Federal Reserve Stands Firm: A Pause on Rates Amid Shifting Market Gaze

In the ever-evolving theater of monetary policy, the Federal Reserve’s latest act unfolded on Wednesday with a decision to hold interest rates steady, a move that underscored the central bank’s cautious stance amidst a whirlwind of economic signals. This pause came at a time when investor sentiment had undergone a dramatic flip-flop, dashing earlier hopes for rate cuts as soon as January 2026. As Chair Jerome Powell and his colleagues convened, the focus was on balancing stubbornly elevated inflation against subtle signs of job market stabilization or unemployment steadiness. For many observers, this decision wasn’t just about numbers—it was a signal of the Fed’s resolve to keep the economic reins tight, prioritizing long-term stability over short-term euphoria. Markets, which had once buzzed with optimism for quicker easing, now grappled with the reality of a “higher-for-longer” policy trajectory, echoing the uncertainties that have defined global finance in 2024.

Delving into the Fed’s statement, the emphasis was clear: labor market gains had slowed to a trickle, and while unemployment showed flickers of calm, inflation hadn’t yet bowed to the pressures of previous hikes. This assessment painted a picture of an economy that’s cooling incrementally but still too hot for comfort. Two dissenting voices broke the consensus—Stephen Miran, a recent appointee by the Trump administration, and Chris Waller, whose name has been floated as a contender for Powell’s chair, both advocated for a quarter-point trim in the fed funds rate. Their push for action highlighted internal debates within the Fed, where personalities and philosophies clash in the nation’s economic command center. It’s a reminder that beyond the data, policy is shaped by people, each interpreting the same economic tapestry differently. Miran and Waller’s stance suggested a belief that the current trajectory might be overly restrictive, potentially risking growth without adequately curbing price pressures. As the Fed navigates this, the dissents serve as a barometer for the diverse viewpoints that influence U.S. monetary strategy, keeping policymakers awake at night and traders on their toes.

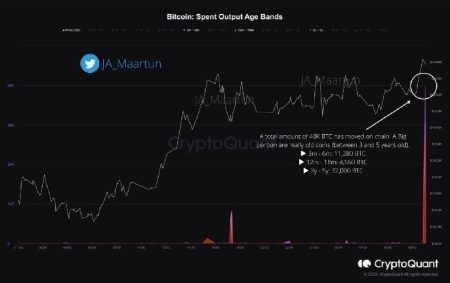

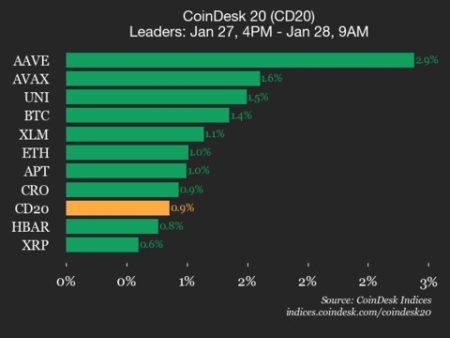

The immediate ripples of this decision radiated across financial markets, creating a mosaic of reactions that reflected both resilience and volatility. Bitcoin, that digital darling of the crypto world, hovered just below $89,500, undeterred by the lack of easing—a testament to its growing independence from traditional monetary levers. U.S. stocks remained largely unchallenged, trading flat in a display of market maturity that’s increasingly rare in turbulent times. Yet, the U.S. dollar surged sharply upward from a steep decline the day before, reclaiming its status as a safe-haven asset amid global uncertainties. Gold, meanwhile, defied gravity with a 3.7% ascent to near-record highs around $5,300 per ounce, whispering tales of investor flight toward tangible hedges. These movements weren’t isolated; they echoed broader trends where fiat currencies and precious metals dance in response to the Fed’s tempo. For crypto enthusiasts, the steady rates signaled ongoing liquidity support, potentially buoying digital assets despite potential future headwinds—a scenario that’s fueled discussions about Bitcoin’s role in a diversified portfolio.

Just a couple of months prior, the predictive landscape had looked vastly different, with traders wagering on an early January rate cut with odds exceeding 40%. It was an era of guarded optimism, where Wall Street’s crystal balls forecast a pivot toward accommodation as economic data trickled in. But by late November, that optimism evaporated like morning mist, and as Wednesday’s meeting loomed, the consensus solidified: nearly 99% odds of no change, per market pricing tools. This seismic shift erased dreams of near-term relief, reinforcing expectations that the Fed’s restrictive grip would endure through at least the first quarter of 2026. It’s a narrative of reversal that’s captivated analysts, illustrating how swiftly sentiment can pivot with fresh data or shifted narratives—from bold bets on easing to a fortress of patience. For everyday investors, this evolution underscores the Fed’s ability to shape expectations, turning fluid predictions into hardened convictions.

While the curtain has fallen on anticipations of immediate cuts, hopes for future easing haven’t vanished entirely. Market watchers aren’t betting on a resumption at the March meeting, with the CME FedWatch tool pegging probabilities at a mere 16%. Odds climb modestly to about 30% by April, suggesting a cautious buildup rather than a rush. This gradual outlook reflects broader economic puzzles, where inflation’s stubborn hold meets whispers of labor relief. Nick Ruck, Director of Research at LVRG, captured the mood in a candid Telegram missive: “The U.S. Federal Reserve’s decision to hold interest rates reflects persistent inflation concerns and a stabilizing economic backdrop, likely resulting in near-term volatility for crypto markets as liquidity remains supportive.” He warned that if Powell adopts a “higher-for-longer” rhetoric or signals fewer 2026 cuts, short-term pressures could mount on risk assets like Bitcoin. Such insights from industry insiders add layers to the story, blending data-driven analysis with speculative foresight, and reminding us that monetary policy isn’t just about charts—it’s about human judgment and its ripple effects on everything from cryptocurrencies to global commerce.

All eyes now turn to Jerome Powell’s press conference, slated for 2:30 pm ET, where his words could sway sentiment as much as any rate adjustment. Investors and pundits alike will parse every inflection, searching for cues on the Fed’s forward path. Will he lean toward the doves, hinting at flexibility, or echo the hawks with vows of vigilance? In the grand narrative of economic policy, these moments define eras—much like landmark conferences of the past that have steered recessions and booms. For cryptomarkets, teased valuations hang in the balance, with Powell’s tone potentially igniting rallies or retreats. As the world waits, this interplay of policy prudence and market whims underscores the intricate ballet of modern finance, where one man’s statements can reverberate across screens and portfolios worldwide, shaping destinies in an unpredictable global economy. The Fed’s steady hand today might foreshadow smoother seas ahead, but as history teaches, the next act is always unfolding.