high has generated excitement, the simultaneous decline in many altcoins underscores the inherent volatility of the crypto market. This divergence in price action could be attributed to several factors, including a flight to safety towards Bitcoin, profit-taking in overvalued altcoins, or a shift in investor focus towards more established cryptocurrencies. The overall market sentiment, however, appears to be relatively balanced, suggesting that investors are cautiously navigating the current landscape.

The current state of the crypto market presents both opportunities and risks for investors. While the potential for significant gains remains, the inherent volatility of cryptocurrencies underscores the importance of responsible investing. Heeding CZ’s advice to act responsibly, even amidst the excitement of potential gains, is crucial for navigating the often turbulent waters of the crypto market. The balancing act between FOMO and cautious optimism will continue to shape the market’s trajectory, making it essential for investors to stay informed and make informed decisions based on a thorough understanding of market dynamics and individual risk tolerance.