XRP Rally Intensifies as Institutional Trading Volume Surges Above Average

Institutional Confidence Drives XRP Momentum Amid Favorable Monetary Policy Signals

XRP has maintained strong upward momentum as it extended its rally on August 23, with institutional trading volumes significantly exceeding average levels. This surge reinforces the bullish sentiment that has been building after weeks of price consolidation in the digital asset market. The timing of this movement aligns perfectly with Federal Reserve Chair Jerome Powell’s dovish remarks at the Jackson Hole economic symposium, which strengthened market expectations for potential interest rate cuts in September. These comments triggered a noticeable rotation into risk assets, with cryptocurrencies being prime beneficiaries of this shift in investor sentiment.

The renewed institutional interest in XRP comes against a backdrop of improving regulatory clarity following the conclusion of Ripple’s long-standing litigation issues. This resolution has removed a significant overhang that had previously constrained institutional participation in the token. Market analysts have become increasingly optimistic about XRP’s potential trajectory, with some setting ambitious price targets ranging from $5 to $8 should the digital asset successfully break above key near-term resistance levels. The convergence of these factors—monetary policy shifts, regulatory clarity, and technical breakouts—has created a compelling narrative for XRP as both retail and institutional investors reassess their positions in the cryptocurrency market.

XRP Price Movement Reveals Strong Buying Pressure at Key Levels

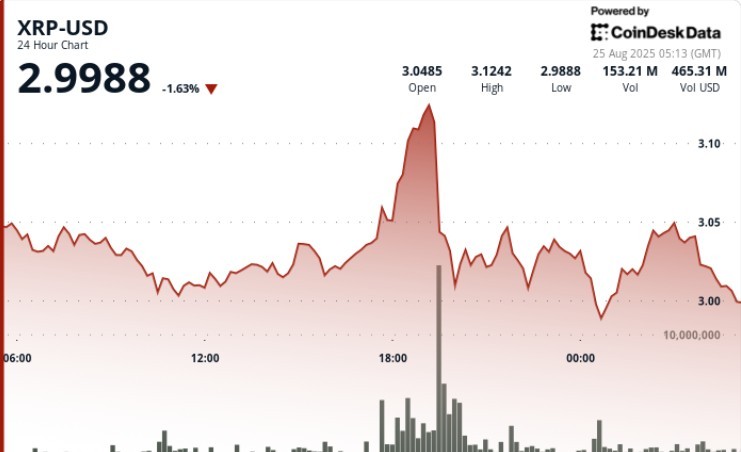

The 24-hour period from August 23 at 15:00 to August 24 at 14:00 saw XRP climb approximately 3%, rising from $3.02 to reach a high of $3.09 before eventually consolidating back at its starting price of $3.02. During this session, the token traded within a relatively narrow $0.09 band, but what stood out was the elevated trading volume that accompanied the price peak. Volume reached 58.8 million during this period, substantially higher than the 24-hour average of 33.2 million, indicating significant institutional participation in the market.

Perhaps more telling was the formation of strong support near the $3.00 psychological level during the 11:00 candle, which saw an impressive 46.6 million in turnover. This high-volume defense of the $3.00 mark validates the presence of substantial demand at this threshold, suggesting that buyers are actively accumulating at these levels. The session ultimately concluded with XRP trading near $3.02, which, while not representing a net gain for the period, signals renewed momentum and suggests that the token is consolidating below resistance before potentially making another push higher. This pattern of high-volume support at key levels typically precedes further upside movement when combined with the broader bullish market sentiment.

Technical Indicators Point to Potential Breakout as Volume Confirms Institutional Interest

From a technical analysis perspective, XRP faces clear resistance in the $3.08-$3.09 range, defined by high-volume rejection during the midnight rally attempt. This price zone has repeatedly capped upward movements, suggesting significant selling pressure at these levels. Conversely, support has become increasingly solid around the $3.00 mark, with multiple bounces occurring on above-average trading volume—a technical signal that often precedes significant price movements. The verification of this support level enhances confidence in XRP’s current valuation and provides a foundation for potential future gains.

What particularly stands out in recent trading sessions is the confirmation of substantial institutional flows into XRP. Data analytics platform fiatleak reported a remarkable $27 million worth of XRP transacted in just one minute—a clear indication of large-scale institutional positioning. The chart formations currently visible resemble classic double-bottom and symmetrical triangle patterns, technical structures that analysts typically associate with continuation moves. Market technicians suggest these patterns could propel XRP toward the $3.30 level in the near term, and if this resistance is successfully breached, open a pathway toward more ambitious targets in the $5 to $8 range. The combination of these technical indicators with increasing institutional volume provides a compelling case for XRP’s potential upside.

Market Participants Focus on Key Indicators as Economic Factors Influence Crypto Sentiment

Professional traders and institutional investors are closely monitoring several critical factors that could influence XRP’s price trajectory in the coming weeks. Primary among these concerns is whether the $3.00 support level will hold during inevitable profit-taking phases, as this psychological threshold has become increasingly important to market sentiment. Equally significant is the potential for a decisive breakout above the $3.30 resistance zone, which many analysts have identified as the trigger point for targeting higher ranges in the months ahead.

Beyond pure price action, market participants remain keenly focused on the Federal Reserve’s policy trajectory ahead of the September meeting. Confirmation of the anticipated rate cuts would likely sustain and potentially accelerate flows into risk assets, including cryptocurrencies like XRP. On-chain metrics have also captured attention, with whale wallet accumulation patterns and settlement volumes showing remarkable activity—including a 500% spike to 844 million earlier in the week. Additionally, XRP’s correlation with traditional equity markets is being closely watched, as lower Treasury yields continue to push crossover inflows from conventional finance into digital assets. This relationship between monetary policy, traditional markets, and cryptocurrency flows has become an increasingly important dynamic in determining price direction.

Broader Market Context Suggests Continued Momentum for XRP Amid Changing Economic Landscape

The current XRP rally exists within a broader context of evolving financial market dynamics and changing investor perceptions toward digital assets. The cryptocurrency market as a whole has shown signs of decoupling from its previous tight correlation with technology stocks, instead responding more directly to monetary policy signals and institutional participation levels. This shift represents a maturing of the digital asset class and suggests that assets like XRP may continue to benefit from the rotation into alternative investments as traditional fixed-income returns remain challenged.

The institutional interest in XRP specifically appears driven by its improved regulatory standing and increasing utility within cross-border payment systems. As global financial institutions continue to explore blockchain solutions for international settlements, XRP’s positioning as a bridge currency offers practical applications beyond speculative value. This utility narrative, combined with technical strength and favorable macroeconomic conditions, creates a potentially sustainable foundation for continued price appreciation. While volatility remains an inherent characteristic of cryptocurrency markets, the convergence of institutional validation, technical breakouts, and practical use cases suggests that XRP’s current momentum may have more durability than previous rallies. As market participants await the Federal Reserve’s September decision and monitor key resistance levels, XRP stands at a potentially pivotal moment in its price discovery journey.