Filecoin Tumbles 4.2% Amid Market Volatility as Traders Navigate Psychological Support Levels

Market Sentiment Shifts as FIL Breaks Below Key Price Point During Broader Crypto Downturn

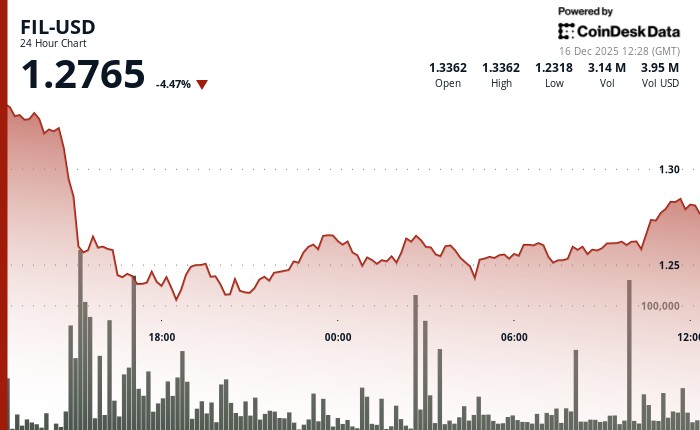

Filecoin (FIL) experienced a substantial 4.2% decline on Tuesday, settling at $1.28 amid pronounced market volatility that saw traders driving sharp price reversals throughout the session. This downturn occurred against the backdrop of a broader cryptocurrency market retreat, according to comprehensive data from CoinDesk Research’s technical analysis framework. The decentralized storage token, which has gained attention for its unique blockchain-based data storage solution, established what analysts describe as a distinctly bearish price trend characterized by $0.08 range movement—representing a notable 6.3% volatility measure that signals potential continued uncertainty ahead.

The day’s trading volume surged significantly above recent averages, with activity registering 12.75% higher than the seven-day average according to market data. Most telling was the session’s peak volume of 11.7 million tokens changing hands, which towered approximately 85% above the typical 24-hour average of 2.81 million tokens. Market technicians point to this volume spike as confirmation of the token’s decisive breakdown below the psychologically significant $1.30 support level—a price point that had previously served as a foundation for bullish sentiment. The intensified selling pressure coincided with widespread declines across cryptocurrency markets, with the influential CoinDesk 20 index—a benchmark tracking performance across major digital assets—recording a substantial 3.7% decline at the time of publication.

Technical Indicators Reveal Institutional Positioning as Support-Resistance Dynamics Emerge

A deeper examination of Filecoin’s market structure reveals a tightly compressed trading environment forming in the wake of Tuesday’s sell-off. Primary support has established itself at $1.278, while resistance appears to be capping upward price movement near the $1.285 level—creating an extraordinarily narrow $0.007 trading range that suggests coiling volatility potentially preceding a larger directional move. Perhaps most significant from an institutional perspective was the dramatic 185% volume surge that accompanied the breakdown below the $1.30 threshold. Technical analysts interpret this as clear evidence of institutional participation in the selling pressure, though the subsequent normalization in late-session activity suggests the market may be entering a consolidation phase before determining its next directional bias.

The price action demonstrated classic support-resistance dynamics throughout the session, characterized by swift capitulation followed by an immediate recovery bounce—a pattern typically indicating renewed buyer interest emerging at lower price levels. This responsiveness from buyers, despite the overall bearish trend, suggests a potential floor forming as value investors begin to perceive opportunity in the discounted price. The immediate technical outlook appears to confine Filecoin within the narrow $1.278-$1.285 range, though the broader 24-hour bearish trend remains firmly intact until the token can successfully reclaim and hold above the psychologically important $1.30 level that previously served as support before becoming resistance.

Filecoin’s Ecosystem Developments Contrast with Market Pressure

Despite current price weakness, Filecoin’s underlying ecosystem continues to develop as the decentralized storage network works to expand its technological footprint in the competitive blockchain storage space. The project, which aims to create a distributed storage market where users can rent unused hard drive space, has been making progress on scalability solutions and enterprise partnerships that could potentially influence longer-term valuation metrics beyond current market sentiment. Industry observers note that while short-term price action remains dominated by technical factors and broader market trends, the fundamental value proposition of decentralized storage infrastructure continues to attract developer activity and strategic investments.

The contrast between ecosystem advancement and price performance highlights the frequent disconnect between technological progress and market valuation in the cryptocurrency sector. Enterprise adoption of Filecoin’s storage solutions has been gradually increasing, with several notable partnerships announced in recent quarters, though these developments have yet to translate into sustained price appreciation. Analysts specializing in on-chain metrics suggest that monitoring network growth statistics such as storage capacity utilization and active storage providers offers more meaningful insight into Filecoin’s long-term trajectory than day-to-day price fluctuations. However, in the immediate term, technical price dynamics and broader market sentiment continue to exert primary influence over FIL’s trading patterns.

Broader Cryptocurrency Markets Show Synchronized Downward Pressure

Tuesday’s decline in Filecoin occurred within a context of synchronized selling pressure across cryptocurrency markets, indicating that macro factors rather than token-specific news may be the primary driver of current price action. The 3.7% drop in the CoinDesk 20 index reflects widespread repositioning among traders and investors in response to evolving economic conditions, regulatory developments, and shifting risk sentiment across global financial markets. This correlation in movement suggests Filecoin’s immediate price trajectory may remain significantly influenced by broader market trends rather than isolated factors specific to its own ecosystem.

Cryptocurrency market analysts point to several potential catalysts for the current market weakness, including concerns about regulatory scrutiny, fluctuations in institutional demand, and macro-economic factors affecting risk assets broadly. Traditional financial markets also showed signs of pressure during Tuesday’s session, potentially indicating spillover effects between conventional and digital asset classes. Trading desks report that liquidations of leveraged positions likely accelerated the downward momentum, creating a cascading effect as stop-losses triggered additional selling. For Filecoin specifically, the break below the psychologically important $1.30 level appears to have unleashed additional technical selling, though the relatively quick stabilization suggests the presence of established support zones at current levels.

Market Outlook: Navigating Volatility Requires Strategic Approach to Risk Management

Looking ahead, market participants focused on Filecoin will be closely monitoring several key technical levels to gauge potential directional bias in coming sessions. The immediate focus remains on whether FIL can reclaim the pivotal $1.30 mark, which would suggest the current breakdown might prove to be a false signal. Alternatively, sustained trading below current levels could potentially open the path toward the next significant support zones. Volume patterns will be particularly telling, as sustained high-volume selling would indicate continued institutional distribution, while tapering volume might suggest exhaustion of immediate selling pressure.

Beyond technical considerations, market participants should remain cognizant of broader cryptocurrency market dynamics and potential catalysts that could influence sentiment across the sector. Regulatory developments, macroeconomic data releases, and institutional positioning in Bitcoin and other major cryptocurrencies often create ripple effects that impact smaller-cap assets like Filecoin. Strategic investors emphasize the importance of contextualizing price movements within longer-term trends rather than overreacting to short-term volatility. While immediate technical signals point to continued pressure on FIL until a convincing reclamation of key levels, the compressed trading range suggests a significant directional move may be approaching—though the ultimate resolution of this pattern remains uncertain pending further market development.

Disclaimer: Parts of this article were generated with assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. This analysis is not financial advice, and investors should conduct their own research before making investment decisions.